Day Trading Style

Trading in the financial markets can be a lucrative way to build wealth and secure financial stability for the future. However, with so many different strategies, it can be challenging for new investors to know where to start.

In this article, we will explore more on day trading, including the essential factors to consider, pros and cons and some key factors to consider when using this approach.

What is Day Trading

Day trading is a popular and active style in that traders open and close positions within the same trading day, aiming to take advantage of short-term price movements in the market. Day traders tend to take a stance early in the day based on their preconceptions and act upon them, closing the day with either gains or losses. They are generally opposed to holding their trades overnight. Forex traders with sufficient time to examine, implement, and oversee trades are well-suited for day trading. Technical analysis is usually the primary method day traders use to execute trades.

Forex day traders typically focus on the more volatile currency pairs, such as those involving the US dollar, Japanese yen, British pound, and euro. These pairs tend to have wider spreads during the day, meaning traders can profit more from a successful trade but also involve higher risks.

Essential Factors to Consider Before Deciding on Day Trading

1. Education and Experience

Day trading requires knowledge and skills, so educating yourself about the market and developing a trading strategy is essential. Practice on a demo account before using real money.

2. Risk Management

Day trading in forex is risky, and you should have a risk management plan to limit potential losses. This includes setting stop-loss orders and taking profits.

3. Market Conditions

Consider the current market conditions, such as economic news and announcements, as they can significantly impact currency prices.

4. Time Commitment

Day trading in forex requires significant time and attention, as you need to monitor the market constantly throughout the trading day.

Types of Day Trading

Day traders looking to maximize intraday profits often use one or multiple of the following day trading strategies.

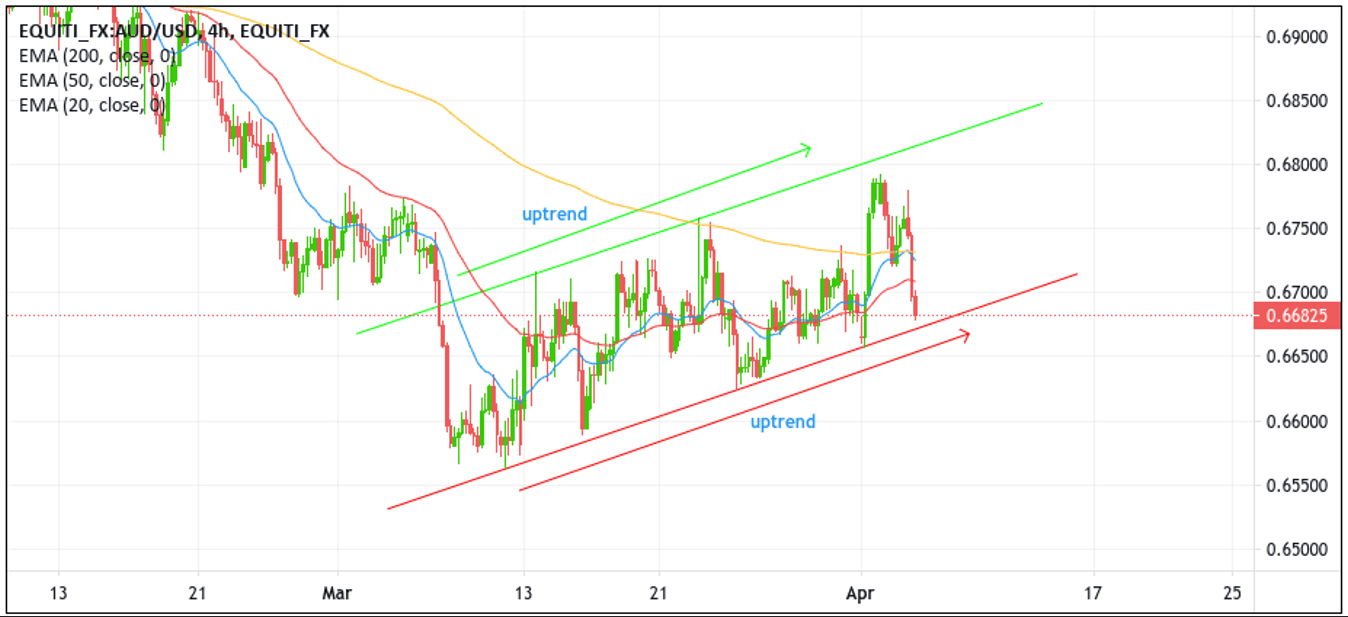

1. Trend Trading - this type of trading strategy involves identifying and following the trend of a particular asset, such as a currency pair in forex trading. Depending on their time horizons and trading goals, it can be used by day traders or longer-term traders. A classic example of an uptrend plotted by trendlines:

As a day trading strategy in forex, trend trading involves identifying the current trend of a currency pair using technical analysis tools such as trend lines, moving averages, and momentum indicators. Once the trend is established, the trader will look for opportunities to enter the market in the direction of the trend, either by buying the currency pair if it is in an uptrend or selling it if it is in a downtrend.

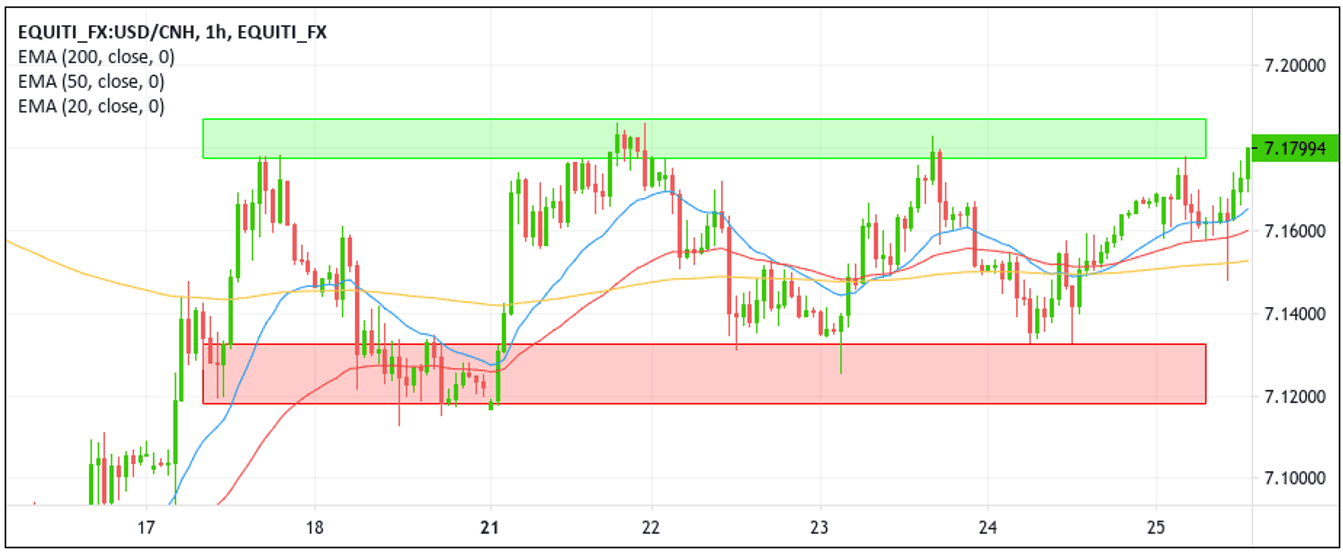

2. Range Trading - The basic idea behind range trading is to identify a currency pair trading within a defined range or price channel and then buy low and sell high within that range.

To implement a range trading strategy in day trading, traders typically look for currency pairs trading in a sideways or consolidating pattern, with precise support and resistance levels. Traders then aim to buy the currency pair at the support level and sell it at the resistance level, profiting from the price fluctuations within the range. Traders utilize stop losses and limit orders to ensure their trading is consistent with their perception of the market conditions.

3. News Trading - This strategy involves taking advantage of price movements immediately after economic news and data release. Day traders who use this strategy typically monitor economic calendars and news releases to identify high-impact events that could cause significant volatility in the currency markets. They then attempt to enter trades in anticipation of these events, hoping to profit from the resulting price movements.

4. Scalping - Involves opening and closing positions quickly to profit from small price movements. The goal of scalping is to accumulate many small gains over time rather than relying on a few large trades. Scalping requires traders to have quick reflexes and the ability to make rapid decisions under pressure. Most scalpers will close positions before the end of the day because the smaller profit margins from each trade will quickly get eroded by overnight funding charges.

Advantages And Disadvantages of Day Trading

Like all trading styles, there are both pros and cons when using. Let us dive deep and know more.

Advantages of Day Trading

1. High potential returns: Day trading can offer the potential for high returns due to the frequent buying and selling of financial assets. This allows traders to profit from small price movements throughout the day.

2. Flexibility: Day trading can be a flexible career option, as traders can work from anywhere with an internet connection. This means they can work from home, in a coffee shop, or while travelling.

3. Quick results: Day traders do not have to wait for weeks or months to see the results of their trades. Instead, they can see the results of their trades within the same day, which can be very satisfying and motivating.

Disadvantages of Day Trading

1. High risk: Day trading can be a high-risk investment strategy, as traders are exposed to the market's volatility. This means they can lose a lot of money quickly if they make the wrong decision.

2. High stress: Day trading can be very stressful, as traders need to make quick decisions and constantly monitor the market. This can lead to burnout and mental health issues for some traders.

3. Requires discipline: Successful day trading requires discipline and a strict trading plan. Traders must be disciplined to stick to their goals and avoid making emotional decisions.

4. High costs: Day traders must pay for trading fees, software, and data feeds. These costs can add up quickly and eat into their profits.

Should You Start Day Trading?

Ultimately, the trading style depends on the trader's goals and preferences. Day trading may be better for traders who enjoy the fast-paced and intense nature of intraday trading and have the time and resources to monitor the markets closely. Traders should choose the strategy that aligns with their goals, experience, and risk tolerance and that they feel comfortable executing consistently.

Regardless of which approach a trader chooses, it's essential to have a solid understanding of technical analysis, risk management, and market psychology. With the right skills and mindset, both day trading can be a profitable strategy for navigating the markets.

Are you looking to start trading in the Forex Market? You can Enjoy FREE USD 10,000 Virtual Funds for trading by Signing Up on Pocket Trader. With Pocket Trader, You can invest in multiple markets, including forex, indices, and commodities, learn from experienced traders and share ideas with their social features to build wealth together.