U.S. 30 Futures Index Rebounds And Moves Back Below 33700.00 Mark, Fed's preferred inflation gauge (PCE Data) Awaited

Key Takeaways:

- The US30 futures index moved lower on Friday during the Asian session, reversing part of its previous day's gains

- Fresh U.S. macro data cements market expectations of a 25bps rate hike before the end of the year

- Intel, Inc. (NASDAQ: INTC) and Boeing, Co. (NYSE: B.A.) led the list of top gainers and top losers, respectively, before the bell

- The market shifts toward releasing the Fed's preferred inflation gauge (PCE) data report for fresh directional impetus

The Dow Jones futures index (US30) ticked lower on Friday during the Asian session, moving back below the 33700.00 mark and reversing back a part of its previous day's gain as investors continue to assess the latest U.S. macro data and its implications on future monetary policies while awaiting the Fed's preferred inflation gauge, Personal Consumption Expenditure (PCE) data, set for release later today.

As of press time, futures tied to the Dow Jones have lost 0.07%/24.7 points to trade slightly below the 33700.00 mark. The move follows a winning day on Wall Street on Thursday, as the main index rose 0.5% before paring gains and closing with modest gains above the 33700.00 mark, following the recent weakness in tech stocks (NASDAQ: GOOGLE and NASDAQ: META) as the rally in U.S. Treasury yields eased.

Despite the modest pullback in U.S. Treasury bond yields, the generally positive sentiment around the buck remains very positive, which in turn should limit further downtick moves around Treasury yields and, in turn, help cap further gains around the U.S. equity markets. This comes on firm market expectations that the Federal Reserve (Fed) will raise interest rates by at least 25 basis points (bps) before the end of this year. Markets seem convinced the Fed will adopt a hawkish approach in either of its last two FOMC meetings after the U.S. central bank signalled during its September FOMC Meeting announcement that there could be another hike this year despite leaving its Fed funds rate unchanged, ranging from 5.25% to 5.5%.

The bets were reaffirmed after FOMC Member Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, said on Tuesday that a soft landing for the U.S. economy is more likely than not but still pegged the probability at about 60% that the Fed "potentially" raises rates one more quarter of a percentage point and then holds borrowing costs steady "long enough to bring inflation back to target in a reasonable period of time." A U.S. Department of Labor report on Thursday showed that the number of Americans filing for unemployment benefits increased by 2,000 to 204,000 on the week ending September 23rd, well below market expectations of 215,000 to remain close to the over-seven-month low in the earlier week. To a greater extent, the data has underscored evidence that the labor market continues to remain resilient in the face of the aggressive Federal Reserve's tightening cycle, adding leeway for a potential hike in November.

In other news, the U.S. economy grew at an annualized rate of 2.1% in the second quarter of 2023, unchanged from the previous estimate and compared to an upwardly revised 2.2% growth in the first quarter, a U.S. Bureau of Economic Analysis report showed on Thursday.

Gainers and Losers

Here are the top US30 index movers today before the bell, a week in which the main index is poised to close with heavy losses and rather close the month with one of its most severe losses in more than four months.

Top Gainers⚡

The top performers on the US30 Index were:

- Intel, Inc. (NASDAQ: INTC) added 1.65%/0.57 points to trade at $35.18per share.

- Caterpillar, Inc. (NYSE: CAT) rose 1.29%/3.53 points to trade at $276.24 per share.

- Cisco Systems, Inc. (NASDAQ: CSCO) gained 1.28%/0.68 points to trade at $53.88 per share.

Top Losers💥

The worst performers on the US30 Index were:

- Boeing, Co. (NYSE: B.A.) lost 2.57%/5.03 points to trade at $190.43 per share.

- IBM, Corp. (NYSE: IBM) declined 1.11%/1.59 points to trade at $141.58 per share.

- Procter & Gamble, Co. (NYSE: P.G.) shed 0.68%/1.00 points to trade at $146.34 per share.

As we advance, investors look forward to the release of the Fed's preferred inflation gauge, Personal Consumption Expenditure (PCE) data, which is expected to show that inflation remained constant in August at 0.2% from a year ago, excluding food and energy. Every month, Core PCE data is expected to show inflation dropped to 3.9% in August from 4.2% in July.

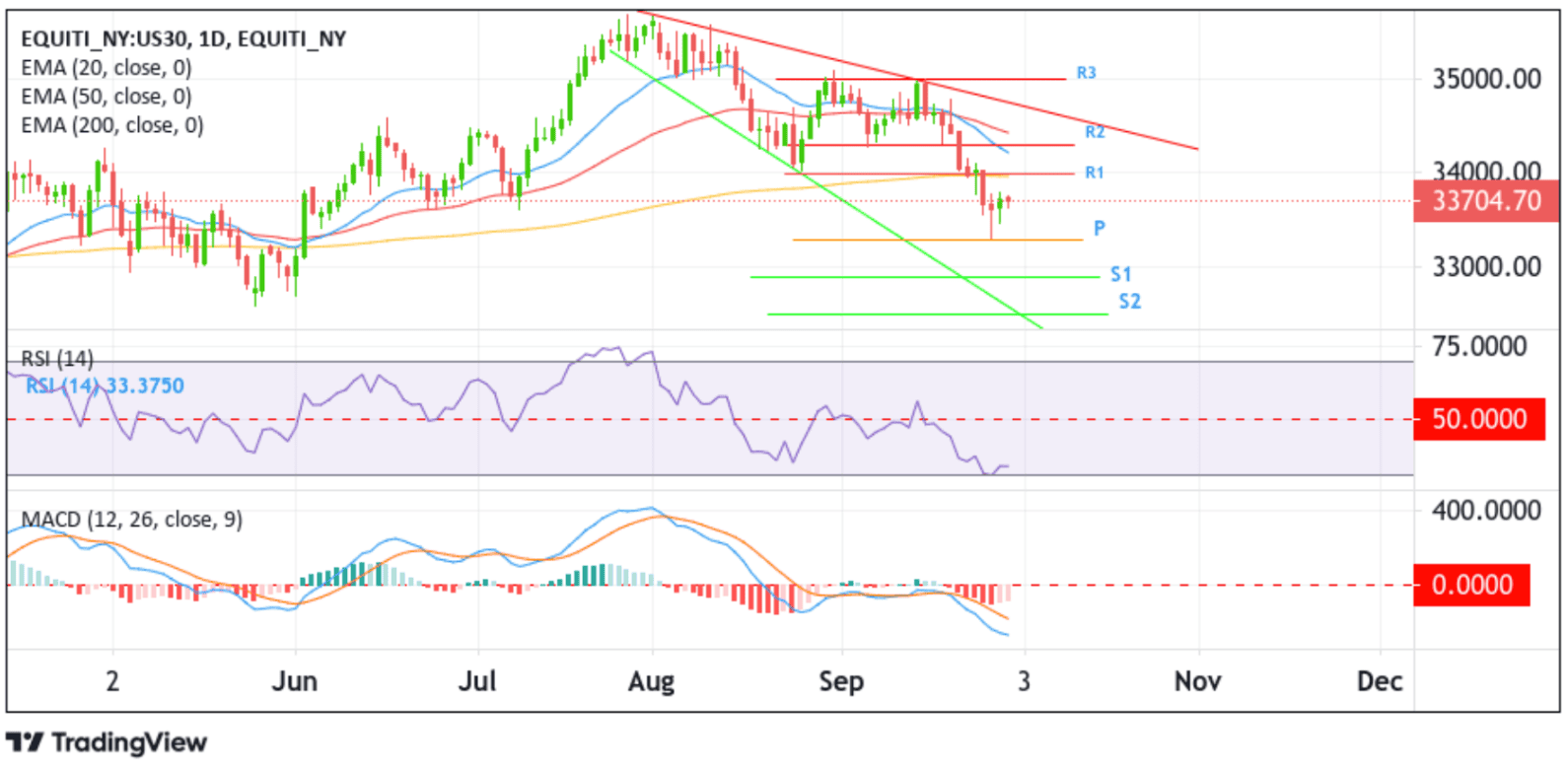

Technical Outlook: One-Day US30 Index Price Chart

From a technical standpoint, the US30 Index's ability to find acceptance below the technically strong 200-day (yellow) Exponential Moving Average (EMA) at 33963.00 acted as a main trigger for sellers to push down the price further downwards and pave the way for more losses around the main index. The price, however, found some support at the 33292.72 pivot level (P) and rebounded modestly, but unfortunately, the uptick was short-lived after failing to find acceptance above the 33700.00 mark. That said, some follow-through selling from the current price level has the potential to drag the main index back toward the pivot (P) level. If sellers break below this pivot level, the main index could accelerate its decline toward the 32922.6 support level (S1). On further weakness, the US30 index could drop toward the next relevant support level (S2) at 32587.9, below which price could fall to the key support level plotted by a downward-sloping trendline extending from the early-August 2023 swing low. A subsequent break (bearish price breakout) below this support level would make the US30 Index more vulnerable to further losses.

On the flip side, if buyers resurface and spark a bullish reversal, initial resistance comes in at the 200-day (yellow) EMA level at 33963.00, which also coincides with a key resistance level (R1). A convincing move above this barrier would negate the bearish outlook and pave the way for aggressive technical buying. The main index could then ascend toward confronting the 34262.68 resistance level (R2). If the price pierces this barrier, attention will shift toward the 34262.68 resistance level (R2). A decisive flip of this resistance level into a support level would pave the way for a further rally toward the downward-sloping trendline extending from the early August 2023 swing high. If the price breaks above this key resistance level, the U.S. 30 index price could rally further toward the 35,000.00 round mark.