Swing Trading Style

Trading in the financial markets can be a lucrative way to build wealth and secure financial stability for the future. However, with so many different strategies, it can take time for new investors to know where to start.

In this article, we will explore more swing trading, including the essential factors to consider, pros and cons and some key factors to consider when using this approach.

What is Swing Trading

Swing trade is a trading style used in forex trading that involves holding positions for several days to take advantage of short-term price fluctuations or price swings. The goal of swing trading is to capture a significant portion of a price movement, either up or down, and then exit the trade when the trend reverses.

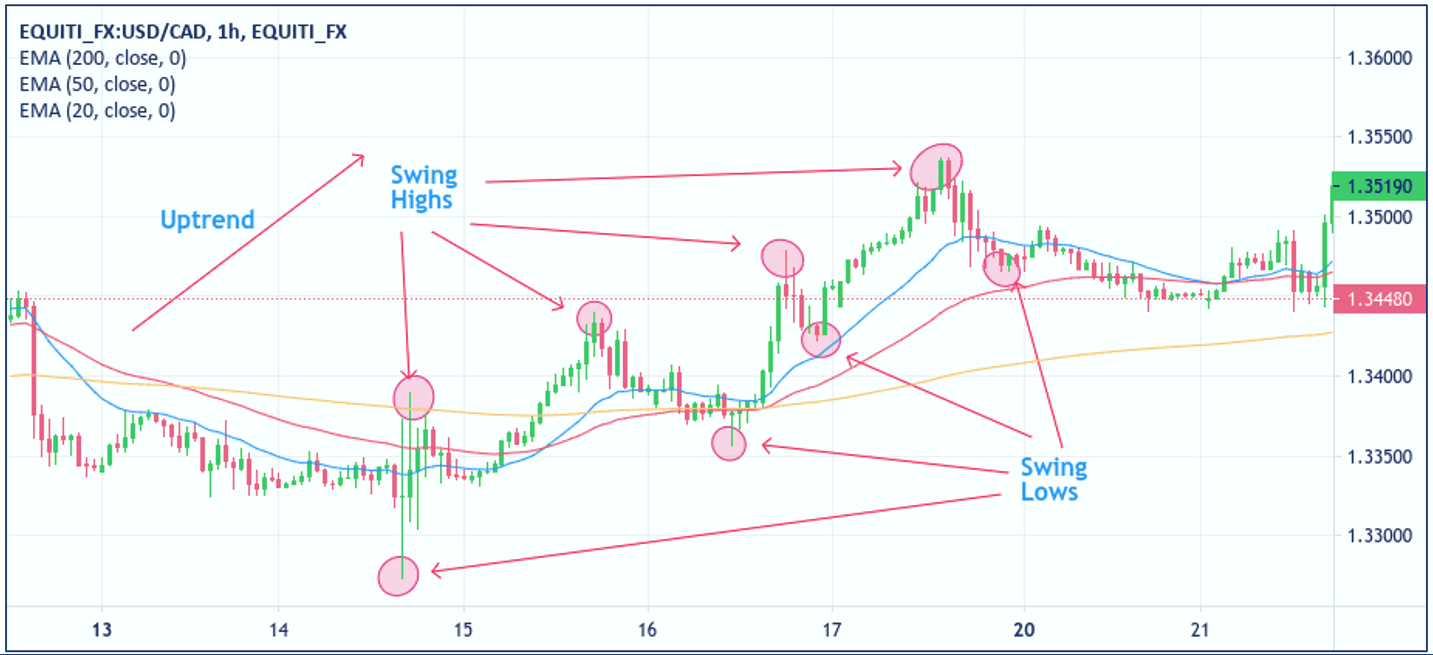

Swing traders typically use technical analysis tools such as chart patterns, trendlines, and moving averages to identify potential entry and exit points. They look for price swings which could be either swing highs or lows that are expected to last a few days to a few weeks, and aim to capture a portion of the overall price movement during that time. Swing traders usually attempt to identify "swings" within a medium-term trend and enter only when there seems to be a high probability of winning. A One Hour USD/CAD price chart depicting swing trading

Since trades have a longer duration than a single day, it is necessary to use more significant stop losses to withstand fluctuations in the market. Forex traders must incorporate this aspect into their money management strategy to effectively manage their finances.

Essential Factors to Consider Before Deciding on Swing Trading

1. Time commitment: Swing trading requires a significant time commitment to analyse market trends, identify potential trades, and monitor positions.

2. Risk tolerance: Swing trading can be a high-risk strategy due to the potential for large price swings and losses. Assessing your risk tolerance and determining how much you are willing to risk per trade is essential.

3. Market knowledge: You need to have a good understanding of the markets you plan to trade in, including their dynamics, trends, and the factors that can affect prices.

4. Technical Analysis skills: Technical analysis skills are essential for swing trading as you need to read charts and identify trends and patterns that signal potential trades.

5. Patience and discipline: Swing trading requires patience and discipline to wait for the right trading opportunities and stick to your trading plan.

Types of Swing Trading

Here are the four most popular types of swing trading: breakout, counter-trend and range-bound swing trading.

1. Breakout Swing Trading: It involves identifying key support and resistance levels and waiting for the price to break through them. When the price breaks through a resistance level, traders will look to buy the stock and hold it until it reaches the next resistance level. Conversely, when the price breaks through a support level, traders will look to short the stock and hold it until it reaches the next support level.

2. Counter-trend Swing Trading: It involves taking trades against the prevailing trend. Traders using this strategy look for stocks or other financial instruments that have become overbought or oversold and are due for a reversal. They may use technical indicators such as RSI or stochastic oscillators to identify overbought or oversold conditions. This strategy can be risky, as it goes against the prevailing trend, but it can also be rewarding if timed correctly.

3. Range-bound Swing Trading: It involves identifying stocks or other financial instruments trading within a defined range and buying when the price is near the bottom of the range, and selling when the price is near the top. This strategy can effectively trade in a sideways pattern but can be challenging to execute in trending markets.

Advantages And Disadvantages of Swing Trading

Like all trading styles, there are both pros and cons when using. Let us dive deep and know more.

Advantages of Swing Trading

1. Potentially high returns: Swing traders can earn high returns in a short period. Since swing traders hold their positions for only a few days to a few weeks, they can take advantage of short-term price movements and potentially make quick profits.

2. Less time-intensive: Unlike day traders, who need to monitor the markets throughout the trading day, swing traders only need to check in on their positions periodically. This makes swing trading a more manageable strategy for those who have full-time jobs or other commitments.

3. Flexibility: Swing trading can be used in any market, including stocks, futures, forex, and options. This allows traders to choose the market that best suits their interests.

Disadvantages of Swing Trading

1. High volatility: Swing trading involves taking advantage of short-term price movements, which can be highly volatile. This can result in significant losses if the market moves against the trader's position.

2. Limited profit potential: While swing traders can earn high returns in a short period, they are limited by the short-term nature of the strategy. This means that swing traders may miss out on more significant long-term gains.

3. Requires market knowledge: To be successful in swing trading, traders need to have a deep understanding of the market and the factors that influence price movements. This requires significant research and analysis, which can be time-consuming.

Should You Start Swing Trading?

Ultimately, the trading style depends on the trader's goals and preferences. Swing trading may be better for traders who prefer a more relaxed trading approach and have the patience to hold positions for several days or weeks. Ultimately, traders should choose the strategy that aligns with their goals, experience, and risk tolerance and that they feel comfortable executing consistently.

Regardless of which approach a trader chooses, it's crucial to have a solid understanding of technical analysis, risk management, and market psychology. With the right skills and mindset, this trading style can be a profitable strategy for navigating the markets.

Are you looking to start trading in the Forex Market? You can Enjoy FREE USD 10,000 Virtual Funds for trading by Signing Up on Pocket Trader. With Pocket Trader, You can invest in multiple markets, including forex, indices, and commodities, learn from experienced traders and share ideas with their social features to build wealth together.