S&P 500 Futures Index Ticks Slightly Higher On Asian Session, Aims For $4300.00 Mark

- The S&P 500 Futures Index rebounded in the Asian session, supported by various factors

- The broad main index extends Thursday's Wall Street rally and aims for the $4300.00 Mark

- Investors are in a holding pattern while awaiting the Fed's upcoming policy meeting next week

- Warner Bros. Discovery Inc. (NASDAQ: WBD) leads the list of top gainers, while DISH Network Corporation (NASDAQ: DISH) leads the list of top losers in the S&P 500 Index

The S&P 500 futures index started off the last day of the week on the right foot, having weakened slightly overnight but rebounded in the previous two hours or so of the Asian session. It is trading within striking distance of its highest level since August last year. As per press time, futures tied to the S&P 500 added 0.02%/50 points to trade at $4290.17, while its counterparts, Nasdaq 100 futures and Dow Jones futures, all gained 0.03% and 0.01% to trade at $14475.2 and $33786 levels, respectively. The moves follow a winning day on Wall Street, as stocks rallied in the regular trading session on Thursday as markets built on their recent gains as investors looked ahead to key inflation data next week and the upcoming Fed policy announcement.

Noteworthy, the broader market index hit its highest level since August on Monday to denote a 2.7% rally month to date. However, it has retracted after that in the following days but is still headed for a second consecutive week of gains for the first time since April. Tech shares supported the rally on Thursday, propelled by Amazon.com (NASDAQ: AMZN) after bullish analyst commentary. The e-commerce giant's shares rose 2.5% and helped the Technology Select Sector SPDR Fund (XLK) climb more than 1%, according to a report by cnbc.com.

Investors had decided to wait on the sidelines before next week's Fed policy announcement, shied away from riskier assets, and flocked to safe-haven assets. This was evident from a generally subdued U.S. dollar due to declining yields and a fresh batch of disappointing data compared to a generally positive tone around the U.S. equity markets.

Nonetheless, the Fed is expected to maintain a hawkish stance next week and lift rates by 25bps to 5.25%. The bets were cemented after a U.S. Bureau of Labor Statistics report on Friday showed job numbers in April smashed expectations, indicating the Fed is less likely to halt its aggressive tightening campaign anytime soon. The stronger-than-expected job numbers and hotter-than-expected US PCE figures released in early May have fully reinforced a hawkish Fed outlook for next week. A fresh batch of data on Thursday showed initial jobless claims reached their highest level since October 2021, indicating a potentially softening labor market. According to a U.S. Department of Labour report, the number of Americans filing for unemployment benefits jumped to 261K in the week ending June 3rd 2023, which included the Labor Day holiday, the highest figure since October 2021, and above market forecasts of 235K. To a greater extent, the uptick in jobless claims has raised hopes that the Fed would pause its rate-hiking campaign at its meeting next week.

In fact, following the downbeat report, the chances of a Fed pivot have increased to 76% compared to 72.5% the previous day, according to CME's Fed Watch Tool. Furthermore, the disappointing jobless claims report joins last week's U.S. services data and mixed Fed talk. Despite the high odds placed for a Fed pivot by the markets, market experts still believe the Fed will lean toward a 25bps rate hike next week.

S&P 500 Movers

Here are today's top S&P 500 index movers, a week in which the index is set to close with heavy gains.

Top Gainers

- Warner Bros. Discovery Inc. (NASDAQ: WBD) rose 6.86%/0.90 points to trade at $14.02 per share

- Adobe Inc. (NASDAQ: ADBE) gained 4.95%/20.71 points to trade at $439.03 per share

- Tesla.Inc. (NASDAQ: TSLA) added 4.58%/10.29 points to trade at $234.86 per share

Top Losers

- DISH Network Corporation(NASDAQ: DISH) lost 4.50%/0.35 points to trade at $7.43 per share

- Pool Corporation (NASDAQ: POOL) declined 4.16%/14.10 points to trade at $324.64 per share

- Eastman Chemical Company (NYSE: EMN) shed 3.98%/3.33 points to trade at $80.42 per share

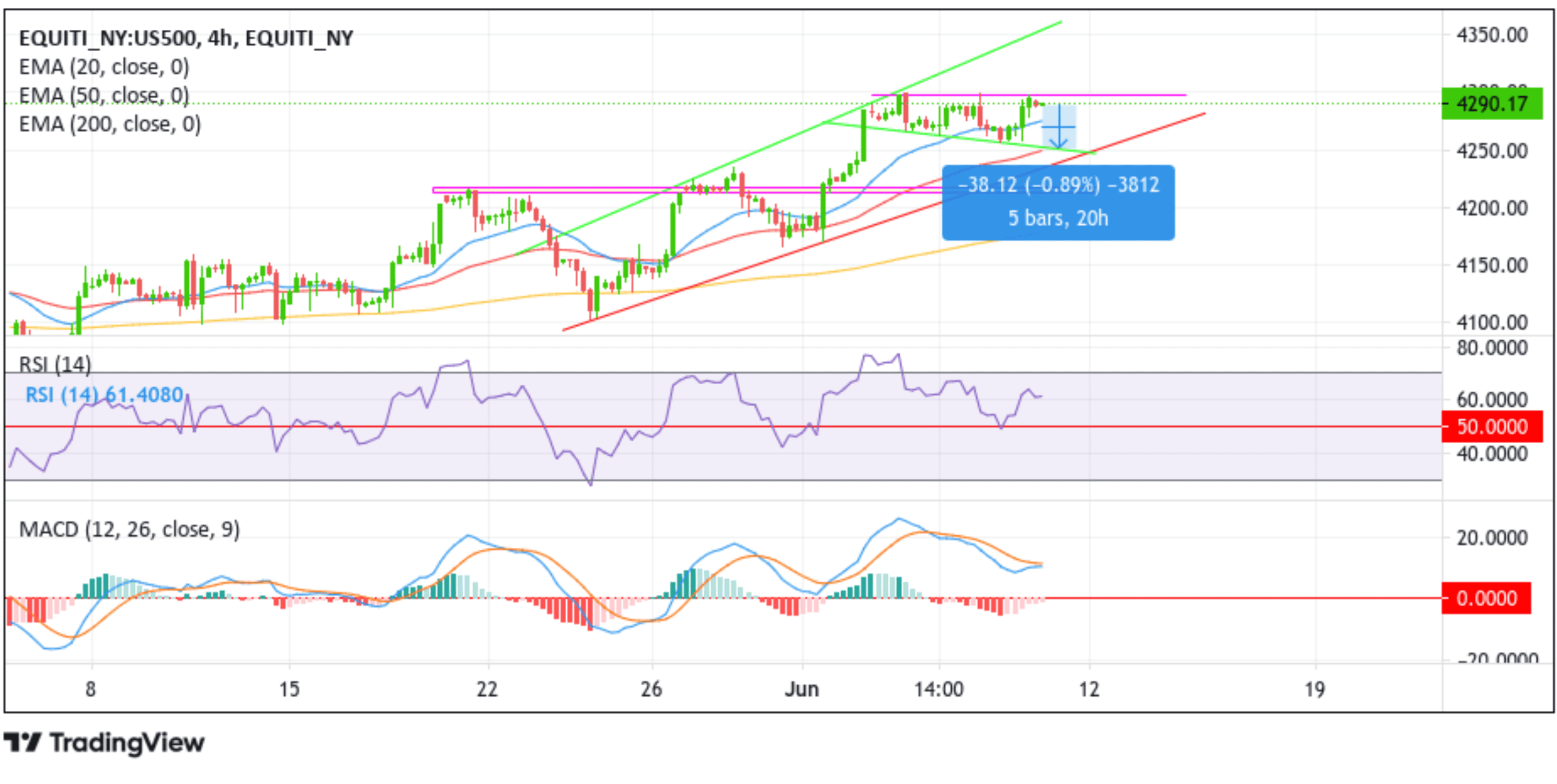

Technical Outlook: Four-Hours US 500 Futures Price Chart

From a technical perspective, a further increase in buying momentum from the current price level would cause the spot index to confront the $4298.42 resistance level. In additional neck up, the price will challenge the $4300.00 psychological mark. If the price finds acceptance above this level, the US500 index could accelerate its ascent toward the August 2020 ceiling at the $4326.7 level and, in highly bullish cases, retest the upper limit of the long-term ascending channel. If buyers manage to breach this ceiling (bullish price breakout) convincingly, it could negate any near-term bearish outlook, and the bullish trajectory could be extended further toward the $4400.00 and $4500.00 marks.

On the flip side, if bears resurface and spark a bearish turnaround price will find support at the 20-day (blue) Exponential Moving Average (EMA) at the $4276.34 level and on further weakness decline toward a descending trendline plotted in lower-time frames to denote a 0.89% drop. If sellers manage to breach this floor, downside pressure could pick up pace paving the way for a drop toward retesting the lower limit of the long-term ascending channel.