GBP/AUD Extends Recovery And Consolidates Above 1.810 Level Amid Lager-Than-Expected Aussie Trade Surplus Data

- GBP/AUD pair attracts some buying during the early Asian session to extend the sharp rebound from the vicinity of the 1.81115 level

- Falling UK house prices and weaker labor market momentum give hope to the bears

- Recession Fears continue to undermine the Aussie dollar's appeal

- Australia’s trade surplus was larger than expected in October

GBP/AUD cross-picked up bids during the early Asian session from the vicinity of the 1.81567 level and extended the sharp rebound from the vicinity of the 1.81115 level to lift spot prices to a fresh daily high during the early Asian session. At the time of speaking, the pair is up over 10 pips for the day and looks set to build upon its steady intraday ascent heading into the European session.

The shared currency's lacklustre performance could be attributed to the UK economy's bleak outlook. Reuters' news that conveyed a slump in house prices after UK Halifax House Price Index data came in below market expectations portrayed pessimism surrounding the GBP/AUD pair.

Reporting to the news, “Britain saw the most widespread house price falls since early in the COVID-19 pandemic last month, as demand from buyers and sales activity slowed in the face of higher borrowing costs, a survey showed on Thursday,” said Reuters.

Housing prices in the UK increased 4.7% YoY in November of 2022, the least since July of 2020, following an 8.2% rise in October, data from Halifax showed. Compared to the previous month, average house prices fell 2.3%, the biggest drop since October 2008, marking the third straight month of declines, as homebuyers feel increased pressure on affordability and many buyers and sellers are taking stock while the market continues to stabilize.

On the same line, the Mortgage Rate in the United Kingdom increased to 5.88 percent in November from 5.41 percent in October 2022. Additionally, The Recruitment and Employment Confederation (REC) monthly staff demand index weighed on the GBP, falling to 54.1 in November from 56.7 in October, the lowest level since February 2021.

Moving on to the Australian docket, the Aussie dollar continues to be undermined by recession fears weighing on continued negative sentiment. Additionally, data from the Australian Bureau of Statistics on Wednesday showed Economic growth missed expectations as GDP increased 0.6% in the September quarter. The Australian economy expanded 0.6% QoQ in Q3 of 2022, compared with market forecasts of 0.7% after a 0.9% rise in Q2. This was the fourth straight quarter of economic growth but the softest rise in the sequence, as household consumption grew the least in a year amid intense cost pressures and rising interest rates (1.1% vs 2.1% in Q2). Every year, the economy advanced 5.9%, less than the consensus of 6.2%. Additionally, Australia unexpectedly posted a current deficit of AUD 2.3 billion in Q3 of 2022, shifting from a downwardly revised AUD 14.7 billion surpluses in Q2 compared with market expectations of AUD 6.2 billion surpluses. This was the first current account gap since Q1 2019, dragged down by a narrowing trade surplus and a widened net primary income deficit.

On Tuesday, The Reserve Bank of Australia raised its cash rate by 25bps to 3.1% at its final meeting of 2022, matching market forecasts. The move marked the eighth straight rate hike, taking borrowing costs to a level not seen since November 2012, with the board flagging more rate hikes ahead as inflation in Australia is too high. Tuesday's widely anticipated decision takes the central bank's cumulative hikes since May to 3 percentage points, the sharpest annual tightening since 1989. The committee reiterated the policy rate was not on a pre-set course, as the size and timing of future rate increases will continue to be determined by the incoming data. The board added inflation in Australia would peak around 8% this year before easing in 2023 and reaching a little above 3% in 2024.

The Reserve Bank of Australia’s monetary policy decision came after The annual inflation rate in Australia climbed to 7.3% in Q3 of 2022 from 6.1% in Q2, above market forecasts of 7.0%. This was the highest print since Q2 1990, boosted by higher prices for new dwelling construction, automotive fuel, and food. Every quarter, consumer prices went up 1.8%, the same pace as in Q2, which remained the steepest pace since the introduction of the Goods and Services Tax, compared to the consensus of 1.6%, due to further rises in the cost of new dwellings, gas, and furniture. Every month inflation in Australia advanced 6.9 percent to October 2022, slowing from September's record high of 7.3% and missing the market consensus of 7.4 percent, amid a softer rise in food prices.

As we advance without any major economic news data from both dockets, the broader risk sentiment would be looked upon for short-term trading opportunities around the GBP/AUD pair.

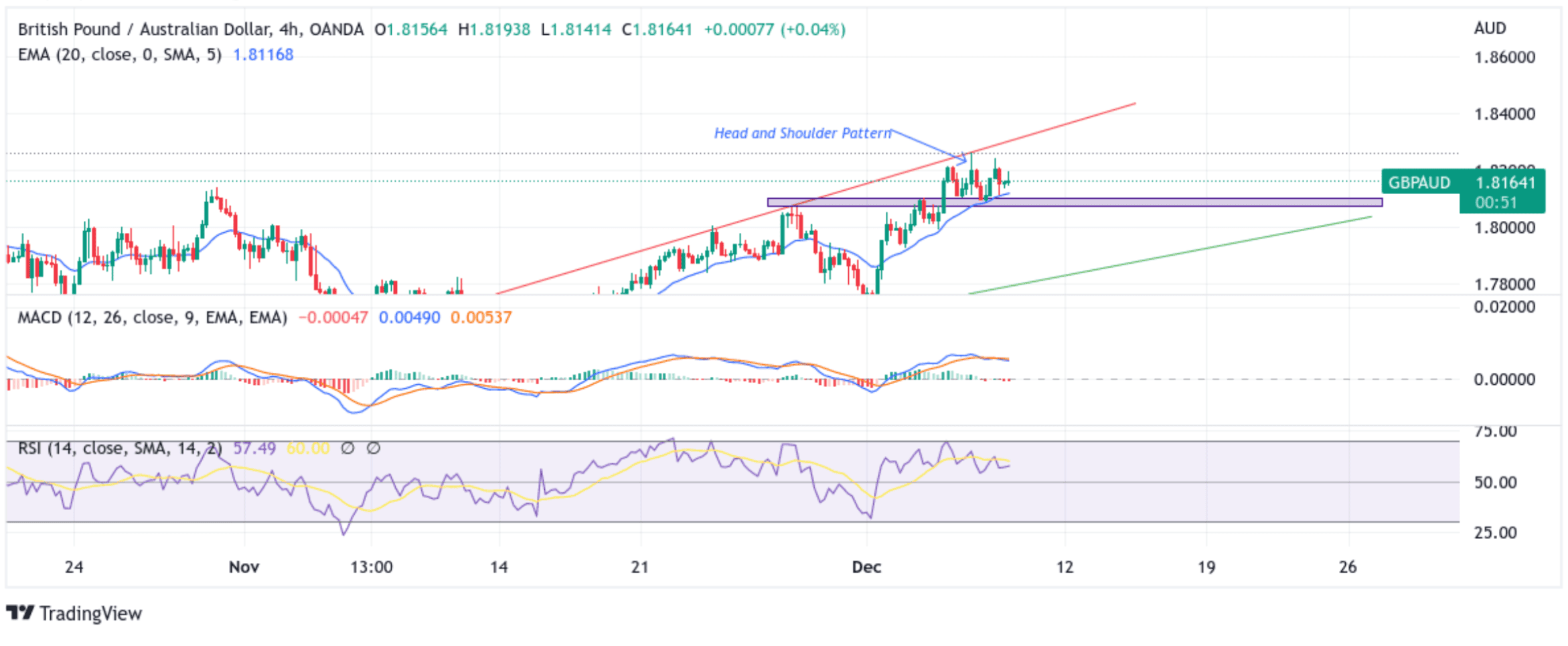

Technical Outlook: Four-Hours GBP/AUD Price Chart

From a technical standstill using a four-hour price chart, the price extended the sharp rebound from the vicinity of the 1.81115 level after the price had initially failed to extend the sharp rebound from the vicinity of 1.82422 level( Second shoulder level of the Head and Shoulder pattern formed between 5th December and 7th December 2022). Some follow-through buying would lift spot prices to the 1.82086 resistance level en route to the 1.82422 level. If the price pierces these barriers, the attention will shift toward retesting the key resistance level shown by an upward ascending trendline plotted from the November swing high. A convincing break above this level would pave the way for aggressive technical buying around the GBP/AUD pair.

All the technical oscillators on the chart are in positive territory, with the RSI (14) at 57.49 above the signal line, portraying a bullish filter, and it will be prudent to wait for a further upside move above the 1.82422 level before placing any additional bullish bets. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is above the signal line, pointing to a bullish sign for price action this week.

On the Flipside, if dip-sellers and tactical traders jump in and trigger a bearish reversal, the price will first find support at the 1.81421 support level en-route the 1.80694 - 1.81020 Demand Zone. If Bears managed to breach these floors, it would negate any recent bullish outlook and pave the way for aggressive technical selling around the GBP/AUD Pair. The downside pressure could then accelerate towards the 1.80000 psychological mark.