GBP/USD Rebounds And Climbs Back Above The 1.21700 Mark On Softer U.S. Dollar And Firmer U.K. Employment Figures

Key Takeaways:

- GBP/USD cross gained positive traction on Wednesday and moved back above the 1.21700 mark

- Retreating Treasury bond yields weigh on the buck and act as a tailwind to the GBP/USD cross

- Better-than-expected UK employment figures offer support to the Great British Pound (GBP)

- Expectations of at least one Fed rate hike before the end of the year, stronger U.S. PMI readings, and concerns of spill over of the Israel-Palestine war remain supportive of the buck

The GBP/USD pair attracted some buying on Wednesday during the Asian session, extending the modest bounce from the vicinity of the 1.21531 level touched on Tuesday and marking a third consecutive section of positive gains. As of press time, the shared currency is up 0.11%/13 pips for the day and looks set to keep its offered tone heading into the European session.

A fresh leg down in U.S. Treasury bond yields, along with a weaker risk tone, helped revive the U.S. dollar supply on Wednesday, which was a key factor that helped limit further losses around the GBP/USD cross. The U.S. Dollar Index (DXY), which measures the value of the USD against a basket of currencies, rebounded from 106.273 during the early Asian session and was last seen trading in modest losses below the $106.200 mark. Apart from this, signs of stability in the U.S. equity markets continue to act as a headwind to the buck and help limit any meaningful downtick for the USD/CAD cross.

During the November meeting, increased market bets that the Fed will keep its benchmark policy rate steady at the current 5.25% to 5.5% range remain supportive of retreating Treasury bond yields, which weigh on the buck and help cap the downside for the GBP/USD cross. This comes on the heels of dovish comments by the Fed chair, whose remarks aligned with those of his colleagues. It is worth recalling that during a speech at the Economic Club of New York last Thursday, Jerome Powell declined to outrightly signal another rate hike after he mentioned that the Fed is "proceeding carefully" in evaluating the need for further rate increases.

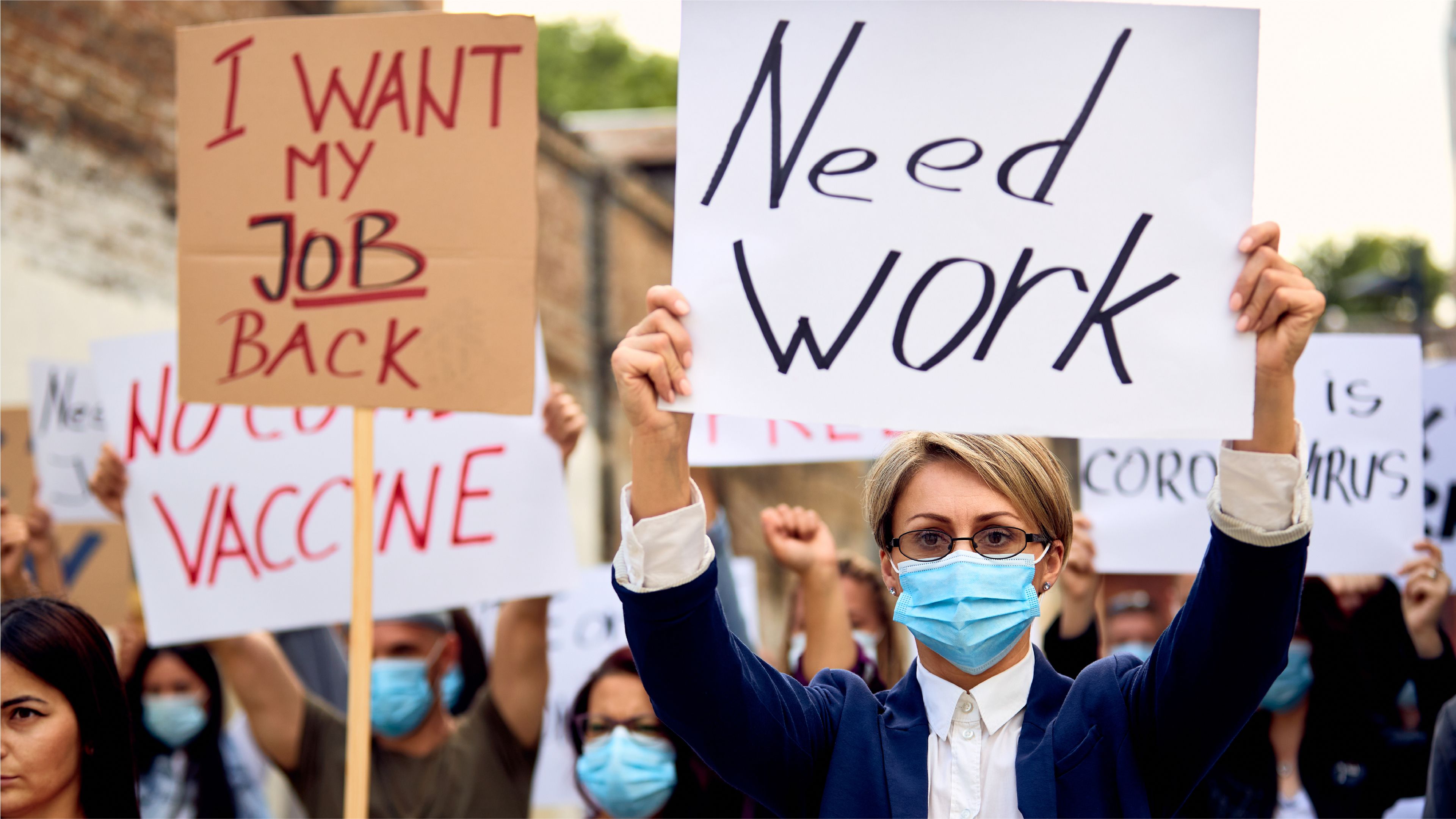

Further contributing to the sentiment around the GBP/USD cross was the U.K. Office for National Statistics (ONS) report released on Tuesday, which showed the number of people in work in the United Kingdom dropped by 82 thousand in the three months to August 2023, coming below market expectations of a 198 thousand fall and following a 207 thousand decrease in the prior period. Additionally, the unemployment rate in the United Kingdom rose to 4.2% in August 2023, against market consensus of a 4.3% rise and dropping slightly from 4.3% in July. To a greater extent, the employment change and unemployment rate figures overshadowed a surge in the number of people claiming unemployment benefits in the U.K.

Nevertheless, the data figures underscored evidence that the labor market remains resilient. This, combined with last week's inflation data report, which showed a moderate rise in inflation pressures in the U.K., suggests the Bank of England could be forced to hike its overnight lending rates during its November meeting.

Despite the combination of negative factors, the greenback continues to be supported by firm market expectations that the Fed will hike interest by at least 25 basis points before the end of the year. Apart from this, there are concerns that the Israel-Palestine war would engulf the rest of the Middle East region, leading to a major global crisis, which continues to weigh on investor sentiment. This was evident from a generally weaker tone around the equity markets, which lends support to the buck and could cap the upside for the GBP/USD cross.

Additionally, a Markit Economics preliminary estimates report on Tuesday showed the S&P Global Manufacturing PMI for the U.S. rose to 50 in October 2023 from 49.8 in September, beating forecasts of 49.5, while the S&P Global U.S. Services PMI increased to 50.9 in October 2023 from 50.1 in September, the highest in three months and above market expectations of 49.8.

In contrast, the S&P Global/CIPS UK Services PMI edged down to 49.2 in October 2023 from 49.3 in September, the lowest in nine months and below market expectations of 49.3, while the S&P Global/CIPS United Kingdom Composite PMI came in at 48.6 in October 2023, little changed from September's 48.5. Broadly in line with market expectations of 48.7, a preliminary estimate showed.

As we advance, investors look forward to the U.S. docket featuring the Building Permits (Sep) release and New Home Sales data report.

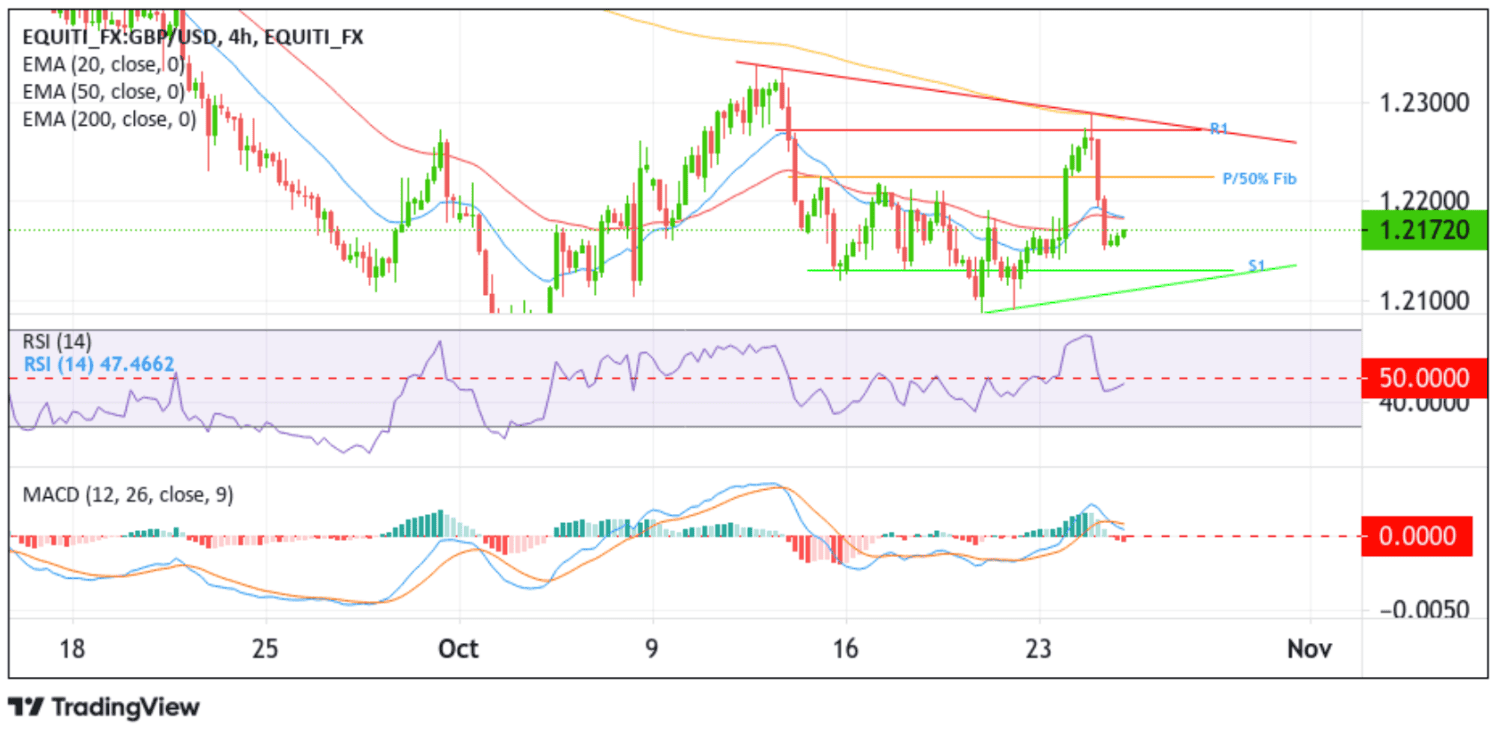

Technical Outlook: Four-Hour GBP/USD Price Chart

From a technical perspective, the GBP/USD pair extended the fresh leg-up from the vicinity of the 1.21531 level and is currently trading with bullish conviction above the 1.21700 mark. A further increase in buying pressure from the current price level would uplift spot prices to tag the 20 (blue) and 50 (red) days Exponential Moving Average (EMA) at 1.21833 level before ascending toward the key pivot level, which coincides with the 50% Fibonacci Retracement level at the 1.22246 level. A convincing move above this level would act as a fresh trigger for bulls to continue pushing the price, paving the way for an extension of the bullish pullback toward the 1.22715 resistance level (R1). A clean move above this level will pave the way for an ascent toward the key resistance level plotted by a downward-sloping trendline extending from the mid-October 2023 swing high. A subsequent break (bullish price breakout) above this resistance level will pave the way for further gains around the GBP/USD cross.

On the flip side, the 1.21318 support level now acts as immediate support, below which the price could drop toward the key support level plotted by an ascending trendline extending from the mid-October 2023 swing low. If sellers manage to breach this key floor, downside pressure could accelerate, paving the way for deeper losses around the shared currency.