Basic Forex Terms You Should Know (Part 3)

As a beginner, you may find yourself overwhelmed with the jargon and technical terms that are commonly used in the industry. But don't worry, we will cover some of the basic Forex terms you should know before you start trading. Understanding these terms will not only help you communicate better with other traders but will also give you a better understanding of how the Forex market works. So, whether you're a novice or an experienced trader, read on to brush up on your Forex vocabulary and take the first step towards becoming a successful Forex trader.

Order Types

One key factor contributing to successful forex trading is understanding the different order types available for trading. In this section, we will explore the various order types in forex trading and how they can be used to maximize profits while minimizing risks.

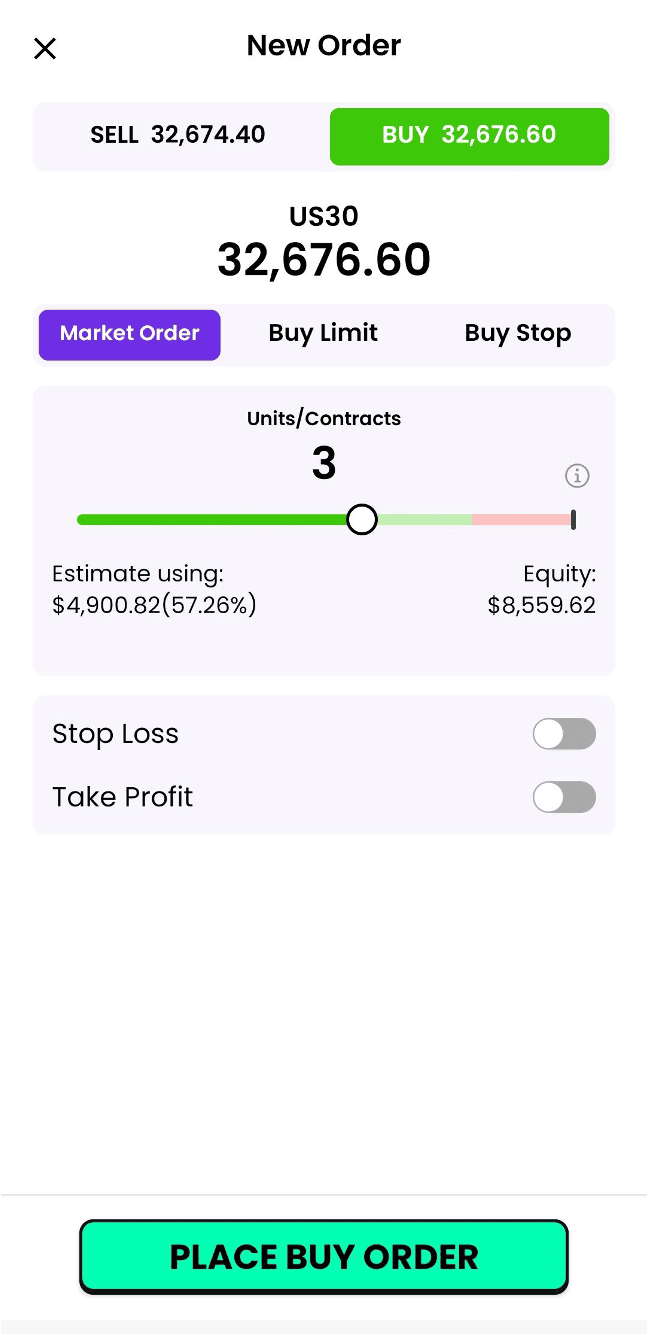

1. Market Orders

Market orders are the most basic type of order used in forex trading. This type of order is used when a trader wants to buy or sell a currency pair at the current market price. The trade is executed immediately at the best available price when a market order is placed.

In this case, if you wanted to buy US30 at the market price, it would be sold to you at 32676.60. You would click place order, and the pocket-trader trading platform would instantly execute a buy order at a nearly exact price.

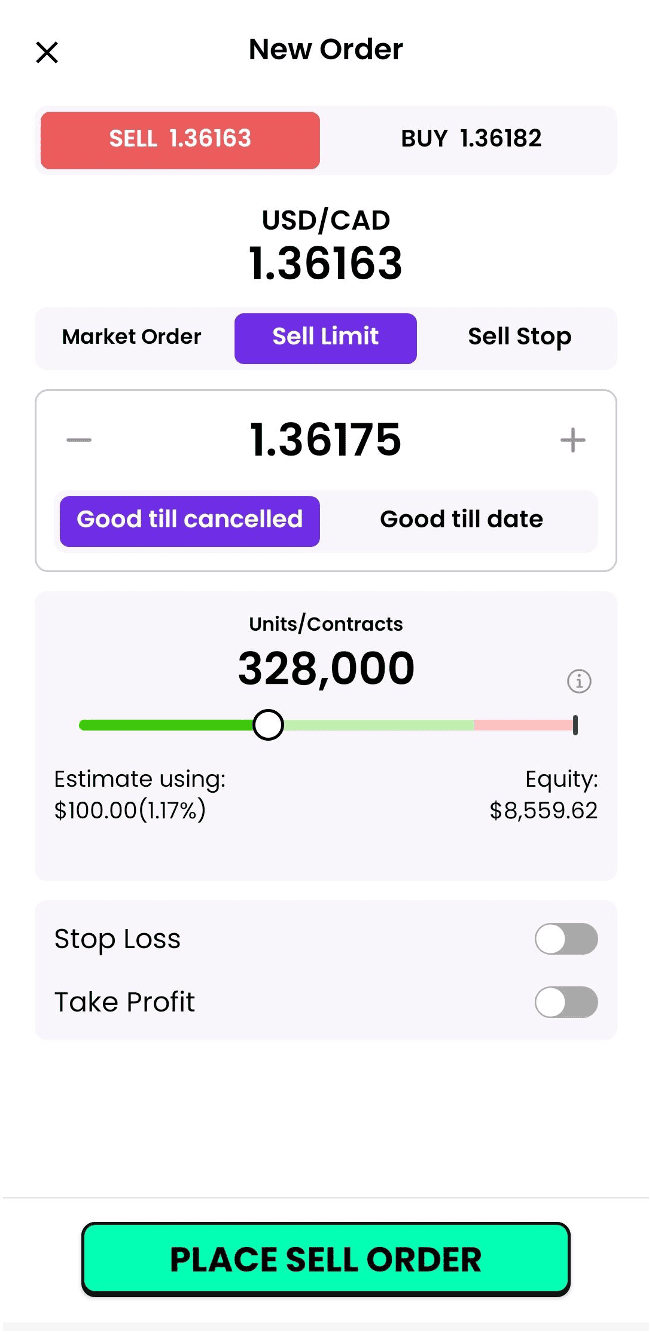

2. Limit Orders

Limit orders are used when a trader wants to buy or sell a currency pair at a specific price. A limit order is placed above the current market price when a trader wants to Sell (Sell Limit) and below the current market price when a trader wants to Buy (Buy Limit). Once the price reaches the specified level, the trade is executed automatically.

In this case, if you want to sell USD/CAD, currently trading at 1.36163, and go Short (Sell) if the price reaches 1.36175.

You will click on "Place Sell Order," and the trading application will place the sell order among the pending orders in your trading account. As soon as the price reaches 1.36175, the trading platform will automatically execute the sell order at the best available price. If the price doesn't reach the targeted level, a trader has the option to cancel the trade.

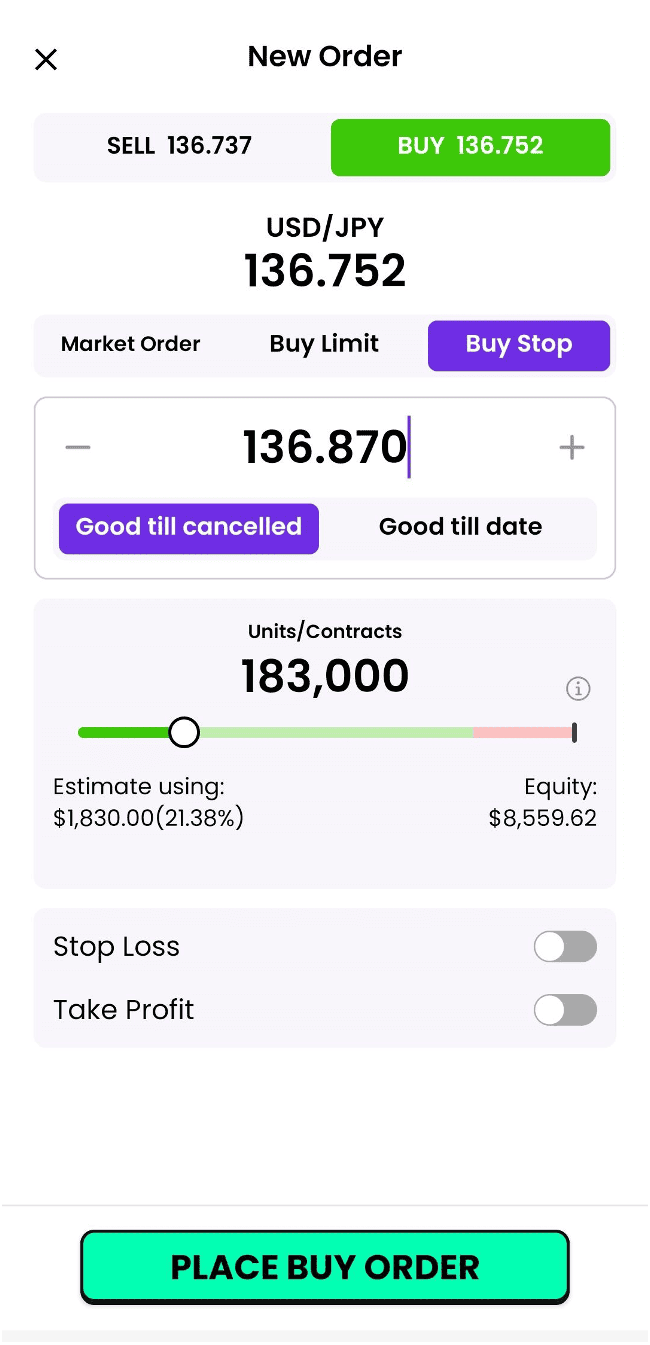

3. Stop Orders

A stop order "stops" an order from executing until the price reaches a stop price. A stop-entry order is placed to buy or sell at a specific price above the market. You place a "Buy Stop" order to buy at a price above the market price, and it is triggered when the market price touches or goes through the Buy Stop price. Alternatively, you place a "Sell Stop" order to sell when a specified price is reached.

In this case, if you want to Buy USD/JPY pair at $136.870, you will click "Place Buy Order," The trading application will place the Buy order among the pending orders in your trading account. The trading platform will automatically execute the Buy order when the price reaches or goes through the 136.870 level. If the price doesn't reach the targeted level, a trader can also cancel the trade.

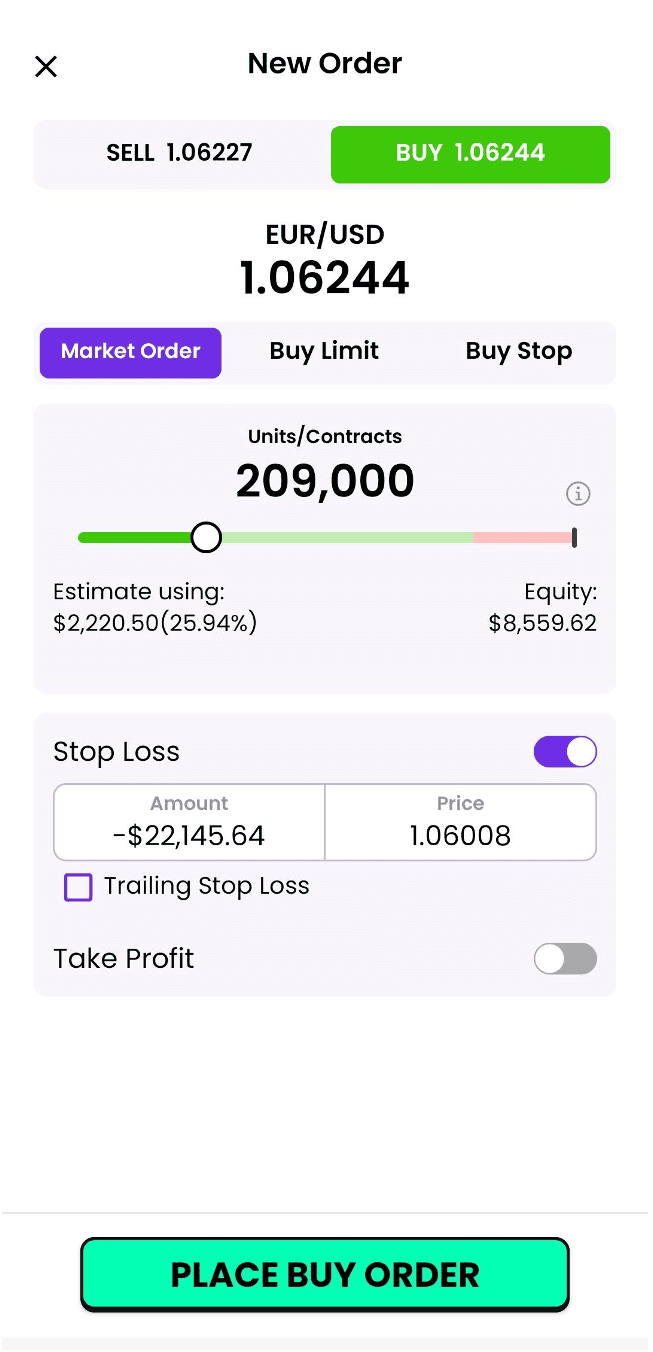

4. Stop Loss (SL)

Stop Loss (SL) orders limit potential losses on trade by automatically closing out a position at a pre-determined price. A Stop loss order is placed at a price that is less favourable than the current market price or below the entry point when a trader is holding a long position and at a price that is more favourable than the current market price or above the entry point when a trader is holding a short position. In short, when a trader enters a stop loss order, they set a price level at which their position will be automatically closed out if the market moves against them.

In this case, a stop loss order is placed at the 1.06008 level. If the price happens to retrace and moves back below the entry point (1.06244 level), the trade will be in losses, and to prevent further losses, the order will automatically close the trade once the price reaches the 1.06008 level.

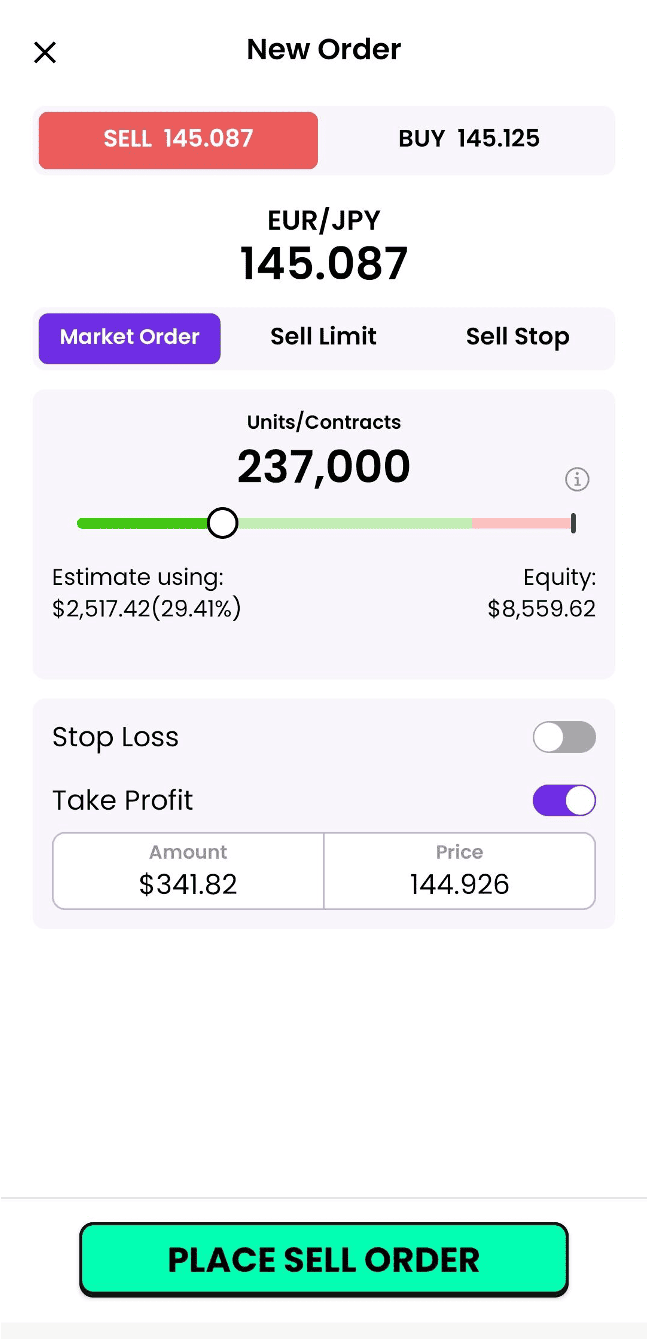

5. Take Profit (TP)

A take-profit order is used in forex trading to automatically close a trade when a specified profit target is reached. Traders use this type of order to lock in profits and protect against market reversals that could result in a loss.

When a trader opens a trade, they can set a take profit order at a specific price level. If the price reaches this level, the order automatically closes the trade at the specified profit target. Take-profit orders can be placed simultaneously with a market or a pending order, such as a buy or sell limit order.

In this case, a take-profit order is placed at the 144.926 level. If the price declines further and reaches the 144.926 level (targeted level), the order will automatically close the trader since profits have been secured.

Understanding basic Forex terms is essential for any trader who wants to succeed in the Forex market. As a beginner, navigating the numerous terms and vocabularies associated with Forex trading can be overwhelming. However, with time and practice, one can quickly master these terms and use them to their advantage.

As with any skill, learning the language of Forex trading takes time and patience. But by understanding these basic terms, traders can gain the confidence to navigate the market successfully and achieve their trading goals.

Are you looking to start trading in the Forex Market? You can Enjoy FREE USD 10,000 Virtual Funds for trading by Signing Up on Pocket Trader. With Pocket Trader, You can invest in multiple markets, including forex, indices, and commodities, learn from experienced traders and share ideas with their social features to build wealth together.