The Market Structure

The market structure of forex trading plays a crucial role in determining how traders approach the forex market. In this article, we'll explore the different types of forex markets a trader, through their price action analysis will meet and what makes them distinct from one another.

Let’s now dive in and look at each market type in-depth and explain how a trader can trade each type.

Trending Markets

Trending markets refer to financial markets where the prices of assets are moving in a particular direction over a sustained period. There is a clear and persistent upward or downward movement in the prices of assets such as indices, commodities, or currencies.

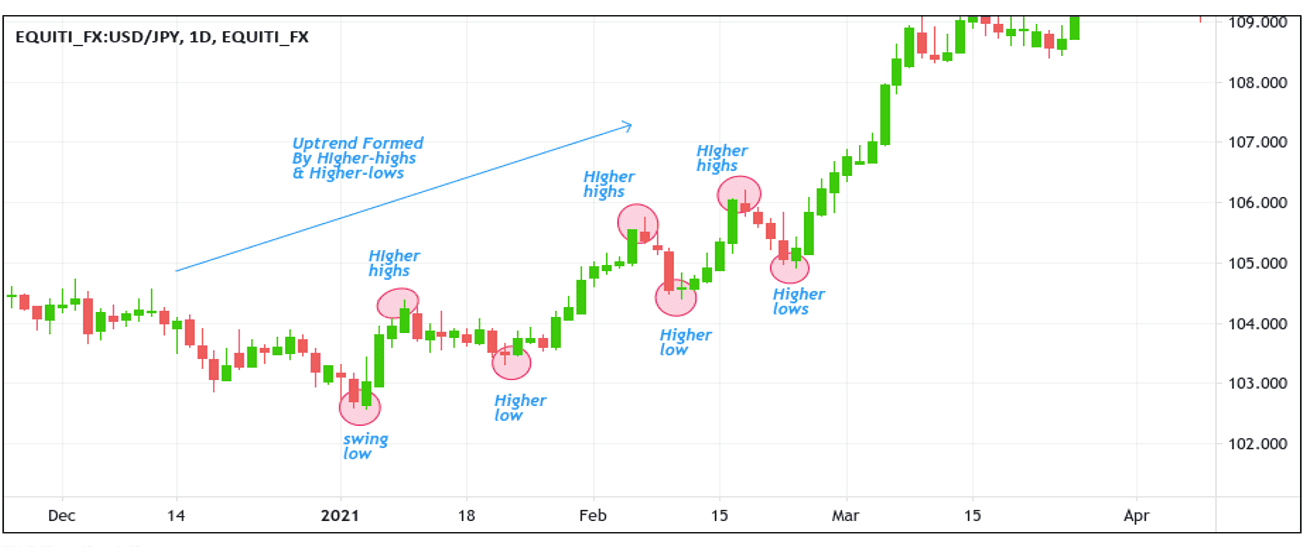

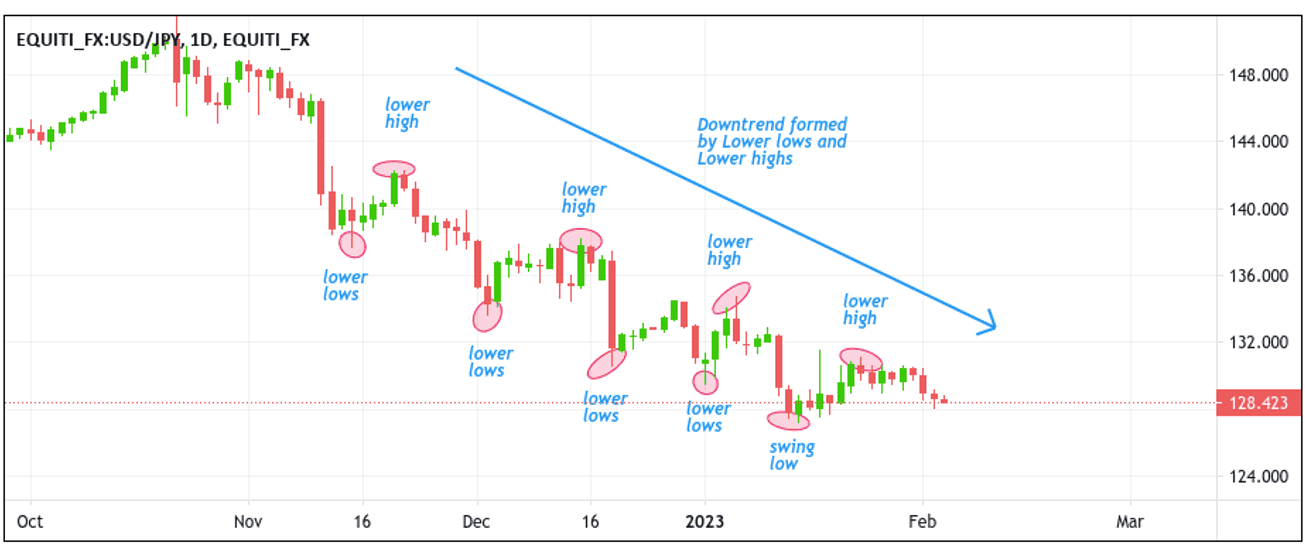

A market is said to be trending when there is a series of higher highs and higher lows (in an uptrend) or lower highs and lower lows (in a downtrend) in the price movement over a period of time.

From the example above, the market is making a series of Higher Highs(HH) and Higher Lows(HL) which indicates that the market is trending up. You don’t need indicators to decide if it is bullish or bearish just a visual observation of price action is quite enough to get an idea about the market trend.

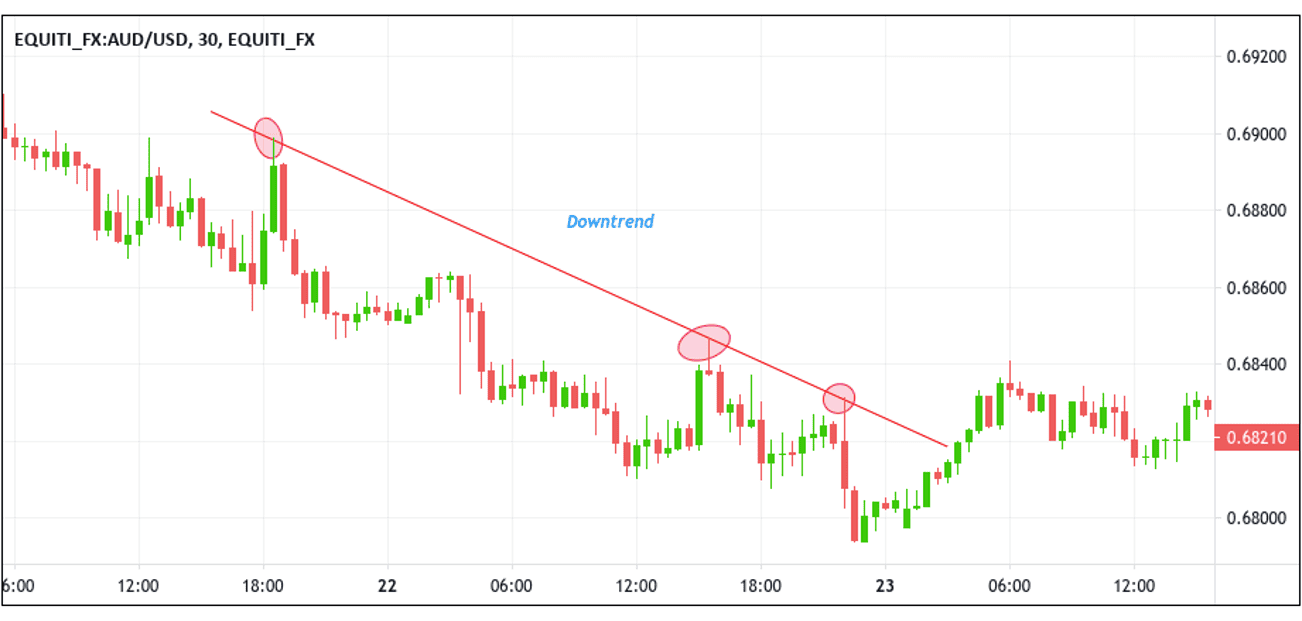

The example above shows a bearish market, as you can see there are series of Lower Highs(LH) and Lower Lows(LL) which indicate an obvious downtrend. To determine whether it is a trending market or not, you have to use bigger time frames such the 4H, the daily or the weekly time frame.

💡How To Trade Trending Markets

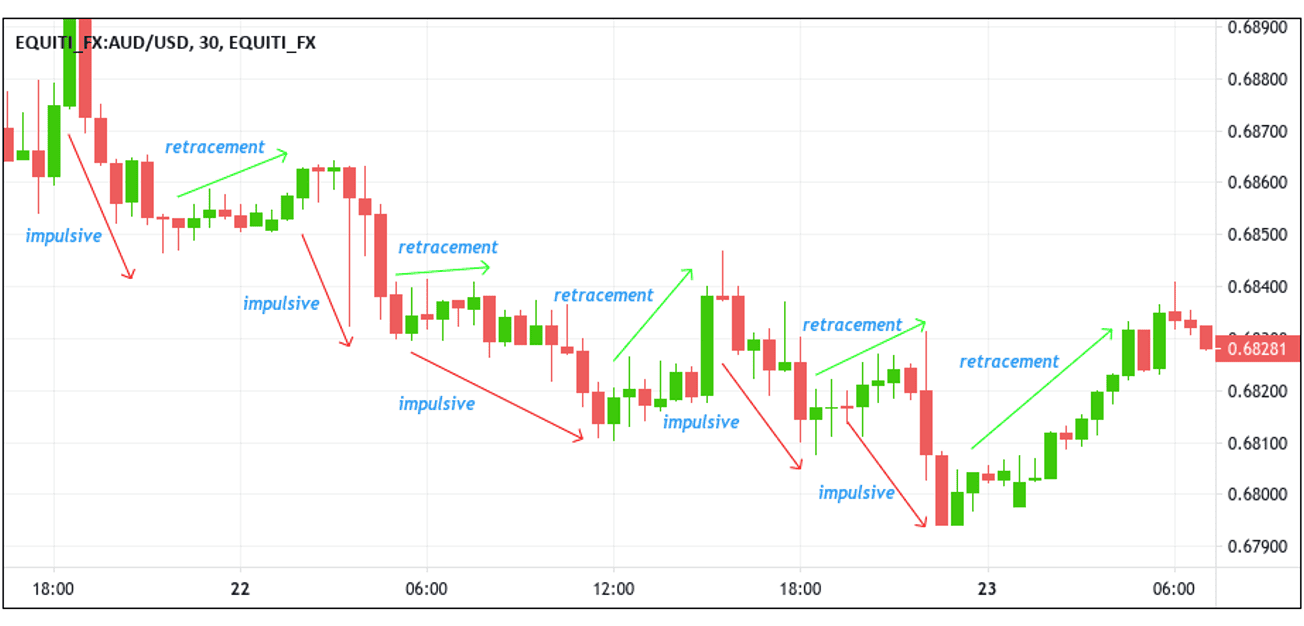

If the market is experiencing an upward trend, you should seek out opportunities to buy because it's important to trade in the direction of the trend. Conversely, if the market is experiencing a downward trend, you should look for opportunities to sell. However, the challenge lies in determining the ideal time to enter a trending market. Trending markets have two key movements: the initial impulsive movement and the subsequent retracement movement.

The example above is making an impulsive move and a pullback or a retracement move. (corrective move). To trade this type of market structure, you should always “Sell” at the beginning of an impulsive move and take profits at the end of it. The same goes for an uptrend always “Buy” the market at the beginning of an impulsive move and take profits at the end of it. It is worth noting If you try to sell/buy in the retracement move whether in an uptrend or downtrend, you will be trapped by professional traders and you will lose your trade.

Additionally, to predict the beginning of an impulsive move in a trending market, you have to draw support and resistance levels and also trendlines.

💡Using Support and Resistance Levels in a Trending Market

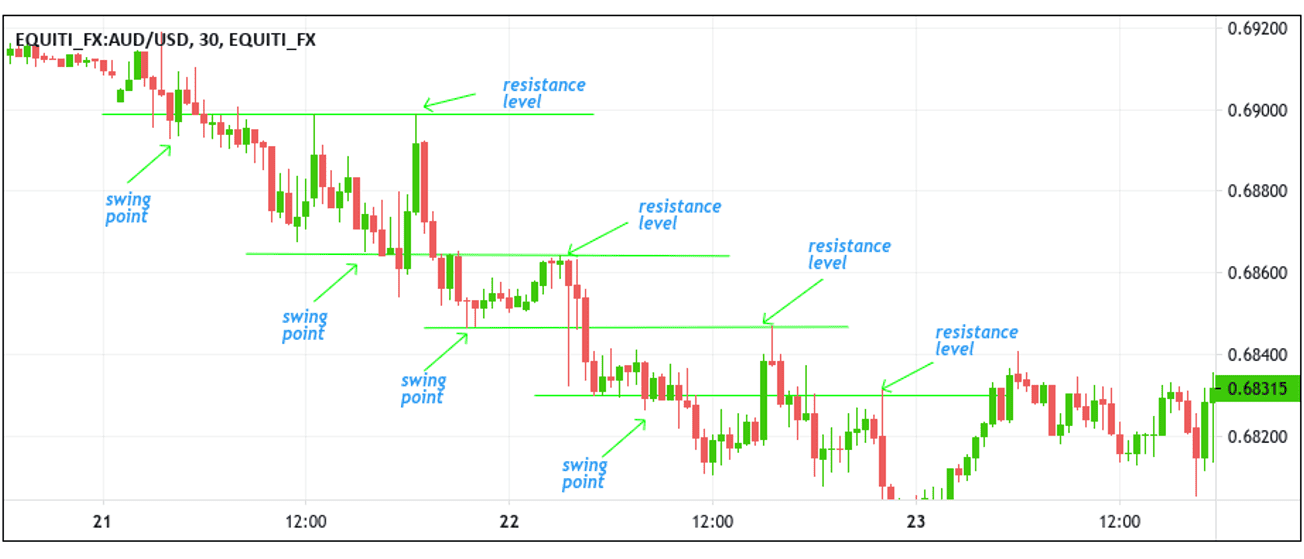

Support and resistance are formed from swing points. In an uptrend the previous swing point acts as a support level, and in a downtrend, the old swing point acts as a resistance level.

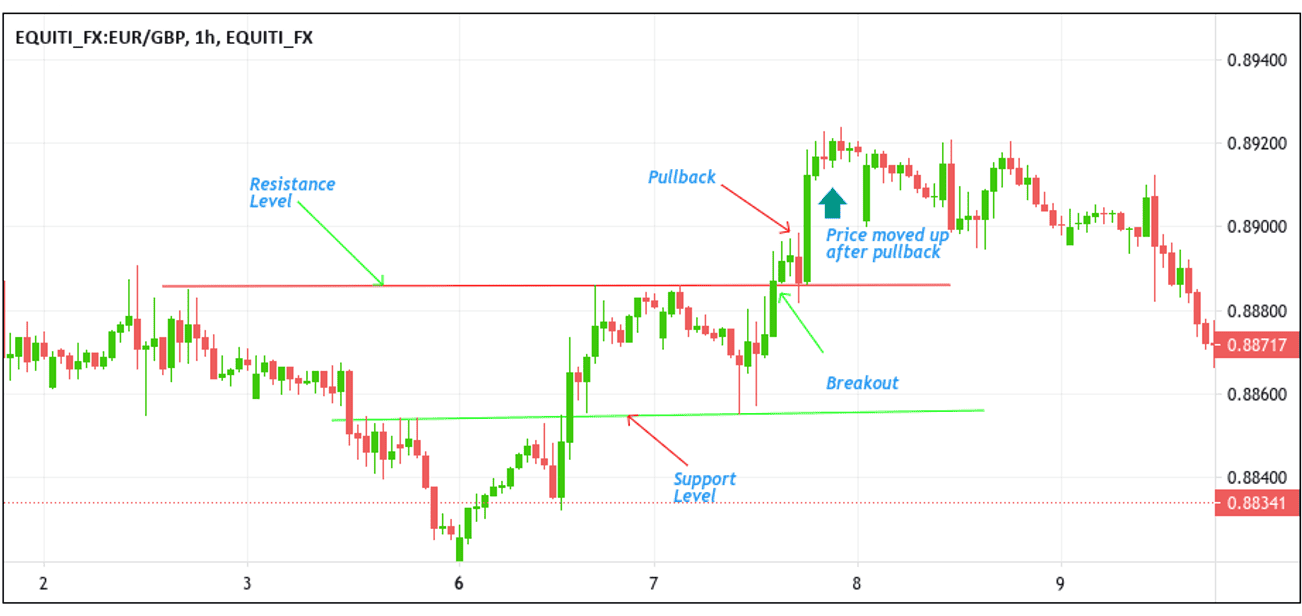

The example above shows the previous swing points acts as resistance level after the breakout. When the market makes the retracement moves, it respects the previous swing point (resistance level) which will represent the beginning of another impulsive move. Hence, making it a suitable place to enter a Sell trade in favour of the trend. When the market tests the previous swing point (support level), it goes up again (offers an opportunity to re-enter the trade again).

💡Using Trendlines in a Trending Market

Drawing a trendline in a trending market can spot the beginning of an impulsive wave and use it to their advantage to enter a BUY/SELL trade.

When the market moves this way, trend lines help us anticipate the next impulsive move in the direction of the market.

The Ranging Market

Markets that move horizontally and don't show any clear trend are commonly known as "ranging markets", sometimes referred to as " sideways markets” as they appear to move in a neutral manner and neither buyers nor sellers can establish control over the market. In contrast, when the market shows a clear upward trend, with a series of higher highs and higher lows, it is said to be trending up. If this pattern of consecutive peaks is broken, the market is considered to be ranging, which implies prices move between a support and resistance level.

The chart above shows a bounce between a horizontal support and resistance level before price later on broke down below the resistance level.

💡How to Trade Ranging Markets

📌 By waiting for the price to approach a support or resistance level - you can buy at the key support level and sell at the key resistance level.

📌 By waiting for the breakout from either the support level or the resistance level - The breakout means that the ranging period is over, and the beginning of a new trend will take place.

📌 By waiting for a pullback after the breakout of the support or the resistance level - The pullback is another chance to join the trend for traders who didn’t enter in the breakout as shown in the chart below. What happens is after the breakout, the market comes back to retest the resistance level that becomes support before it goes up.

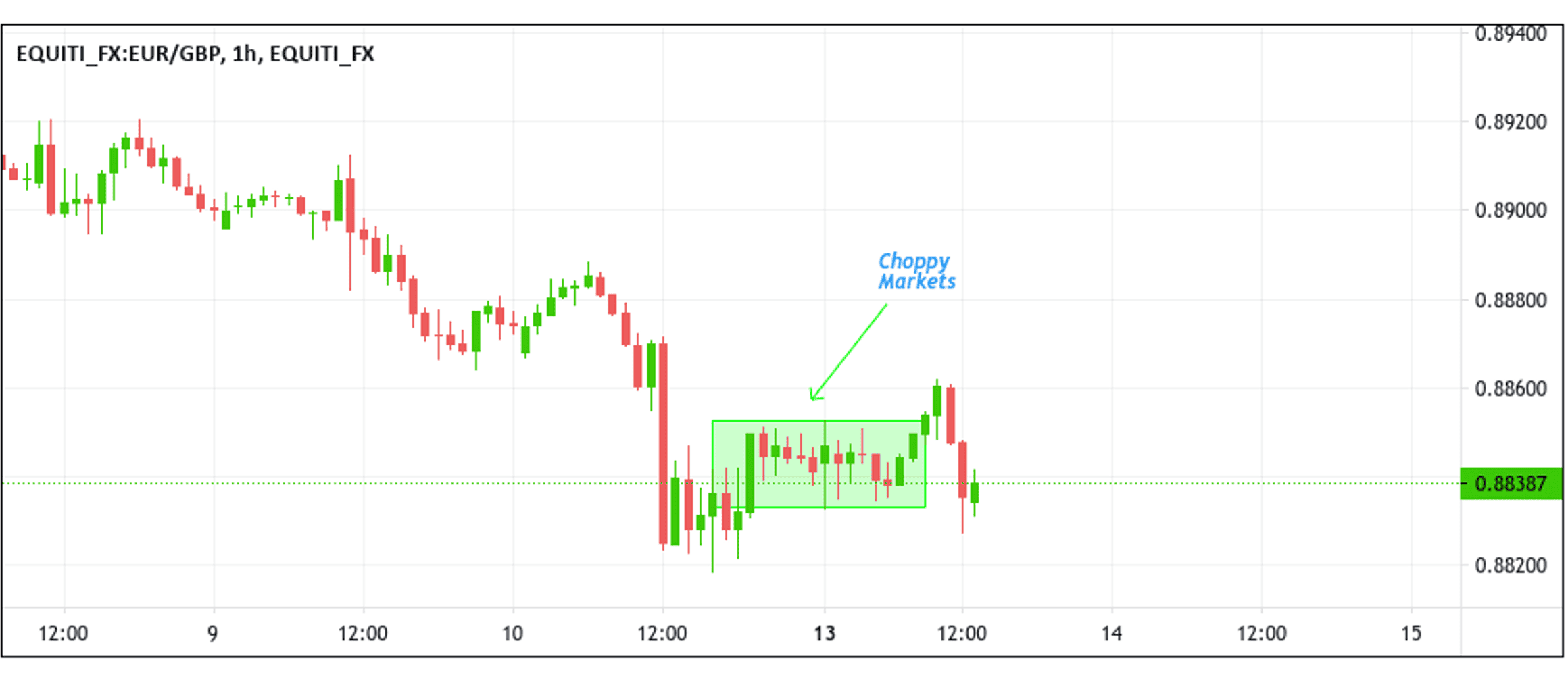

Always make sure that the market is worth trading if you feel like you can’t identify the boundaries (support and resistance), this is a clear indication of a choppy market.

The Choppy Market

Choppy markets are characterized by erratic price movements with no clear trend. Prices can fluctuate rapidly in both directions, making it difficult for traders to identify profitable trading opportunities, which can last for a few hours, days, or even weeks, depending on the underlying economic and geopolitical factors driving the market.

Choppy markets can make a trader feel very emotional and doubt their trading strategies as it starts to drop in performance.

In conclusion, the above markets can have a significant impact on the effectiveness of trading strategies and risk management techniques. Traders need to be aware of the characteristics of each market and tailor their approach accordingly. Technical and fundamental analysis, stop-loss orders, leverage, and monitoring economic and political developments are all important tools that can help traders navigate the forex market and manage their risks effectively.

Are you looking to start trading in the Forex Market? You can Enjoy FREE USD 10,000 Virtual Funds for trading by Signing Up on Pocket Trader. With Pocket Trader, You can invest in multiple markets, including forex, indices, and commodities, learn from experienced traders and share ideas with their social features to build wealth together.