EUR/GBP Rebounds From Weekly Low And Clings To Positive Euro Area Macro Data

- EUR/GBP Cross attracts renewed buying during the Mid-Asian Session to lift off spot prices to a new daily high

- Positive Euro area Economic Macro data offers some support to the Euro

- European Central Bank Vice-President Luis de Guindos predicts recession in the Euro Zone area as early as January 2023

- Negative UK Economic Macro data undermines the British pound and exerts upward pressure on the pair

- Investors now look forward to the UK's Chancellor of Exchequer's Autumn Statement

EUR/GBP cross-picked up bids from the vicinity of the 0.87133 level during the second part of the Asian session and reversed part of its earlier losses to lift spot prices to a new daily high around the 0.87310 - 0.87353 regions. On the European economic data front, the Euro Area recorded a trade deficit of EUR 34.4 billion in September of 2022, the 11th consecutive gap and the third highest on record, as soaring energy prices inflated the turnover of imports that member states take in. Imports surged by 44.5% to EUR 294 billion, while exports expanded at a softer 23.6% to EUR 259.6 billion. Additionally, The ZEW Indicator of Economic Sentiment for the Euro Area improved to -38.7 in November of 2022 from – 59.7 in October. It was the highest reading since June and likely related to prospects that inflation could start easing soon, allowing ECB policymakers to slow the pace of its interest-rate increases. At the same time, the indicator of the current economic situation increased by 5.5 points to -65.1. In comparison, inflation expectations fell by 16.4 points to -52, according to a report published on Tuesday by the Centre for European Economic Research.

In the third quarter of 2022, seasonally adjusted GDP increased by 0.2% both in the euro area and in the EU, compared with the previous quarter, according to a flash estimate published by Eurostat, the statistical office of the European Union. Compared with the same quarter of the previous year, seasonally adjusted GDP increased by 2.1% in the euro area and by 2.4% in the EU in the third quarter of 2022, after +4.3% in both the euro area and in the EU in the previous quarter. Additionally, In September 2022, the seasonally adjusted industrial production rose by 0.9% in both the euro area and the EU, compared with August 2022, according to estimates from Eurostat, the statistical office of the European Union. In August 2022, industrial production increased by 2.0% in the euro area and 1.5% in the EU. In September 2022, compared with September 2021, industrial production increased by 4.9% in the euro area and 5.7% in the EU. That said, the combination of factors was seen as key factors that underpinned the Euro.

European Central Bank Vice-President Luis de Guindos, in his speech on Monday at the 25th Frankfurt Euro Finance Week, providing a brief overview of the euro area economic outlook, said, "One year on, the Russian invasion of Ukraine and the ensuing global energy crisis have added to already high inflationary pressures, which continued to rise throughout 2022. As a result, economic activity has slowed down to the point that we cannot rule out a technical recession at the turn of the year". This, in turn, was seen as a factor that made the EUR/GBP bears hopeful of a turnaround.

Moving on to the British docket, The UK trade deficit shrank to GBP 3.1 billion in September of 2022 from a downwardly revised GBP 4.7 billion in the previous month, according to a flash estimate published by the UK Office for National Statistics. It was the smallest trade shortfall since last December, as imports slumped by 3.8%, primarily driven by a decrease in fuel imports, linked to falling gas imports from Norway and falling oil prices during September. Additionally, The British economy contracted by 0.6% month-over-month in September of 2022, following a downwardly revised 0.1% decline in August, and worse than market forecasts of a 0.4% fall. It marks a second consecutive month of falling economic activity and probably the beginning of a long recession. At the same time, the additional bank holiday for the Queen's funeral also weighed, as many businesses closed or operated differently on that day, according to a flash estimate by the UK Office for National Statistics. Manufacturing Production in the UK also decreased by 5.80 per cent in September of 2022 over the same month in the previous year, while Industrial Production in the UK contracted by 3.1 per cent in September of 2022, slowing from the 4.3 per cent decline in the previous month, according to a flash estimate by the UK Office for National Statistics. That said, the combination of negative factors was seen as a key factor that undermined the pound and exerted upward pressure on the pair.

As we advance, investors now look forward to Jeremy Hunt, Chancellor of Exchequer's Autumn Statement this week in which he is reportedly set to rule out a tax hike for banks after previously keeping the option on the table. It has been widely reported that the chancellor was considering overturning plans to cut the bank surcharge to offset a broader increase in Corporation Tax, which sparked concern about the City's future global competitiveness. The Financial Times reports Hunt will slash the bank surcharge from 8 to 3 per cent, as initially planned by Rishi Sunak when the Corporation Tax increases to 25 per cent next year for the UK's most profitable firms. This will result in banks paying 28 per cent tax on their profits, which is still higher than the current 27 per cent they pay.

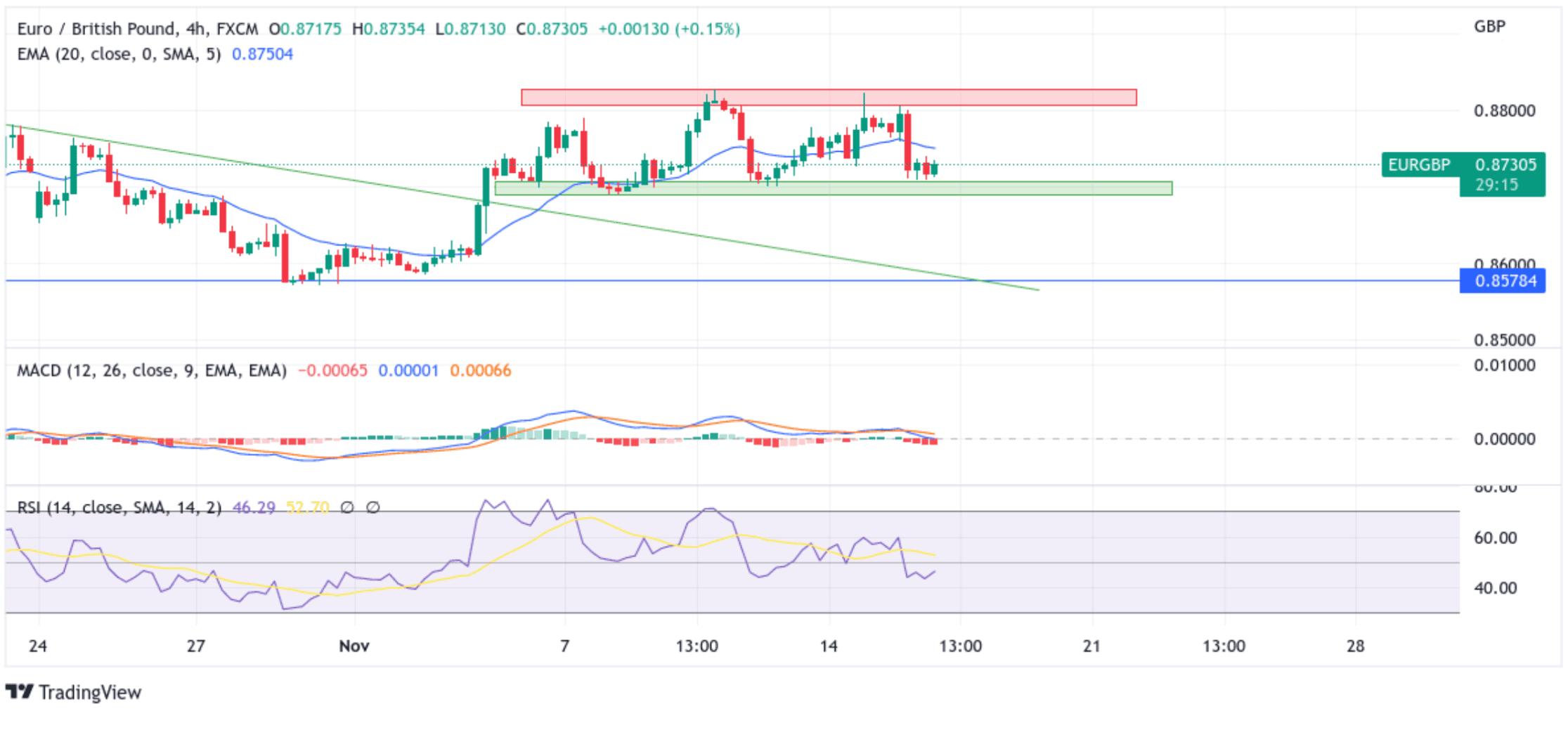

Technical Outlook: Four-Hours EUR/GBP Price Chart

From a technical perspective, using a four-hour price chart, the price extended a modest rebound from the vicinity of 0.87089 level but faced an immediate barrier at the 0.87496 level (20 Exponential Moving Average(EMA)). A convincing break above the aforementioned barricade would pave the way for additional gains, and the upward momentum could accelerate toward the key supply zone ranging from 0.88062 - 0.88277 levels. If buyers manage to pierce this ceiling, it would negate any near-term bearish outlook and pave the way for aggressive technical buying.

The moving average convergence divergence (MACD) is in the positive territory and on the verge of moving below the signal line, pointing to a bearish sign for price action this week. On the other hand, the RSI(14) at 46.29 level is displaying a shift change and is inching closer to the mid-level (50).

On the flip side, if sellers and technical traders spark a bearish turnaround, initial resistance will be at the 0.87089 support level. If sellers manage to breach this floor, the attention will shift toward the 0.86902 support level. That said, a convincing break below the aforementioned support level would pave the way for aggressive technical selling around the EUR/GBP pair.