Basic Forex Terms You Should Know (Part 2)

As a beginner, you may find yourself overwhelmed with the jargon and technical terms that are commonly used in the industry. But don't worry, we will cover some of the basic Forex terms you should know before you start trading. Understanding these terms will not only help you communicate better with other traders but will also give you a better understanding of how the Forex market works. So, whether you're a novice or an experienced trader, read on to brush up on your Forex vocabulary and take the first step towards becoming a successful Forex trader.

Basic Terms

If you are new to forex trading, it is essential to understand the basic terms used in the industry. Here are some of the key forex terms you should know:

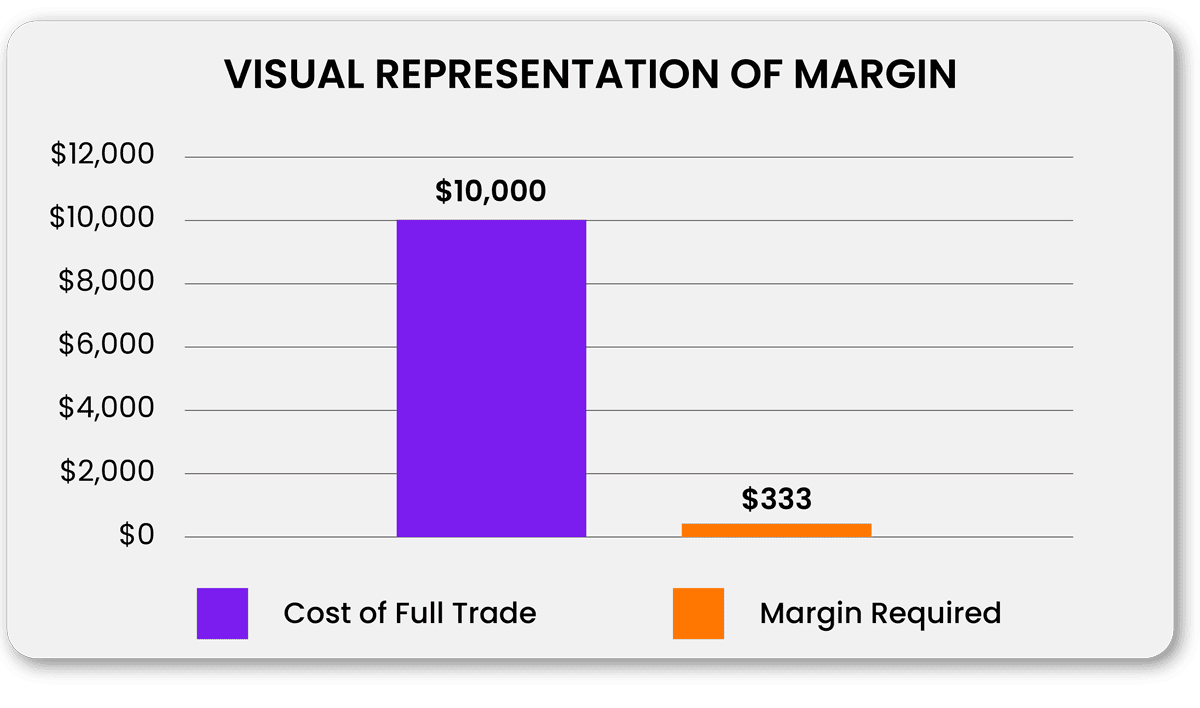

1. Margin

Margin is the amount of money that you need to put up to open a trade. It is usually a percentage of the total trade size. For instance, if you want to buy $10,000 of a financial asset you will not need to put up the full amount, you only need to put up $333 (the percentage margin used is 3.33%).

2. Leverage

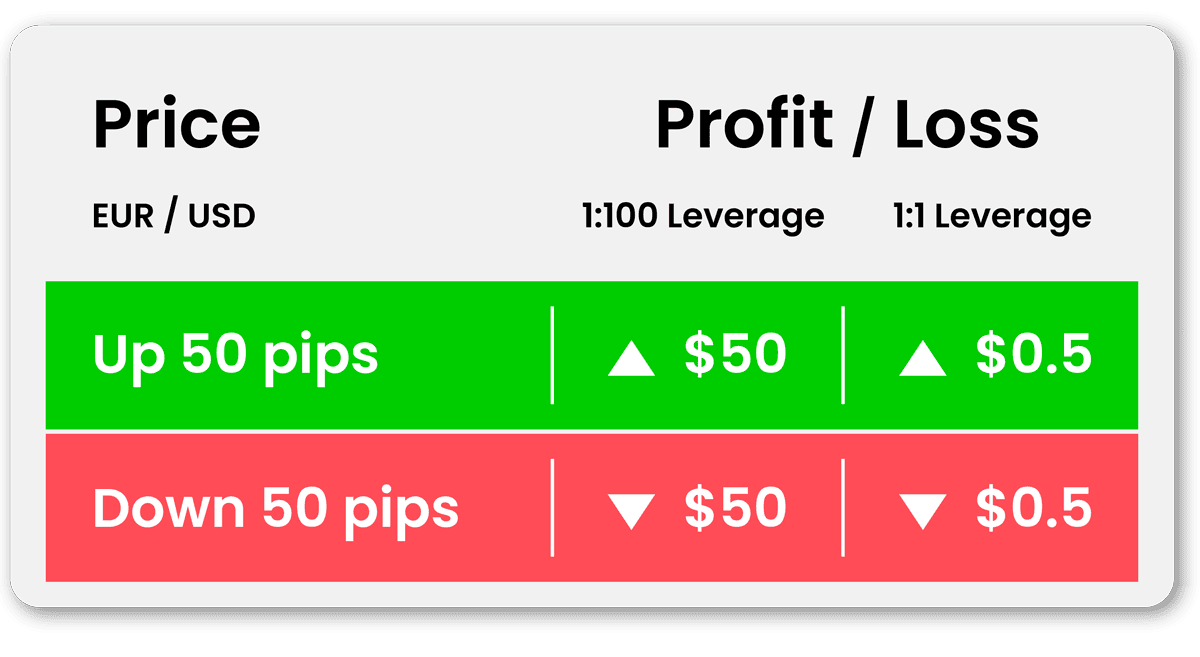

Leverage is the ability to control a large amount of money with a small amount of capital. It is expressed as a ratio, such as 1:100, which means that for every dollar of capital that you put up, you can control $100 of currency.

For instance, let’s say a trader has a trading capital of $10,000 and is trading with 1:100 leverage. According to his leverage, his trading capital is increased 100 times, which means he has $1,000,000 (10,000 x 100) to trade with. If he decides to buy the EUR/USD at 1.3055 and close his position at 1.3105, he will have almost doubled his capital! ((1.3105 – 1.3055 = 50) x $1,000,000 = $5,000).

Conversely, if this same trader buys the EUR/USD pair at 1.3055 but closes his position at 1.3005, he will have lost almost half his capital. ((1.3005 – 1.3055=-50) x $1,000,000 = -$5,000).

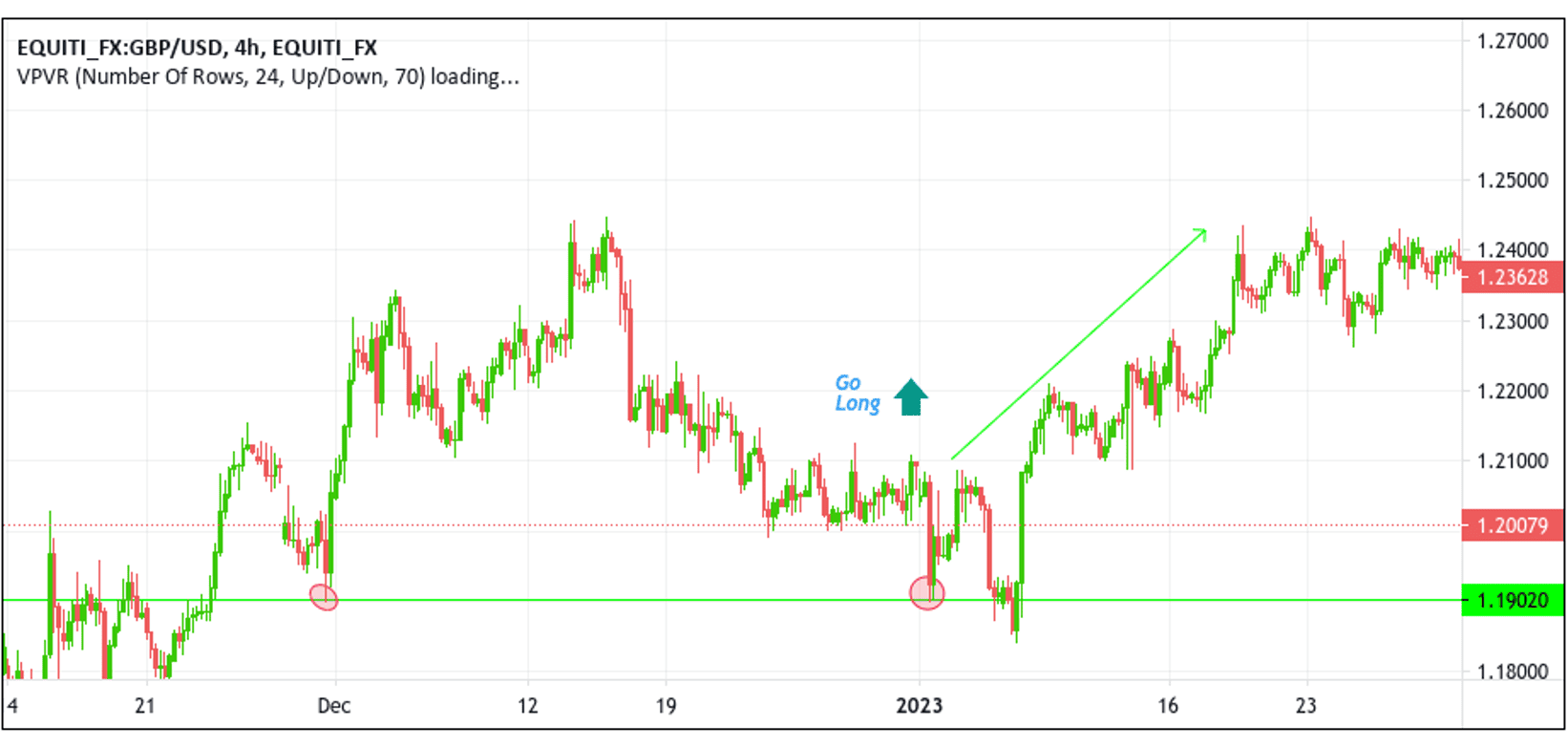

3. Long Position

A long position refers to a trade in which a trader buys a currency with the expectation that its value will rise over time. In other words, the trader is betting that the currency they buy will appreciate relative to another currency.

For example, if a trader buys 100 units of GBP/USD at 1.2000, they have taken a long position on the pound, betting that its value will increase against the U.S. dollar. If the exchange rate rises to 1.2500, the trader can sell their position for a profit of 500 pips (the difference between the entry price and the exit price).

4. Short Position

A short position refers to a trader's bet that the value of a currency will decrease in value relative to another currency.

For example, if a trader takes a short position on the XAU/USD currency pair, they are essentially selling euros and buying US dollars. If the value of the euro subsequently falls relative to the dollar, the trader can buy back euros at a lower price, realizing a profit on the difference.

Understanding basic Forex terms is essential for any trader who wants to succeed in the Forex market. As a beginner, it can be overwhelming to navigate the numerous terms and vocabularies associated with Forex trading. However, with time and practice, one can easily master these terms and use them to their advantage.

As with any skill, learning the language of Forex trading takes time and patience. But by taking the time to learn these basic terms, traders can gain the confidence they need to navigate the market successfully and achieve their trading goals.

Are you looking to start trading in the Forex Market? You can Enjoy FREE USD 10,000 Virtual Funds for trading by Signing Up on Pocket Trader. With Pocket Trader, You can invest in multiple markets, including forex, indices, and commodities, learn from experienced traders and share ideas with their social features to build wealth together.