How to invest in a bear market with Forex?

The words "Bear Market" strike fear into the hearts of many investors. Many fear a bear market because investor confidence is low, earnings weak, and economic indicators often contract, stocking fears of a potential recession, which could feed the downward spiral. In turn, they run for the exits, hoard cash, and hope their portfolio allocations can weather the storm. But these deep market downturns are unavoidable and often relatively short, especially compared with the duration of bull markets, when the demand is rising in value. Bear markets can even provide good investment opportunities.

A bear market is an unavoidable part of investing. Understanding the meaning of a bear market will help alleviate fear and allow investors to navigate a bear market with bear market investing strategies capable of delivering long-term profitability.

What is a Bear Market?

At the most simplistic level, a bear market definition is that of a market experiencing falling prices. It describes a condition where securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment. While the bear market meaning primarily applies to an index, like the S&P 500, or a sector, like technology, the same principle applies to forex currencies and individual assets if they experience a decline of 20% or more over a sustained period —typically two months or more.

In Forex, Bearish markets tend to follow a downward trend as investors sell riskier assets such as stocks and less-liquid currencies such as those from emerging markets. The U.S. dollar (USD) and Japanese yen (JPY) are safe-haven currencies and tend to strengthen in a bear market as riskier instruments are sold off, and safe-haven currencies are in demand.

Causes of a Bear Market

What causes a bear market often varies, but in general, a weak or slowing or sluggish economy, bursting market bubbles, pandemics, wars, geopolitical crises, and drastic paradigm shifts in the economy. Shifting to an online economy are all factors that might cause a bear market. In addition, any intervention by the government in the economy can also trigger a bear market.

Examples of a Bear Market

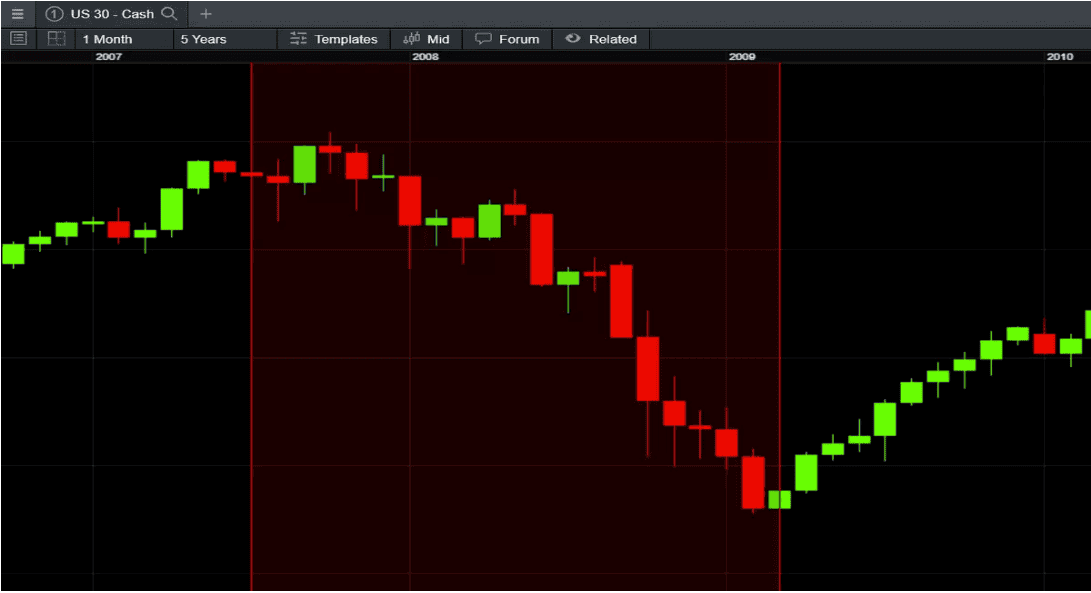

The most notable bear market began in 2007 and lasted through 2009. The ballooning housing mortgage default crisis caught up with the stock market in October 2007. The S&P 500 touched a high of 1,565.15 on October 9, 2007. By March 5, 2009, it had crashed to 682.55, as the extent and ramifications of housing mortgage defaults on the overall economy became apparent. The U.S. major market indexes were again close to bear market territory on December 24, 2018, falling just shy of a 20% drawdown.

U.S. 30 index showing the bear market during the Global Financial Crisis of 2007-2009

6 tips for investing in a Bear Market

Bear markets can undoubtedly be scary for investors, and nobody enjoys watching the value of their portfolios go down. On the other hand, these can be opportunities to put money to work for the long run while stocks are trading at a discount.

Below are some of the tips you can use to invest in a forex bear market the right way:

1. Take a short-selling Position

As the saying goes, 'the trend is your friend. Short-selling is a way to follow the directional momentum in a bear market – you'd take a sell position (go short) by speculating on falling market prices. If your prediction pans out, you'll make a profit. But even in bear markets, prices can move either way. So, you'll incur a loss if the price action moves against your position.

2. Find a Good Entry Position

When the decline in price hits the 20% mark, it's official - bear market territory has been entered. If looking to short-sell, for example, this could be a good point to open the position. Even though the price is likely to continue dropping, it's impossible to know how long it'll keep falling or whether it'll continue to drop. If it does continue, there's also no way of knowing how long the decline will last (the following tip addresses this).

3. Take profits at Regular Interval

The probable price action direction in a bear market is descending. This could be an opportunity to lock in profits regularly, but it's important to remember that prices can move up now and then, even in bear markets.

4. Trade Indices and ETFs

While indices such as the US30 represent a basket of stocks by company market capitalization, exchange-traded funds (ETFs) track the performance of a market, for example, a country's stocks, an index, or a sector. With bear markets often being triggered by supply and demand factors and in turn, impacting economic conditions, such broad exposure to related assets offers an opportunity to benefit from the expected similarities in price movements. Naturally, if the actual price movements go against expectations, this would spell losses. That said well, it's essential to diversify your trading portfolio by trading in different indices and ETFs as well as in commodities to minimize your overall portfolio losses in case of a mix of relative winners and losers.

5. Set a Stop Loss Order

Stop-loss orders are a valuable tool to close an open trade against you at a predefined price level to limit capital loss. However, markets can move fast, which is often the case when they turn bearish. Bear markets don't head down continuously – prices may pull back from time to time. Traders may risk being stopped when the market consolidates rather than making a fundamental shift.

6. Be Patient

Bear markets can reveal the tenacity and determination of a trader, including professionals. While the former may be a time of financial insecurity, history teaches us that they don't last very long. Patience is essential to reap good profits when trading in a bear market. This includes knowing when to enter a trade when the currency price slows. You can also choose to keep yourself updated on the latest economic news that has the potential to impact the movement of a specific currency pair before you decide to move with the trend(entering short positions)-to avoid being stopped out in case the market moves against you.

Bottom Line

Bear markets are no reason to panic, but a good time to make sure your trading portfolio is adequately diversified and de-risked. Know how much you have at stake and how much time you have to recoup any losses. Before you commit to investing in a bear market, you must fully grasp the reality that financial losses are part of the game. This might mean the first weeks or months of trading result in losses. The only way to move past those losses is to identify lessons to be learned and sharpen your skills, rather than letting emotions get the better of you and doubling down on losing methods.

On Pocket Trader, you join the wider trading community to discuss trading ideas, validate plans, learn to read between the candles to identify trading opportunities and lift your trading game to master the markets.

You can stick to a demo trading account to learn the tricks of the trade in a safe, risk-free environment before you commit real money while still getting the most out of linking up with more experienced traders.