EUR/CHF Surrenders Modest Intraday Recovery Gains, Retreats To Mid-0.98900s

- EUR/CHF cross attracted fresh selling during the mid-Asian session and dragged spot prices further below mid-0.98900s

- The current sour mood around the eurozone area greatly overshadows positive German microdata

- Swiss Central Bank's decision to raise rates by 50 bps continues to underpin the Swiss Franc

- A slew of key speeches from Top E.C.B. and Bundesbank officials awaited fresh directional impetus

During the mid-Asian session, the EUR/CHF pair witnessed fresh selling on Tuesday. They rebounded modestly from the vicinity of 0.98923 level to trade in modest losses below mid-0.98900s amid the cautious mood in the eurozone area following the past two weeks of banking turmoil. The current mood in the eurozone remains sour as the ongoing protests in France from protesters seeking pension reforms and the cautious mood ahead of key E.C.B. top official speeches undermine the Euro, which is seen capping the major against any further uptick.

Apart from this, signs of a mild recession in the eurozone area act as a headwind to the Euro against further uptick. An S&P report last week showed the rating agency expects headline inflation to remain above the European Central Bank's 2% target until the first quarter of 2025 and for core inflation to remain above target until the third quarter of 2025. "Sticky inflation will force the E.C.B. to raise rates for longer than we previously expected, probably until the deposit facility rate reaches 3.50% by the summer, unless the market turmoil undermines the current outlook for growth and inflation," the note says. This came after S&P Global PMI manufacturing PMI In the Euro Area decreased to 47.10 points in March from 48.50 points in February 2023. While the Euro Area Services PMI showed modest growth after it rose to 55.6 in March 2023 from 52.7 in February, above market expectations of 52.5, preliminary estimates showed.

Despite the above negative factors, hawkish comments from Bundesbank President Joachim Nagel in a lecture at King's College last week continue to offer some support to the single currency should cap a lid on any further losses for the Euro and help limit losses for the EUR/CHF pair, at least for the time being." We have to tame inflation and to do so, we have to be bold and decisive. In my view, our job is not done yet. If inflation develops as projected, further interest rate hikes have to follow in upcoming meetings," Nagel said.

Additionally, positive German macrodata released on Monday was also seen as other factors underpinning the Euro. Business sentiment in Germany climbed for a fifth straight month in February to 91.2 points, up from 88 points and above market expectations of 88.3 points, as measured by the Ifo Business Climate Index. Germany's Ifo Current Conditions subindex also increased to a seven-month high of 95.40 points in March from 93.90 points in February of 2023, beating forecasts of 94.1. That said, the Euro rose by more than 0.31% against the Swiss Franc following the better-than-expected German microdata and closed in modest gains at the 0.98912 level.

Shifting to the swiss docket, the Swiss National Bank's decision to raise its interest rates as per the market expectations continued to support the Swiss Franc, which capped the major against further uptick. The Swiss National Bank raised its policy rate by 50 bps to 1.5% in its March meeting, following a similar move in December and bringing borrowing costs the highest since November 2008. The central bank also said that additional hikes in the policy rate could not be ruled out to ensure price stability over the medium term.

Also, stronger-than-expected Swiss Current Account figures released last week supported the Swiss Franc. According to a report by Reuters last week, Switzerland's fourth-quarter current account surplus widened to 15 billion Swiss francs ($16.25 billion), 6 billion higher than in the same quarter of 2021, the Swiss National Bank (S.N.B.) said on Wednesday. "Primary income (lower expenses surplus), goods trade (higher receipts surplus), as well as services trade (lower expenses surplus), contributed to this increase," the S.N.B. said in a statement.

As we advance, investors look forward to the Eurozone docket, featuring the release of a slew of key speeches from Top E.C.B. and Bundesbank officials. Traders will look at the speeches keenly for cues on future monetary policies and fresh directional impetus.

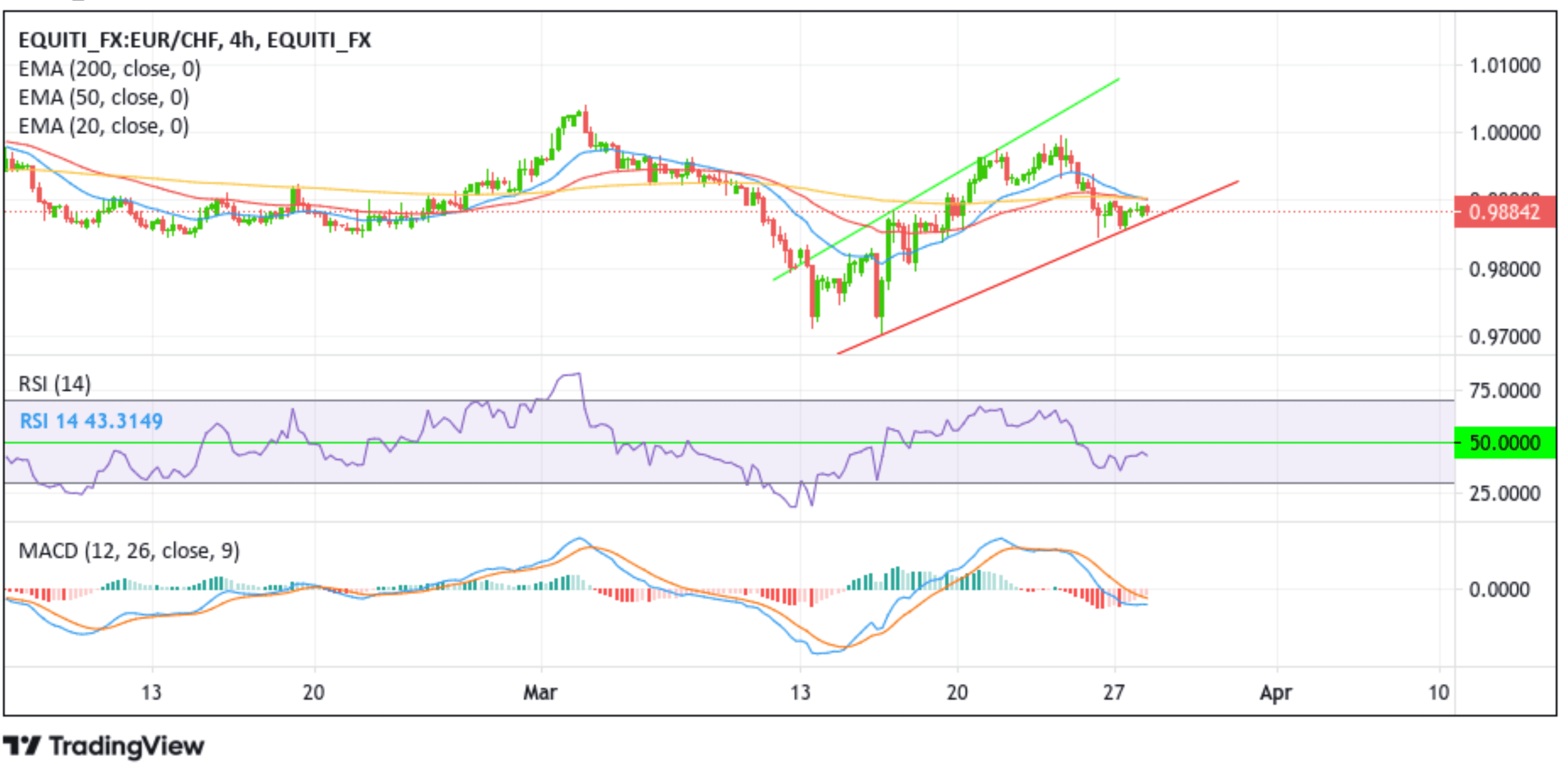

Technical Outlook - Four-Hour EUR/CHF Price Chart

From a technical standstill using a four-hour price chart price rebounded from the vicinity of 0.98923 level after sensing strong overhead resistance plotted by the convergence of the 20 (blue), 50 (red) and 200 (yellow) E.M.A.'s at 0.99027 level. If sellers increase the selling pressure, EUR/CHF cross could squat toward the immediate support plotted by an ascending trendline extending from the mid-March 2023 swing lower-low. Sustained weakness below this level (bearish price breakout) would pave the way for a drop toward the 0.98464 support level. A four-hour candlestick close below this level could negate any near-term bullish outlook and pace the way for aggressive technical selling around the EUR/CHF pair.

All of the technical oscillators on the chart are holding in bearish territory, with both the R.S.I. (14) at the 43.3149 level and the M.A.C.D. crossover sitting below their signal lines, indicating a bearish sign of price action this week. The bearish bias is further supported by the acceptance of the price above the technically strong 200 (yellow) E.M.A. level at 0.99455. Additionally, the 50 and 200 E.M.A. crossover (Golden Cross) at the 0.99220 level adds credence to the bullish thesis.

Conversely, if dip-buyers and tactical traders jump back in and trigger a bullish reversal, the price will face initial resistance at the 0.99027 level. A four-hour candlestick close above this level could invalidate the bearish thesis. After that, increasing buying momentum could uplift the shared currency toward the 0.99231 resistance level. A decisive flip of this obstacle into a support level could pave the way for EUR/CHF to register more gains.