How To Avoid FOMO In Trading

In the world of trading, FOMO, or the fear of missing out, can be a powerful force. It's the feeling that you're not participating in a profitable opportunity that others are taking advantage of, leading to impulsive and emotional decision-making. In this article, we'll explore FOMO, why it's dangerous for traders, and, most importantly, how to avoid it. By understanding and overcoming FOMO, traders can make rational and profitable decisions that lead to long-term success.

What is FOMO In Trading

FOMO, or Fear Of Missing Out, refers to the feeling of anxiety or stress that traders experience when they see others making money or profiting from a particular trade or investment, and they fear they may miss out on potential gains. FOMO can affect anyone, from new traders to experienced traders and even trading professionals working for big companies.

FOMO can be particularly prevalent in volatile markets, where prices fluctuate rapidly, making traders eager to ride in the move and avoid regretting missing out on a potentially profitable trade. The desire to join in on the price movement clouds their judgment, making it difficult to conduct proper research or analysis of the trade. Social media and online forums can also amplify it, where traders share their successes and post about their gains, creating a sense of urgency to jump on the bandwagon and avoid missing out on the action, thereby driving the markets further up. Naturally, placing trades out of FOMO stems from our natural disposition to believe that the current price movement will continue even soon, which is a popular cognitive bias. In reality, price movements in the trading world can change direction depending on certain factors, such as political tensions, major news releases, or even inflation.

The characteristics of a FOMO trader

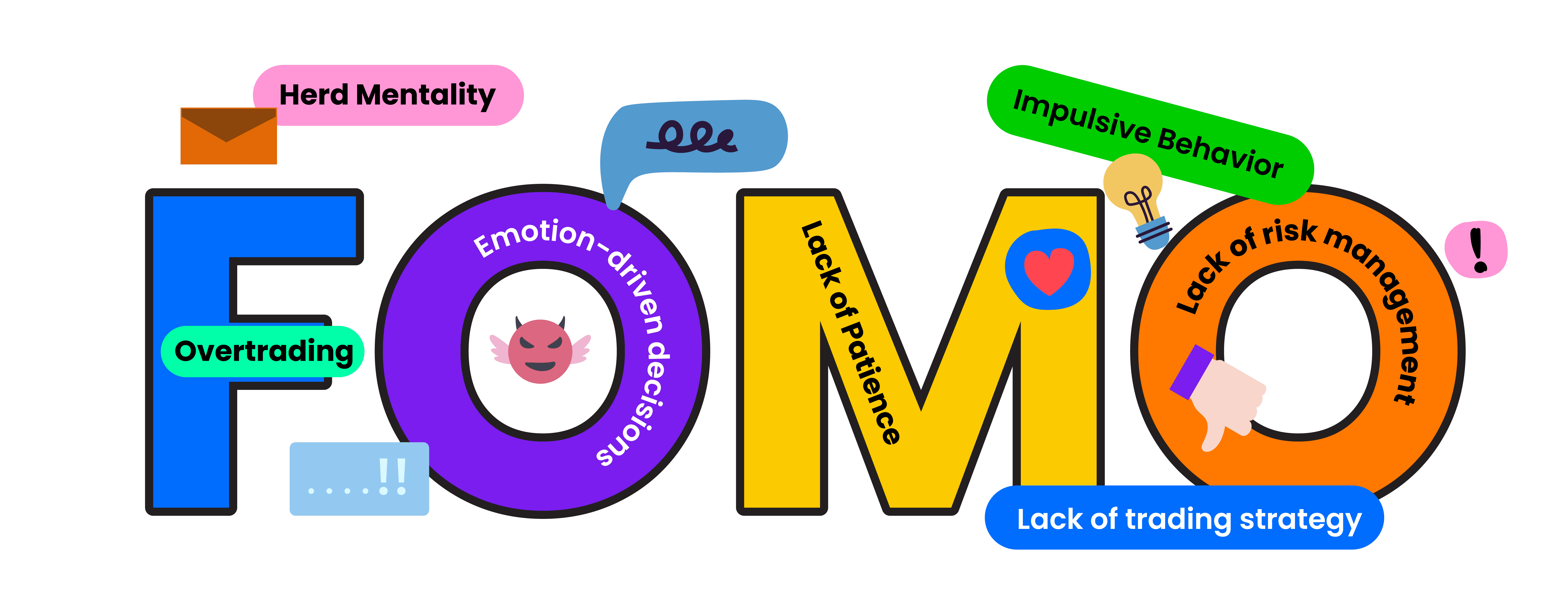

The fear of missing out on a potential trade is a nightmare for all traders as it affects their decision-making process, causing traders to make impulsive decisions, such as buying an asset that is already overvalued or selling too soon before realizing the full potential of a trade. However, not all traders have perfected the art of keeping emotions in check during a time of wild price movements. Still, even now, as we speak, some traders act on FOMO, and they usually have the following characteristics:

- Impulsive Behaviour: FOMO traders often make hasty decisions without proper research and analysis. They act on the fear that they will miss out on a potential profit, which drives them to take action without carefully considering the risks and rewards.

- Lack of Patience: FOMO traders have a short-term focus and are unwilling to wait for long-term gains. They want to make quick profits and move on to the next opportunity. This lack of patience can lead to poor decision-making and result in losses.

- Emotion-Driven Decisions: FOMO traders are driven by their emotions, particularly fear and greed. They may enter trades based on rumours or hype rather than on fundamental analysis and exit trades based on fear rather than rational analysis.

- Lack of Trading Strategy: FOMO traders often lack a strategy. They trade based on mood swings. When the price is moving in a specific direction, depending on their moods, they jump in, thinking the price will move in that direction forever.

- Herd Mentality: FOMO traders often follow the crowd and may be influenced by the actions of other traders or market trends. This can lead to a lack of independent thinking and poor decision-making.

Three factors that can trigger FOMO

Since FOMO is a powerful psychological phenomenon that can lead people to make irrational decisions and feel anxious or stressed, a range of factors can trigger the feeling. Some of these factors include the following:

- Increased Market Volatility: When the market experiences a significant increase in volatility, it can create a sense of urgency and pressure on investors to act quickly to avoid missing out on potential profits. This can cause FOMO to kick in and lead to impulsive trading decisions.

- Social Media: Platforms like Facebook, Instagram, and Twitter can make people feel like they are missing out on experiences or opportunities their peers enjoy. Traders sharing their successes and posting about their gains can create a sense of urgency to jump on the bandwagon and avoid missing out on what seems like a winning trade.

- News: News events such as economic data releases, company earnings reports, or political developments can significantly impact the market and trigger FOMO. Positive news can lead to a surge in buying activity, causing investors to feel like they are missing out if they don't participate in the market rally. Conversely, negative news can trigger panic selling and create a sense of urgency to sell before the market declines further.

How to avoid FOMO in trading

Some of how a trader can avoid FOMO in trading include:

- Having a Trading Plan: Before making any trades, it's essential to have a solid trading plan in place. This includes setting straightforward entry and exit points and having a risk management strategy. Stick to your plan and avoid making impulsive trades based on emotions.

- Use Stop-Loss Orders: Stop Loss (SL) orders limit potential losses on trades by automatically closing out a position at a pre-determined price. Using a stop-loss order, you can limit your losses and prevent FOMO from causing you to hold onto a losing trade.

- Keep a Trading Journal: Keeping a journal can help you track your emotions and identify patterns in your trading behaviour. You can adjust your strategy accordingly if you notice that you're consistently making impulsive trades due to FOMO.

- Practice Patience: The market can be volatile, and it's essential to remain patient and avoid making trades based on short-term movements. Take a long-term view and focus on your trading plan.

- Limit your Exposure: Don't put all your eggs in one basket. Diversify your portfolio and limit exposure to any financial asset or asset class. This can help reduce the impact of FOMO on your trading decisions.

In conclusion, FOMO, or the fear of missing out, can be a dangerous emotion for traders. It can lead to impulsive decision-making and prevent traders from making poor investment choices. However, traders can avoid FOMO by developing a disciplined approach to trading, staying informed about market trends without getting caught up in the hype, focusing on long-term investment goals, and finally, remembering that losses are a natural part of trading. By following these rules, traders can make informed decisions and avoid the pitfalls of FOMO in the world of trading.

Are you looking to start trading in the Forex Market? You can Enjoy FREE USD 10,000 Virtual Funds for trading by Signing Up on Pocket Trader. With Pocket Trader, You can invest in multiple markets, including forex, indices, and commodities, learn from experienced traders and share ideas with their social features to build wealth together.