NZD/USD Rises To A Fresh 3-Months High As RBNZ Holds Rates But Warns Of More Rate Hikes Ahead, U.S. GDP QOQ (Q3) Data Eyed

Key Takeaways:

- NZD/USD cross jumped almost 1% to trade above the 0.62000 mark and record a fresh three-month high on Wednesday

- Despite the RBNZ holding rates steady, the accompanying MPS was interpreted by markets as very hawkish, which underpinned the Kiwi

- Bets that the Fed is done with rate hikes continue to weigh on the buck and help cap the downside for the NZD/USD pair

- The market's focus entirely switched toward the release of the U.S. GDP QOQ (Q3) data report for fresh NZD/USD directional impetus

The NZD/USD pair attracted some dip-buying from the vicinity of the 0.61470 level during the second part of the Asian session and rose to a fresh three-month high above the 0.62000 mark, buoyed by the latest decision by the Reserve Bank of New Zealand (RBNZ). On Wednesday, the Reserve Bank of New Zealand announced it had kept its official cash rate (OCR) unchanged at 5.5% during its November meeting, extending the rate pause for the fourth straight gathering and matching market consensus.

The accompanying monetary policy statement (MPS) stated that the board remained confident that the current level of OCR is restricting demand. However, ongoing excess demand and cost pressures were of concern amid elevated core inflation. The committee further agreed that interest rates must stay restrictive to bring inflation back to a target of 1 to 3% and support sustainable employment. While forecasting a cash rate peak of 5.7%, policymakers noted they need to wait for further data to observe the speed and extent of easing domestic capacity pressures.

It is worth noting that Wednesday's decision was widely expected after data last month showed the annual inflation rate in New Zealand eased to 5.6% in the September quarter of 2023 from 6% in the second quarter. It was the lowest figure since the third quarter of 2021. Additionally, the unemployment rate in New Zealand rose to 3.9% in the September quarter of 2023, remaining at the highest level since the June quarter of 2021, compared to 3.6%% in the preceding quarter and in line with market expectations.

That said, further contributing to the sentiment surrounding the NZD/USD cross is the generally weaker U.S. dollar, weighed by firm market expectations that the Federal Reserve is done with its rate-hiking cycle. This comes after minutes of the November meeting revealed that Federal Reserve officials at their most recent meeting expressed little appetite for cutting interest rates anytime soon, particularly as inflation remains well above their goal.

Apart from this, two U.S. Bureau of Labor Statistics reports released early this month pointed to cooling inflation pressures at the consumer and producer level, which, together with slowing job and wage growth, fully reinforce market expectations that the Fed is done with its monetary policy tightening campaign. In fact, CME's Fed watch tool shows that Fed fund futures traders have priced in a 100% chance that the Fed will leave its Fed Funds rates unchanged at 5.25% - 5.5% during the December meeting. Further weighing on the buck is the generally positive tone around the U.S. equity markets, which extends support to the risk-perceived Kiwi and helps cap the downside for the NZD/USD cross. Additionally, the buck continues to be weighed down by the disappointing U.S. Census Bureau report released on Monday, which showed sales of new single-family houses in the United States fell more than market expectations.

That said, the generally downbeat mood around the buck sees markets overlook the better-than-expected U.S. Conference Board report, which showed the Consumer Confidence Index® increased in November to 102.0 (1985=100), up from a downwardly revised 99.1 in October.

As we advance, investors have now set their focus on the U.S. GDP QOQ (Q3) data report, set for release during the early North American session, for fresh NZD/USD directional impetus. The data report is expected to show that the U.S. economy expanded by 4.9% in the third quarter. Of 2023

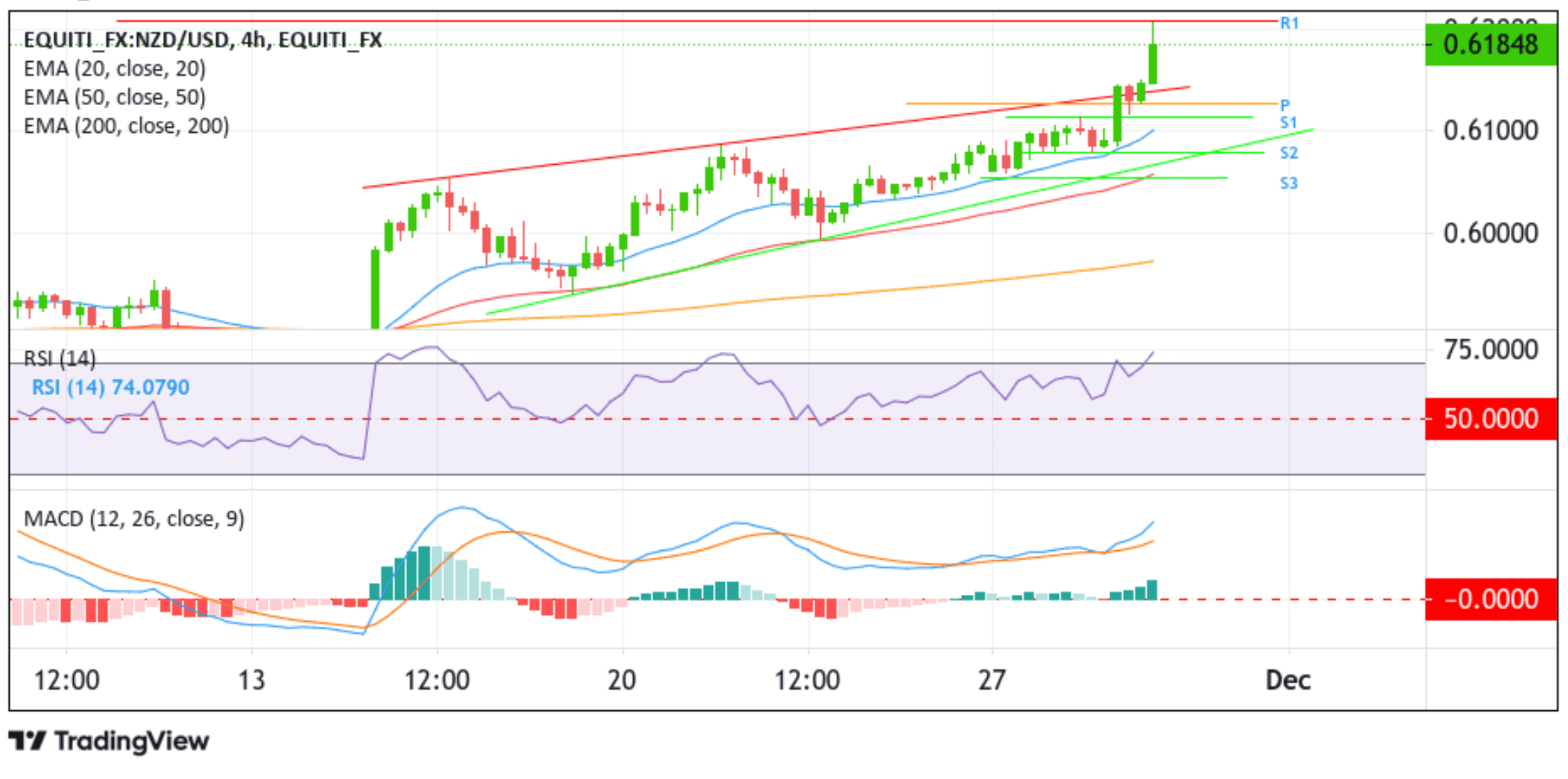

Technical Outlook: Four-Hours NZD/USD Price Chart

From a technical standpoint, the NZD/USD cross confirmed a fresh price breakout above the upper limit of the ascending channel pattern (key resistance level) earlier today and followed up with a convincing move above the 0.62000 psychological mark to register almost a 1% daily gain before later bouncing from the 0.62073 level (R1) and subsequently moving back below the aforementioned psychological mark to trade at the 0.61848 level as of press time. In the coming sessions, if the price finds acceptance above the aforementioned barrier, the NZD/USD cross could rally further toward the 0.62754 ceilings, followed by the 0.64103 – 0.63796 supply zone.

All technical indicators point to bullish, solid momentum and support the case for further upside moves. However, the RSI(14) level at 74.07 flashes overbought conditions, which warrant caution to traders against submitting aggressive bullish bets and wait for near-term depreciating moves before placing fresh bullish bets ahead of the much-awaited release of the U.S. GDP QoQ 3 report data. Further reinforcing the bullish outlook is the acceptance of prices above the 200-day (brown) exponential moving average (EMA) at the 0.59015 level.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes in at the upper limit of the ascending channel pattern. A clean break below this support level will pave the way for a move towards the pivot level (P) at the 0.61260 level. On further weakness, NZD/USD could drop towards the 0.61165 support level (S1). A decisive move below this level will pave the way for a drop toward the next relevant support level at the 0.60773 level (S2) before the price falls further to retest the key support level plotted by an ascending trendline extending from the mid-November 2023 swing lower-lows (lower limit of the ascending channel pattern).