USD/CNH Eases Below 6.81300 Levels Amid Strong Overbrought Conditions

- USD/CNH pair attracts fresh selling on Tuesday after a strong move up the previous day

- Sustained US Dollar buying underpinned the safe-haven greenback

- disappointing Chinese macro data undermines the Chinese Yuan causing it to weaken across the board

USD/CNH pair struggled to capitalize on the recent strong move up witnessed on Monday from 6.73556 levels or a multi-week low and attracted fresh selling on Tuesday during the early part of the Asian session. The pair looks set to extend its offered tone heading into the European session amid strongly overbought conditions.

Elevated US Treasury bond yields, bolstered by recent hawkish remarks by several FED officials despite signs of cooling inflation, turned out to be a key factor that weighed on the USD/CNH pair and offered some support to the safe-haven greenback. That said, some intraday US Dollar buying along with a generally positive risk tone helped to cap the downside for the pair.

Apart from this, a new batch of disappointing data from China bolstered global recession worries, hence prompting the People's Bank of China to unexpectedly cut its interest rates to revive demand as data showed the economy unexpectedly slowing. In July, with the factory and retail activity squeezed by Beijing's zero-COVID policy and a property crisis. Following the disappointing Chinese macro data, the Chinese Yuan weakened across the board and helped limit any meaningful downside for the USD/CNH pair.

Economic data released earlier Monday showed China's economic growth rate unexpectedly slowing in July, as the world's second-largest economy struggled to shake off the hit to growth in the second quarter from strict COVID restrictions. Industrial output grew 3.8% in July from a year earlier, with the growth rate below the 4.6% increase expected, while retail sales rose 2.7% from a year ago, missing forecasts for 5.0% growth and the 3.1% growth seen in June.

"The July data suggest that the post-lockdown recovery lost steam as the one-off boost from reopening fizzled out and mortgage boycotts triggered a renewed deterioration in the property sector," said Julian Evans-Pritchard, senior China economist at Capital Economics.

"Going forward, whether PBOC would cut interest rates again could be data-dependent in our view." said analysts at Goldman Sachs.

As we advance, in the absence of significant market-moving economic news data from both dockets, the focus now shifts toward the FOMC minutes report scheduled for release on Wednesday during the mid-north American session. The report would influence the near-term USD price dynamics. This, in turn, should assist traders in determining the next leg of a directional move for the GBP/USD pair. Additionally, retail sales data on Friday will give some fresh insight into the economy's health.

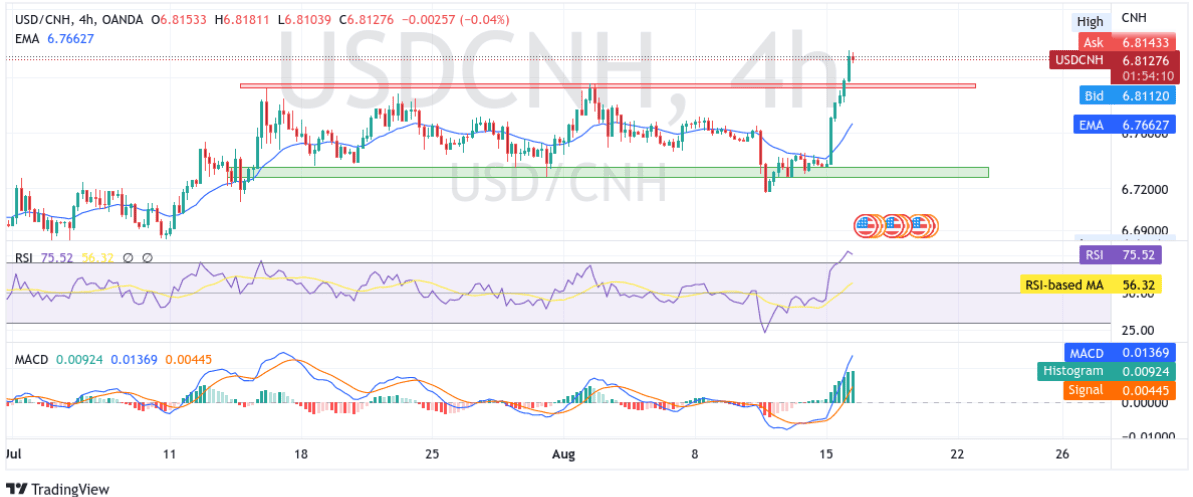

USD/CNH Technical Outlook: Four-Hour Price Chart

From a technical perspective, using a four-hour price chart, the price has retreated from the weekly highs after the recent strong move-up witnessed on Monday from 6.73556 levels. Some follow-through selling(pullback) has the potential to drag the USD/CNH pair towards testing the key resistance level ranging from 6.79125- 6.79560 levels. (it is worth noting Monday's strong move up convincingly broke above the aforementioned level(supply zone). Sustained strength below the supply zone would negate any near-term bullish outlook and pave the way for technical selling.

All technical indicators point to strong bullish momentum, and the recent pullback could be short-lived. That said, the RSI(14) level at 75.52 level flashes strongly overbought conditions. The 20 Exponential moving average (EMA) points upwards, adding to the bullish sentiment. To add to that, the Moving Average Convergence Divergence (MACD) crossover at -0.005966 adds to the bullish filter. That said, despite all the technical indicators pointing to a solid bullish trajectory, traders should be careful against submitting aggressive bullish bets ahead of the much-awaited FOMC minutes report.

On the flip side, if the bulls manage to regain back control of the market, pushing up would negate any term bearish outlook and pave the way for aggressive technical buying.