AUD/USD Extends Modest Recovery Above 0.63500 Mark On Weaker U.S. Dollar, U.S. PMI data Awaited

Key Takeaways:

- AUD/USD cross witnessed fresh buying on Tuesday and extended the bullish uptick above the 0.63500 mark

- Retreating treasury bond yields amid receding bets for a November rate hike weighs on the buck and acts as a tailwind to AUD/USD cross

- Expectations of at least one Fed rate hike before the end of the year, plus concerns of spill over of the Israel-Palestine war, remain supportive of the buck

- Investors await the release of U.S.PMI data readings for fresh AUD/USD directional impetus

AUD/USD pair struggles to capitalize on the overnight bounce from the vicinity of the 0.64349 level and attracts fresh buying on Tuesday during the early-Asian session. As of press time, the pair is up over 0.3% for the day, trading firmly above the 0.63500 mark, and looks set to maintain its bid tone heading into the European session.

A combination of factors assisted the greenback in attracting some intraday selling on Tuesday. On Tuesday, the U.S. Dollar index (DXY) extended its heavy bearish momentum below 105.500, marking the fourth successive day of negative moves in the previous five. This, in turn, was seen as a key factor that helped cap the downside for the AUD/USD pair.

Speculation that the Fed will likely leave its Fed funds rate unchanged during the November meeting remains supportive of retreating Treasury bond yields, which weigh on the buck and help exert upward pressure on the AUD/USD cross. This comes on the heels of dovish comments by the Fed chair, whose remarks aligned with those of his colleagues. During a speech at the Economic Club of New York last Thursday, Jerome Powell declined to outrightly signal another rate hike after he mentioned that the Fed is "proceeding carefully" in evaluating the need for further rate increases. To a greater extent, these remarks cemented market expectations that the Fed will keep its benchmark policy rate steady at the current 5.25% to 5.5% range at the November meeting.

However, Powell went further ahead to mention that he and his colleagues are united in their commitment to bringing inflation down sustainably to 2%. He doesn't think rates are too high now, suggesting the Fed could hike at least once before the end of the year, presumably during the December meeting, which remains supportive of the greenback and indicates the path of least resistance for the AUD/USD cross is to the downside.

Further lending support to the greenback are concerns that the Israel-Palestine war would engulf the rest of the Middle East region, leading to a significant global crisis, which weighs on investor sentiment. This was evident from a generally weaker tone around the equity markets, which lends support to the buck and could prompt profit-taking around the AUD/USD cross.

Apart from this, Australia's seasonally adjusted unemployment unexpectedly was at a three-month low of 3.6% in September 2023, easing slightly from August's figure and falling below the market consensus of 3.7%. Additional details revealed that employment in Australia increased by 6700 in September 2023, far below market expectations of 20,000 and dropping heavily below August's figure of 64.9K. To a greater extent, the data has raised concerns about the resilience of the labor market, adding leeway for a potential pause by the Reserve Bank of Australia (RBA) in November, which is set to weigh on the Aussie dollar.

As we advance, investors look forward to the Ausi docket featuring the RBA's Assistant Governor's speech during the mid-European session. Investors will further look for cues from releasing the U.S. Manufacturing PMI (Oct) and Services PMI (Oct) preliminary data.

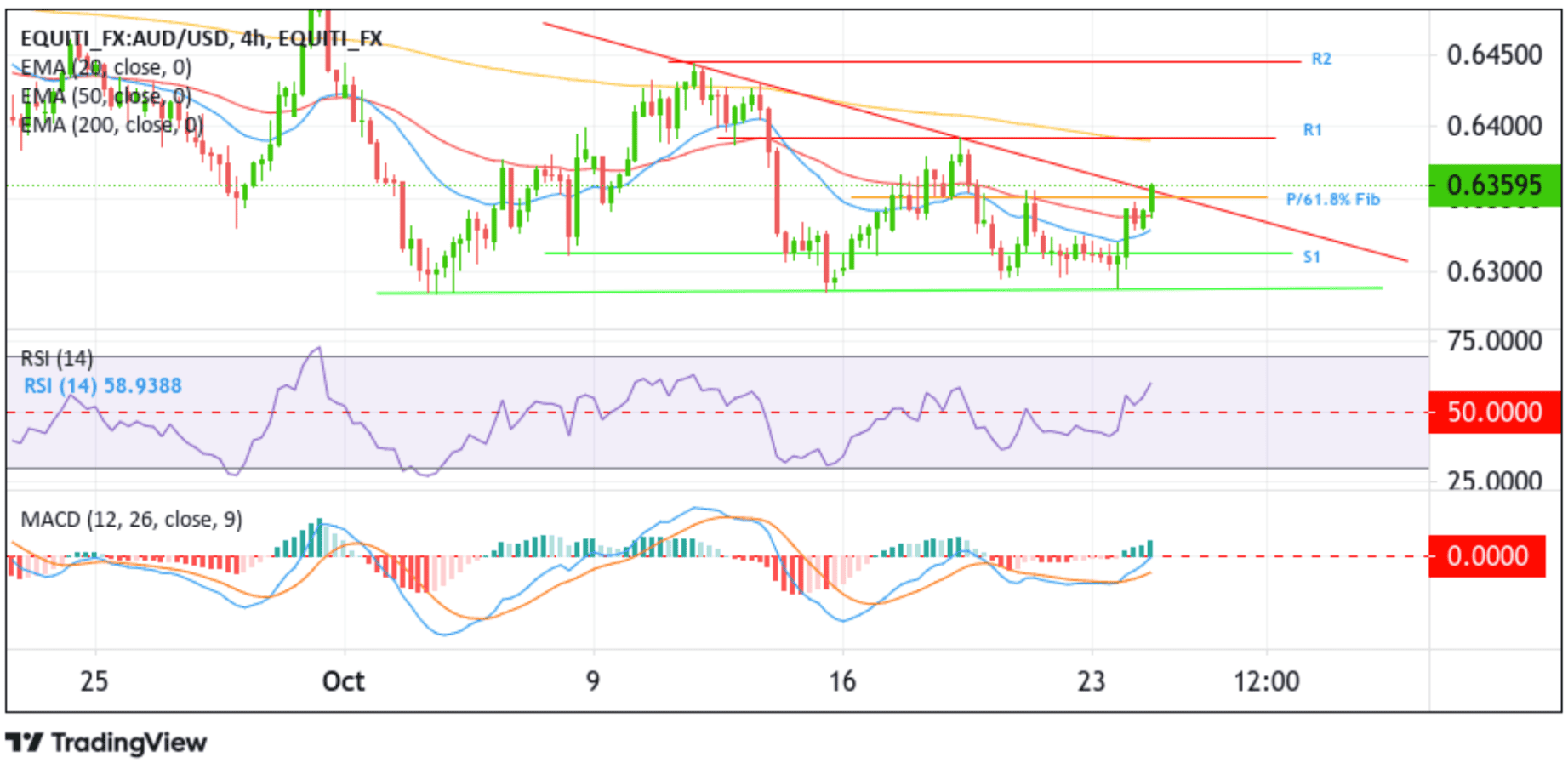

Technical Outlook: Four-Hour AUD/USD Price Chart

From a technical perspective, the price's ability to find acceptance above the pivot level, which coincides with the 61.8% Fibonacci Retracement level (Golden Fib) at the 0.63515 level, followed by a break above the key resistance level plotted by a downward-sloping trendline extending from the mid-October 2023 swing high, favored bulls and supported the case for further upside moves. Some follow-through buying would uplift spot prices toward the 0.63927 resistance level (R1), which coincides with the technically strong 200-day (yellow) Exponential Moving Average (EMA). A convincing move above this barricade will negate any near-term bullish outlook and pave the way for an extended rally toward the next relevant resistance level at 0.64471.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support comes in at 0.63515. On further weakness, the focus shifts lower to 0.63121 (S1), followed by the key support level plotted by a horizontal line extending from the early October 2023 swing low.