What Is a Trade Signal?

Key Takeaways:

- Trade signals are a critical component of the financial markets, providing traders with valuable insights and information to make informed decisions

- A trade signal is a trigger for action in the financial markets, indicating to a trader when it may be an excellent time to buy or sell a particular asset

- How a trade signal works is based on a set of predefined criteria that indicate when it may be a good time to buy or sell a particular asset

- While forex signal providers can offer valuable insights and trading ideas, it is essential to remember that they are not infallible

Trade signals are critical to the financial markets, providing traders with valuable insights and information to make informed decisions. In today's fast-paced and complex trading environment, having access to reliable trade signals can mean the difference between success and failure. But what exactly is a trade signal? How do they work, and why are they so important for traders? In this article, we will explore the ins and outs of trade signals, including what they are, how they are generated, and how traders can use them to their advantage. Whether you are a seasoned trader or just starting in finance, understanding trade signals is key to staying ahead.

What Is a Trade Signal?

A trade signal triggers an action in the financial markets, indicating to a trader when it may be an excellent time to buy or sell a particular asset. These signals are typically generated by analyzing various technical indicators, such as moving averages, trend lines, oscillators, fundamental economic data and market news analysis. By using trade signals, traders can make more informed decisions about when to enter or exit a trade, helping them to increase their profitability and potentially reduce their risk. Additionally, trade signals can be used for short-term day trading and longer-term investing, guiding timing trades across different time horizons.

How a Trade Signal Works

A trade signal works based on a set of predefined criteria that indicate when it may be a good time to buy or sell a particular asset. These signals can be generated through various technical analysis methods, such as moving averages, trend lines, and chart patterns. When a signal is triggered, it provides traders with a clear indication of when to enter or exit a trade, helping to minimize risk and increase potential profits.

Where can I get Signal?

One standard method is technical analysis tools and indicators, which can help identify potential entry and exit points based on price movements and trends. Additionally, some traders rely on fundamental analysis, such as economic reports and geopolitical events, to make informed trading decisions. Another popular option is to subscribe to signal services or newsletters, where experienced traders and analysts provide recommendations and insights on market conditions. Ultimately, it's crucial for traders to carefully consider their own trading goals and strategies when selecting a source for trade signals.

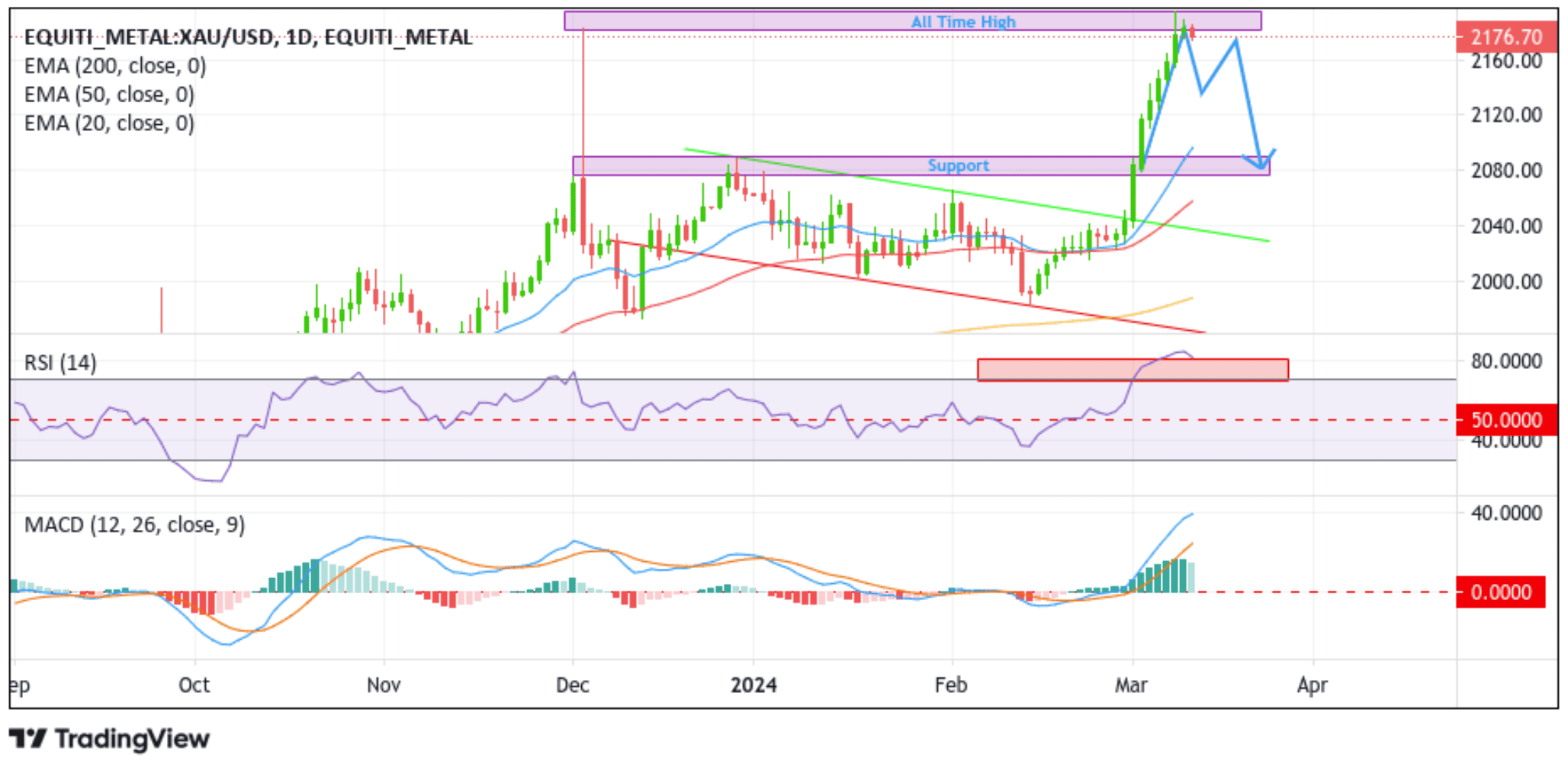

Example of a Trade Signal

Below is an excellent classic example of a gold trade signal sent by a signal provider to his subscribers

Now, we are watching gold (XAU/USD) expectations of a selling opportunity around the 2139 / 2145 ALL-TIME-HIGH supply zone. Once we get any bearish confirmation, the trade will be executed.

GOLD SELL CLOSED

@ 2139 & 2144

SL 2147

TP 2135: 2135.50

TP 2130

Profit: 35+ pip

Breakeven Hit

Can I trust Forex signal providers?

This is a question that often plagues both new and experienced traders alike. While forex signal providers can offer valuable insights and trading ideas, it is essential to remember that they are not infallible. As a trader, especially if you are a beginner, it is crucial not to rely too heavily on signals. Instead, use them as a guide to inform your own analysis and decision-making process. Consider the risks involved in each trade and take the time to analyze the market yourself. By taking a proactive approach to your trading, you can better protect yourself from potential losses and make more informed decisions in the long run.

Conclusion

Trade signals play a crucial role in trading, providing traders with valuable insights and opportunities to make informed decisions. By analyzing various market indicators, trade signals help traders identify potential entry and exit points, manage risks, and optimize their trading strategies. Whether generated by human analysts or automated systems, trade signals can significantly improve trading performance and contribute to overall success in the financial markets. Traders need to understand the significance of trade signals and incorporate them into their trading routines to stay ahead of the market trends and maximize profitability.

Looking to grow your wealth through social trading? Look no further than Pocket Trader! With Pocket Trader, you can connect with other traders, learn from experienced investors, and share your own insights with the community! Trade wiser now.