Psychology of Market Cycles

Investing in financial markets can be a rollercoaster ride, with prices fluctuating wildly and investors' emotions riding high. While market cycles are a normal part of economic activity, they can still be difficult to predict and navigate. In this article, we will explore the various emotional stages an investor goes through during a market cycle and provide some tips on navigating them successfully.

By gaining a deeper understanding of the psychology of market cycles, traders can better prepare themselves for the ups and downs of the markets and make more rational trading decisions.

What is Market Psychology

Market psychology is a crucial concept in finance, and it refers to the emotional and mental factors that influence the behaviour of investors and traders in financial markets.

Understanding market psychology is critical because it helps traders make better trading decisions on when to buy or sell a financial asset. It can also help them manage their emotions during market volatility.

Market psychology is a key factor in determining the direction of the market. Traders and investors react to various news events and economic data releases, which can cause the market to move in a particular direction. For example, if there is positive financial news, traders may become optimistic about the economy's future, causing them to buy currencies, increasing the value of those currencies/financial assets.

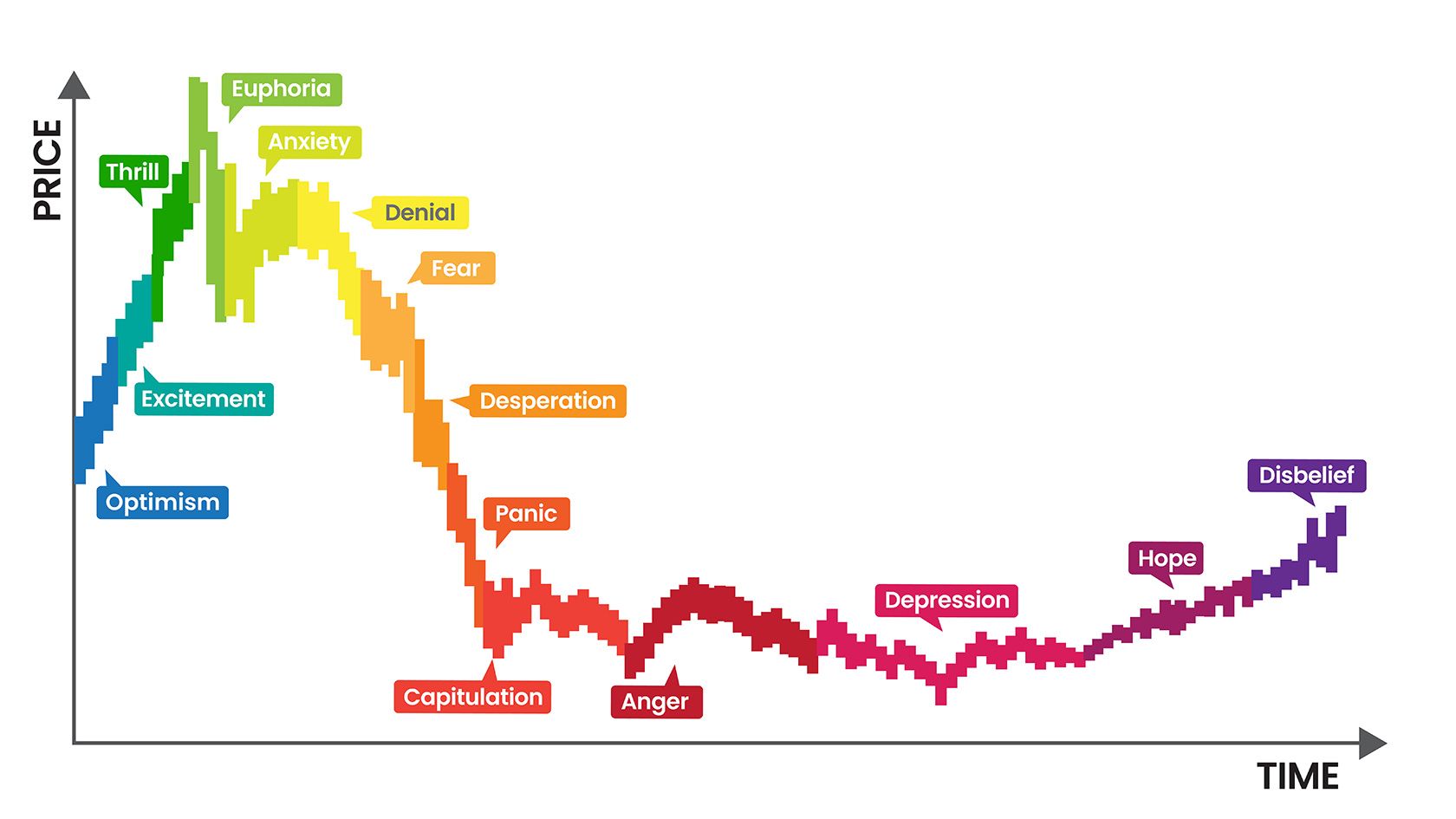

Understanding Investors' Emotions During a Market Cycle

Understanding investor emotions during a market cycle is crucial to making informed investment decisions and avoiding costly mistakes. The market cycle is characterized by four stages: expansion, peak, contraction, and trough. Each stage has its own unique set of emotions that investors experience.

During the expansion stage, investors are generally optimistic and enthusiastic. Stock prices are on the rise, and the economy is growing. Investors feel confident in their investment decisions and are willing to take on more risk. However, this optimism can lead to overconfidence and poor investment decisions.

As the market reaches its peak, investors become more cautious. They are still optimistic about the market but wary of taking too much risk. Investors begin to take profits, and the market starts to slow down. This caution can quickly turn into fear as the market begins to contract.

During the contraction stage, fear takes over. Investors begin to panic as stock prices plummet. They worry about losing their investments and start selling off their shares. This selling can lead to a self-fulfilling prophecy, as more selling results in lower stock prices. As fear takes hold, investors may make rash decisions, selling their investments at a loss.

Finally, during the trough stage, investors are at their most pessimistic. The market is at its lowest point, and investors feel like there's no end in sight. They may feel like they've made a huge mistake investing in the market and regret not selling earlier. However, it's important to remember that the market is cyclical and will eventually recover.

The Cycle of Investor Emotions

The cycle of investor emotions describes an investor's emotional stages during a market cycle. Here's a closer look at each stage:

- Optimism: At the start of a market cycle, investors are optimistic. They believe that the market will continue to rise and that they will make money

- Excitement: As the market continues to rise, investors become excited. They start to see the potential for significant profits

- Thrill: The price is still rising, so there is no reason to consider potential negative effects

- Euphoria: When the market reaches its peak, investors are euphoric. They believe that the market will continue to rise indefinitely, and they will take on more risk

- Anxiety: As the market starts to fall, investors become anxious. They start to worry about losing their profits and may start to sell some of their investments

- Denial: Even as the market continues to fall, some investors may be in denial. They may believe the market will bounce back and refuse to sell their investments

- Fear: When the market decline accelerates, investors become fearful. They start to panic and may sell their investments at a loss

- Desperation: Some investors may become desperate as the market falls. They may try to find ways to recoup their losses, such as buying more investments or taking on more risk

- Panic: Investors panic when the market hits rock bottom/full-blown bear market

- Capitulation: Not knowing what exactly to do, they may sell all their investments, regardless of the price, to try to avoid further losses

- Anger: Realizing they have lost significant money and may be unsure how to recover, they blame themselves and the market drivers

- Depression: The pain of realizing they have lost all their hard-earned money kicks in

- Hope: Because markets cycle naturally, there is a point when the market stops falling and begins to move sideways. The accumulation phase is when the most seasoned traders and investors wait to buy

- Disbelief: A new uptrend begins from the bear market while most investors are frozen in fear. Investors who lost money now believe that perhaps their instincts were correct

Tips on How to Navigate Market Cycles Successfully

To successfully navigate market cycles, investors need to understand the patterns and know how to adjust their investment strategies accordingly. Here are some tips on how to navigate market cycles successfully:

- Understand the Market Cycles The first step to successfully navigating market cycles is understanding how they work. The stock market moves in cycles, with periods of growth and decline. Economic and political factors drive these cycles, such as interest rates, inflation, and geopolitical events. Understanding the patterns of these cycles and the factors that drive them is critical to making informed investment decisions.

- Develop a Long-Term Strategy One of investors' most common mistakes when navigating market cycles is trying to time the market. While trying and buying low and selling high may be tempting, this strategy takes time to execute consistently. Instead, investors should focus on developing a long-term investment strategy based on their financial goals and risk tolerance. By sticking to a long-term strategy, investors can weather the ups and downs of market cycles and avoid making impulsive decisions based on short-term market movements.

- Stay Disciplined Discipline is critical to successfully navigating market cycles. Sticking to your long-term investment strategy and avoiding making impulsive decisions based on short-term market movements is essential. Investors should also be disciplined in their approach to risk management, regularly reviewing their portfolio and rebalancing as needed to ensure they stay on track to meet their financial goals.

In conclusion, the psychology of market cycles plays a critical role in determining investors' behaviour and the economy's overall state. The emotions of fear and greed often drive market cycles, leading to periods of irrational exuberance and devastating crashes.

It is essential to recognize that market cycles are inevitable, and no one can predict precisely when they will occur. However, by monitoring trends and staying informed about market developments, investors can be better prepared to weather the ups and downs of the market.

Are you looking to start investing in the Financial Markets? You can Enjoy FREE USD 10,000 Virtual Funds for trading by Signing Up on Pocket Trader. With Pocket Trader, you can invest in multiple markets, including forex, indices, and commodities, learn from experienced traders and share ideas with them about social features to build wealth together.