US WTI Crude Oil Remains Defiant Above $86.60 Despite A Stronger U.S. Dollar And Overbought Conditions

Key Takeaways:

- US WTI Crude oil price ticked slightly higher on Wednesday during the Asian session and remained firm above $86.60

- Saudi Arabia Extends voluntary oil cuts until the end of the year, which in turn remains supportive of rising crude oil prices

- A stronger U.S. dollar, weak eurozone services PMI data, plus concerns of a subdued recovery in China could help limit further U.S. WTI crude oil gains

The U.S. West Texas Intermediate (WTI) crude oil price edged slightly higher on Wednesday during the Asian session, recovering some of its previous losses following a modest reversal in the mid-north-American session on Tuesday. It looks set to maintain its offered tone heading into the European session. As of press time, the precious black liquid is up 0.05%/ (4 cents) for the day and 0.77%/ (66 cents) for the week to trade at $86.95 per barrel and remains under heavy bullish pressure amid supply concerns as a result of further oil supply cuts by OPEC+ members.

According to a report by the state-owned Saudi Press Agency, Saudi Arabia extended its 1 million barrels per day voluntary crude oil production cut until the end of the year on Tuesday. The reduction will put Saudi crude output near 9 million barrels per day over October, November, and December and will be reviewed monthly.

It is worth recalling that Saudi Arabia first applied the 1 million barrel per day reduction in July before announcing in August its decision to extend its unilateral production cut of 1 million barrels per day into September, the same as in August, while pledging the move can be raised or extended and deepened.

At that same time in August, Russia announced it would continue voluntarily reducing its oil supply in September by 300,000 barrels per day, compared to a cut of 500,000 barrels per day in August. Recently, according to a report by cnbc.com, Russian Deputy Prime Minister Alexander Novak said on Tuesday that Russia will extend its 300,000 barrels per day reduction of exports until the end of December 2023 and will likewise review the measure every month.

That said, crude oil prices continue to be defiant in the face of a generally stronger U.S. dollar buoyed by market expectations that the Federal Reserve (Fed) will hike interest rates by 25bps by the end of this year. This comes against the backdrop of a mixed U.S. monthly job report released on Friday, which indicated a gradual easing of labor market conditions and suggested the Federal Reserve (Fed) will likely leave its Fed Funds rate unchanged during the September meeting. The generally positive tone around the greenback, supported by rising Treasury Bond yields, is still set to continue to act as a headwind to crude oil prices and suggests the path of least resistance is to the downside. Apart from this, concerns about a subdued recovery in China and a downturn in the eurozone service sector continue to pose heavy headwinds to crude oil prices and would help limit further gains for crude oil prices.

As we advance, without any significant economic news data today, the broader market risk sentiment and U.S. Treasury bond yields will continue to influence the U.S. dollar and provide short-term trading opportunities around the U.S. WTI Crude oil price. The focus, however, remains on the U.S. PMI data, Crude Oil Inventories data, and the Chinese Trade Balance and CPI and PPI data.

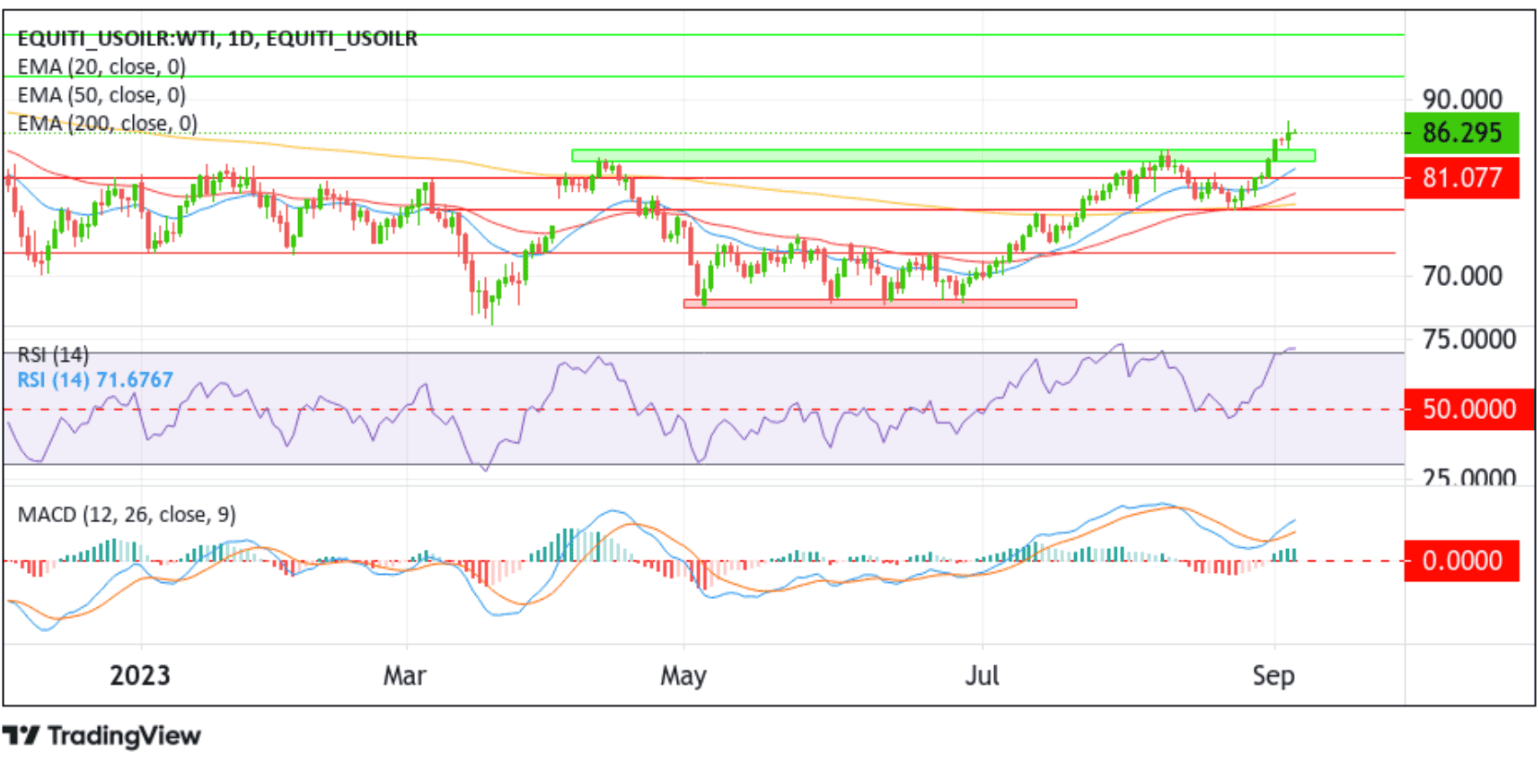

Technical Outlook: One-Day US WTI Crude Oil Price Chart

From a technical standpoint, the US WTI crude oil price’s acceptance above the 84.316 - 83.048 supply zone supported the case for further upside moves. A further increase in buying momentum from the current price level would pave the way for the crude oil price to rise toward the 90.00 round mark en-route to the 92.558 resistance level. A clean break above these barriers would pave the way for an ascent toward the 93.299 resistance level, about which a decisive break above this barrier would pave the way for a further bullish rally toward the 97.238 resistance level and, in highly bullish cases, extend the bullish trajectory toward the 100.00 round mark.

All the technical oscillators are in positive territory and support the case for further upside moves; however, the Relative Strength Index (RSI) at 71.6767 is flashing overbought conditions, warranting caution to traders against submitting aggressive bullish bets ahead of the release of key U.S. and Chinese data. Further validating the bullish bias is the 200 (yellow) and 50 (red) day Exponential Moving Average crossover (Golden cross) at the 77.969 level.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support comes in at 81.077 level. On further weakness, the focus shifts lower to the 77.573 support level. If oil sellers manage to breach this floor, downside pressure could accelerate, paving the way for a drop toward the 72.624 support level. A decisive break below this level would pave the way for a further decline toward the demand zone, ranging from 67.463 to 66.568 levels. Sustained weakness below this zone, followed by a break below the 64.387 support level, would pave the way for more profound losses around crude oil prices.