GBP/NZD Price Rebounds From Weekly Low and Steadies Above 1.9000 Mark Amid Record Low N.Z. Consumer Confidence

- GBP/NZD pair witnessed some buying during the early Asian Session and rallied over 50 pips to recover part of its early lost ground

- Bank of England hikes key rate by 50 basis points, will continue to respond 'forcefully' if needed

- U.K. Retail Sales unexpectedly Fell in November

- New Zealand (N.Z.) Consumer Confidence at a record low, in turn, undermines the Kiwi

GBP/NZD cross attracted some deep buying from the vicinity of the 1.90218 level to lift spot prices to a fresh daily high during the early Asian session. The pair has recovered part of its early lost ground and climbed over 50 pips above the daily low. The pair looks set to maintain its bid tone heading into the European Session.

The Bank of England last week on Thursday hiked its main interest rate by 50 basis points and signalled that more tightening would be needed to rein in inflation. The Monetary Policy Committee voted 6-3 in favor of the half-percentage point hike, which takes the bank rate to 3.5%. The rise marks a slowdown from November's 75 basis point increase.

"The labor market remains tight and there has been evidence of inflationary pressures in domestic prices and wages that could indicate greater persistence and thus justifies a further forceful monetary policy response," the MPC said in its statement Thursday.

"The majority of the Committee judges that, should the economy evolve broadly in line with the November Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target."

The MPC noted the "considerable uncertainties" around the outlook but said it would "respond forcefully" if inflationary pressures begin to look more persistent.

The Bank of England's interest rate decision came a day after inflation data showed inflation in the U.K. slowed down in November after hitting a 41-year high in October. The Bank expects inflation to fall gradually over the first quarter of 2023 as earlier spikes in energy and other goods prices drop out of the annual comparisons.

U.K. inflation came in slightly below expectations at 10.7% in November, as cooling fuel prices helped ease price pressures, though high food and energy prices continued to squeeze households and businesses.

Economists polled by Reuters had projected an annual increase in the consumer price index of 10.9% in November after October saw an unexpected climb to a 41-year high of 11.1%. Every month, the November increase was 0.4%, down from 2% in October and below a consensus estimate of 0.6%.

A More Cautious Path

The Bank expects U.K. GDP to contract by 0.1% in the fourth quarter of 2022, 0.2 percentage points stronger than in its November Report.

The MPC is trying to drag inflation back toward its target while remaining sensitive to a weakening economy beset by several unique domestic pressures and global headwinds.

The Bank has found itself increasingly difficult as concerns about a looming recession and financial stability are weighed against ongoing wage pressures, including the risk of inflation. This is reflected in the many votes cast today," said Hussein Medhi, macro and investment strategist at HSBC Asset Management.

"The downward shift to 0.5% is reasonable and the MPC believes he will follow a more cautious trajectory in 2023," he said.

This was borne out in the latest U.K. labor market data, published earlier last week, which showed an uptick in unemployment and wage growth. At the same time, economic inactivity and long-term illness rates also remain historically high.

The MPC said that while labor demand has begun to ease, the labor market remains tight. The unemployment rate rose slightly to 3.7% in the three months to October. Wage pressures are a key focal point as policymakers assess the inflation outlook.

In another news released on Friday, Retail sales in the U.K. unexpectedly declined 0.4% month-over-month in November of 2022, after jumping an upwardly revised 0.9% in the previous month when there was a bounce back from the impact of the additional Bank Holiday in September for the State Funeral. Figures compare with market forecasts of a 0.3% rise, with sales falling in non-food stores (-0.6%), namely second-hand goods stores, particularly auctioning houses and computer stores; auto fuel (-1.7%), as fuel and lubricant prices rose by 0.8%; and non-store retailing (-2.8%). Additionally, Retail Sales Excluding Fuel in the United Kingdom decreased 0.3% month-over-month in November of 2022, worse than market forecasts of a 0.3% rise. Compared to a year earlier, retail sales excluding fuel were down 5.9%. That said, the combination of mixed data was a key factor that offered some support to the Cable and exerted upward pressure on the GBP/NZD pair.

Shifting to the New Zealand docket, The Westpac-McDermott Miller consumer confidence index for New Zealand tumbled to a record low of 75.6 in the last quarter of 2022 from 87.6 in the previous period, in a sign more New Zealanders are pessimistic about the economic environment than those who are optimistic. Mounting financial pressures are a major concern that is worrying households, as living costs have been skyrocketing and borrowing costs have increased sharply. The drop in confidence has been widespread across all age groups, income brackets and regions.

Further limiting the Kiwi was the China Retail sales data released last week on Thursday, which missed expectations across the board during a month in which widespread Covid controls weighed on growth.

China's retail trade declined 5.9% year-on-year in November 2022, much faster than a 0.5% fall in the prior month and worse than market expectations of a 3.7% drop. This was the second straight month of decrease in retail trade and the steepest pace since May, as consumption deteriorated due to the impact of a new wave of COVID infections and ongoing restrictions. Considering the year's first eleven months, retail sales edged down 0.1%. That said, the downbeat macro data undermined the Kiwi and, in turn, drove flows toward the Cable.

As we advance, investors now look forward to the British Docket featuring the release of the CBI Industrial Trends Order (Dec) data which is expected to show a decrease in order volume and land at -9, down from -5 the prior month.

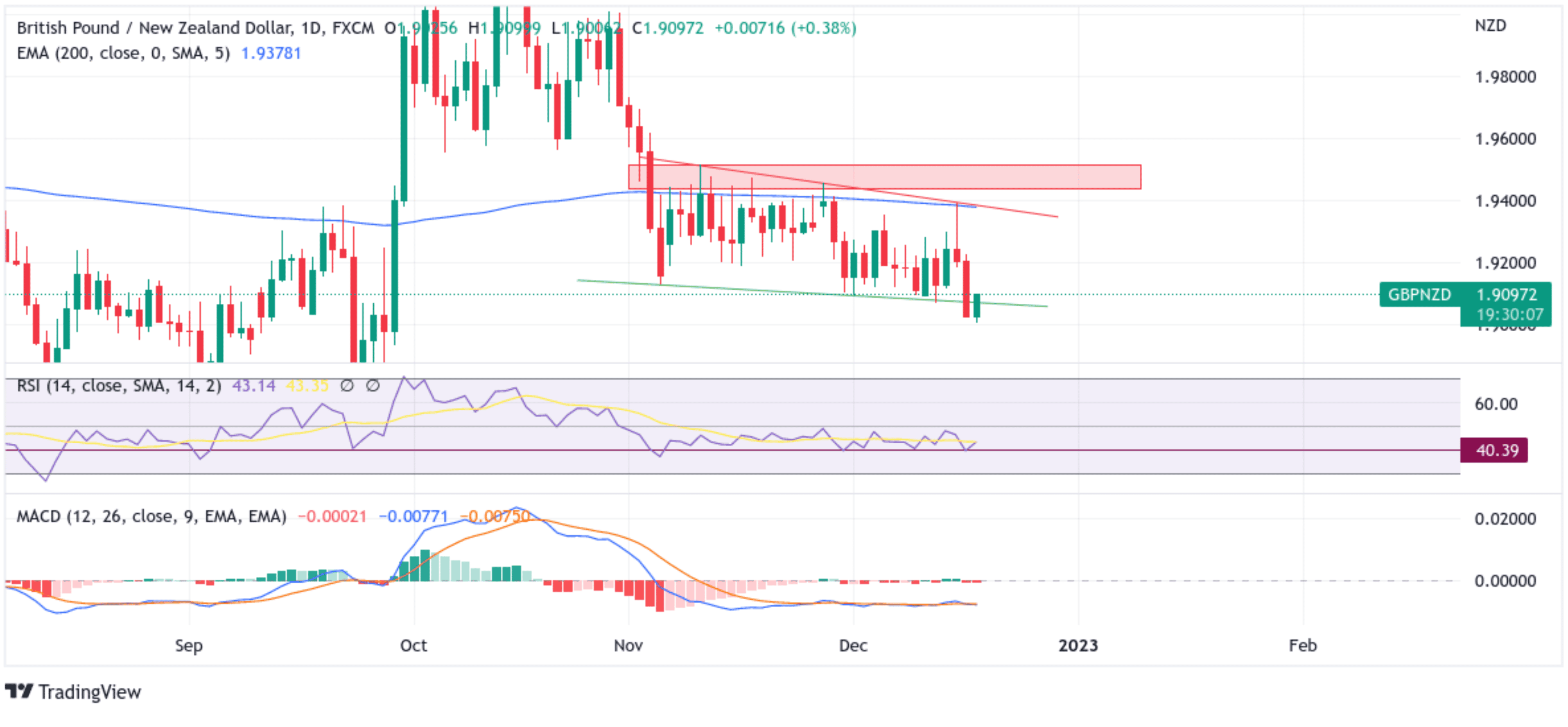

Technical Outlook: One-Day GBP/NZD Price Chart

From a technical standstill using a one-day price chart, the price rebounded modestly from the vicinity of the 1.90218 level to break above the key support level plotted by a downward trendline of a bearish Flag Chart Pattern extending from the 4th November 2022 swing low. Subsequent follow-through buying would uplift spot prices to the immediate hurdle ranging from 1.91905 - 1.92120 levels. Sustained strength above this barricade would confirm bullish momentum. The attention would shift toward retesting the key resistance level plotted by a downward-sloping trendline extending from the 10th November 2022 swing high. If the price pierces this barrier (bullish price breakout), it will pave the way for ascent towards the key Supply zone ranging from 1.94343 - 1.95155 levels. A convincing break above this barricade would pave the way for aggressive technical buying around the GBP/NZD Pair.

All the technical oscillators on the daily chart are in negative territory, with the RSI (14) at 43.14 below the signal line but are moving up after rebounding from 40.39 below, suggesting that the buying pressure could increase. The Moving Average Convergence Divergence (MACD) Crossover is below the signal line, pointing to a bearish sign for price action this week, but a move above the signal line would add credence to the bullish filter.

On the Flipside, if dip-sellers and tactical traders jump in and trigger a bearish reversal, the price will find support at the 1.88651 support level. If sellers manage to breach this floor, the USD/ZAR pair could turn vulnerable and accelerate the downfall toward testing the 1.87837 key support level. On further weakness, the downside pressure could accelerate toward testing the 1.87183 support level.