US WTI Crude Oil Remains Firm Above $79.80 A Barrel

Key Takeaways:

- U.S. WTI Crude, oil futures price, edged slightly higher on Tuesday during the Asian session, supported by a combination of factors

- A generally weaker U.S. Dollar weighed by retreating U.S. treasury bond yields and supply concerns acts as a tailwind to U.S. WTI crude oil price

- Despite supporting factors, further crude oil price uptick seems elusive amid firming market expectations of a hawkish Fed

The U.S. West Texas Intermediate (WTI) crude oil futures price ticked slightly higher on Tuesday during the Asian session, supported by a weaker U.S. dollar. Oil traders continued to assess the Fed Chair's stance on the following rate hike path. As of press time, the precious black liquid is up 0.08%/ (7 cents) for the day to trade at $79.882 per barrel but is still 0.02%/ (2 cents) down for the week and remains under heavy bearish pressure amid firming market expectations that the Federal Reserve (Fed) will hike interest rates one more time by 25 basis points (bp) either during the September or November meeting.

This comes after Fed Chair Jerome Powell warned last Friday during an annual retreat in Jackson Hole, Wyoming, that there could still be further rate hikes. While Powell said the central bank could be flexible, he said it still has a long way to go to fight inflation. Further cementing the odds of a hawkish Fed was August's FOMC Meeting Minutes report released this month. Federal Reserve officials expressed concern at their most recent meeting about the pace of inflation and said more rate hikes could be necessary unless conditions change.

Despite the hawkish Fed expectation, the ongoing decline in U.S. Treasury Bond yields and a weaker risk tone undermine the safe-haven buck and is seen as a key factor acting as a tailwind to crude oil prices. Additionally, a goodish bounce in the U.S. equity markets further undermines the greenback and helps limit further losses around crude oil prices.

Moreover, market sentiment remains fragile in the wake of growing concerns about worsening economic conditions in China, which lends support to the precious black liquid and helps cap the downside around US WTI crude oil prices. Furthermore, the US WTI crude oil price continues to draw some support from pledges by Saudi Arabia and Russia's decision to extend supply cuts through September.

As we advance, Oil traders look forward to the release of the U.S. personal consumption expenditures price index report, which is due on Thursday, and the August nonfarm payrolls data on Friday, which are set to influence the U.S. dollar price dynamics and provide directional impetus around the US WTI crude oil price.

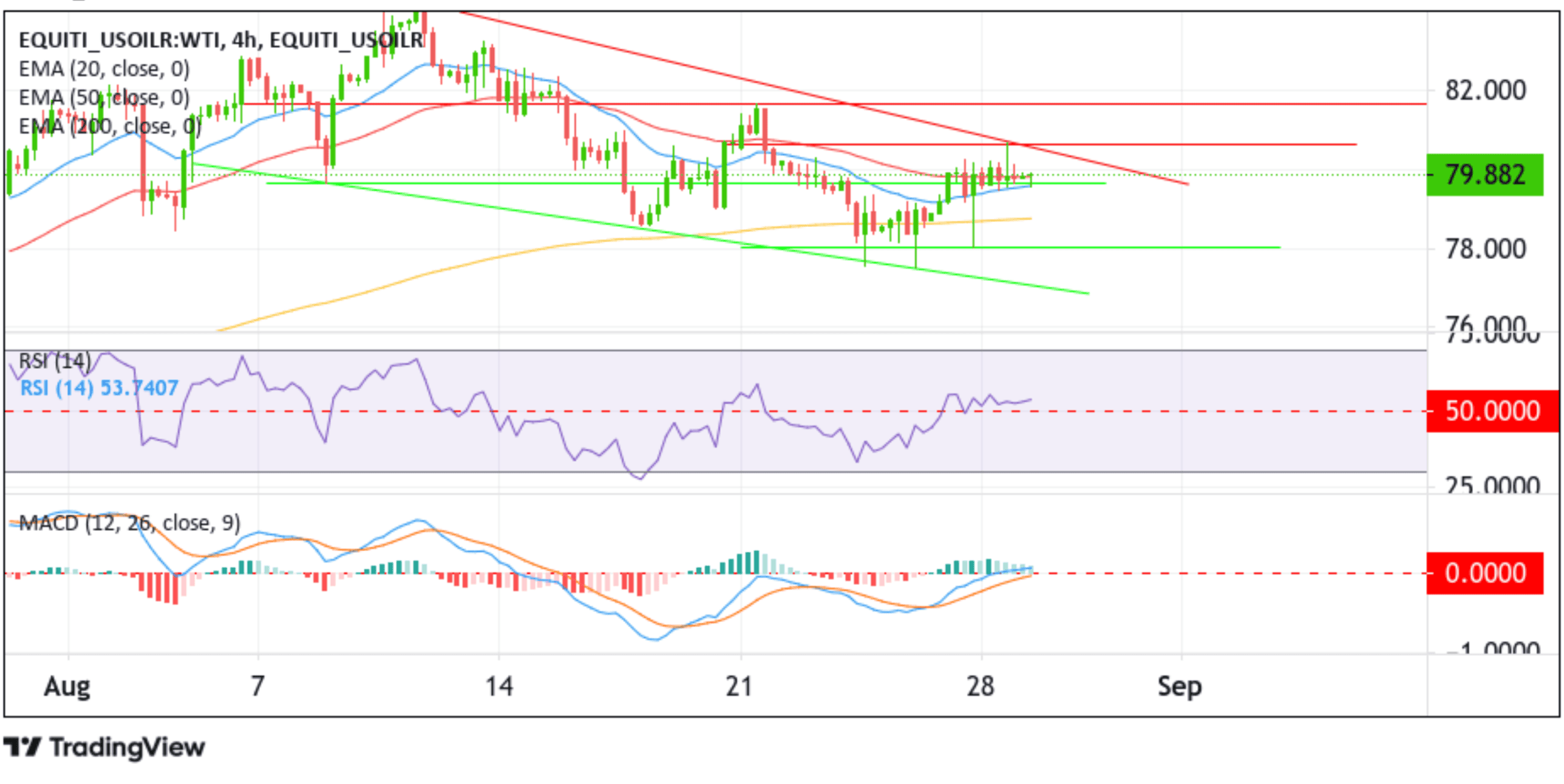

Technical Outlook: Four-Hours US WTI Crude Oil Price

From a technical perspective, using a four-hour price chart, Monday's modest rebound from the vicinity of the 79.620 level and the subsequent ascent adds credence to the positive outlook. A further increase in buying momentum beyond the current price level, followed by acceptance above the upper downward-sloping trendline extending from the early August 2023 swing high, would reaffirm the bullish bias. On further strength, the price could ascend toward the 80.665 resistance level, above which a bout of short-covering can lift the pair towards the 81.679 resistance level. A four-hour candlestick above this level could pave the way for a further rally toward the 82.000 mark.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes in at the 79.620 level. If sellers breach this floor, the price could drop to tag the 20-day (blue) Exponential Moving Average (EMA) at the 79.591 level. Acceptance below this level could pave the way for an accelerated decline toward the technically strong 200-day (yellow) EMA level at 78.743. A convincing move below this level would negate the bullish thesis and pave the way for a provocative move toward retesting the lower downward-sloping trendline extending from the early August 2023 swing low. A move below this support level (bearish price breakout) would pave the way for further losses around US WTI crude oil.