NZD/USD Rebounds Modestly On New Zealand's Improved Economy Projections, U.S. CPI And PPI Data Eyed

Key Takeaways:

- NZD/USD rebounded modestly during the mid-Asian session, supported by N.Z.'s improved economic projections

- News of China's new bank loans rising more than expected further supports the Kiwi

- A further uptick seems elusive amid increased market bets that the Fed will lift interest rates by 25 basis points (bps) before the end of this year

- Markets await fresh USD/CNH directional impetus from the release of key U.S. inflation data later this week

The NZD/USD cross gained positive traction on Tuesday following a modest bounce from the vicinity of the 0.59171 level/daily low touched during the mid-Asian session. As of press time, the shared currency pair has recovered most of its lost ground but is still down over eight pips for the day.

The Kiwi's modest uptick in the last hour or so against the buck could be attributed to the news that New Zealand's government on Tuesday forecast a more significant budget deficit and higher debt but better than expected economic conditions in the year ahead as it opened its books and updated forecasts heading into the October election.

Further contributing to the sentiment around the NZD/USD cross is the weaker tone around the U.S. dollar, attributed to the ongoing decline in U.S. treasury bond yields. Additionally, the decision by investors to stay on the side lines ahead of the release of key U.S. inflation data reports on Wednesday and Thursday this week was also seen as another factor that undermined the buck and helped cap the downside for the NZD/USD Pair. Furthermore, a goodish bounce in the U.S. equity markets was also a contributing factor, helping exert upward pressure on the NZD/USD cross.

Apart from these, the Kiwi continues to draw support from the decision by China's banks to extend CNY 1.36 trillion in new yuan loans in August 2023, marking a sharp increase from July's CNY 0.35 trillion and surpassing the market consensus of CNY 1.20 trillion, as the central bank aimed to bolster economic growth in the face of subdued demand both domestically and internationally.

Despite the combination of supporting factors, the upside seems cushioned amid hawkish market expectations that the Federal Reserve (Fed) will lift interest rates by 25 basis points (bps) before the end of this year. Increasing market bets for a final 25bps Fed rate hike before 2024 was the U.S. Department of Labor report last week that showed that new unemployment claims in the U.S. fell to their lowest in over six months in the final week of August, surprising market expectations of a moderate increase and challenging recent data that suggested some softening in the labor market. Additionally, the ISM Services PMI in the U.S. unexpectedly rose to a six-month high in August, reflecting resilience to high borrowing costs.

As we advance, investors now look forward to second-tier U.S. economic data, which will influence the USD and the broader market risk sentiment. The main focus, however, remains on the key U.S. CPI and PPI data for August, which are expected to show a moderate rise in inflation pressures in the U.S.

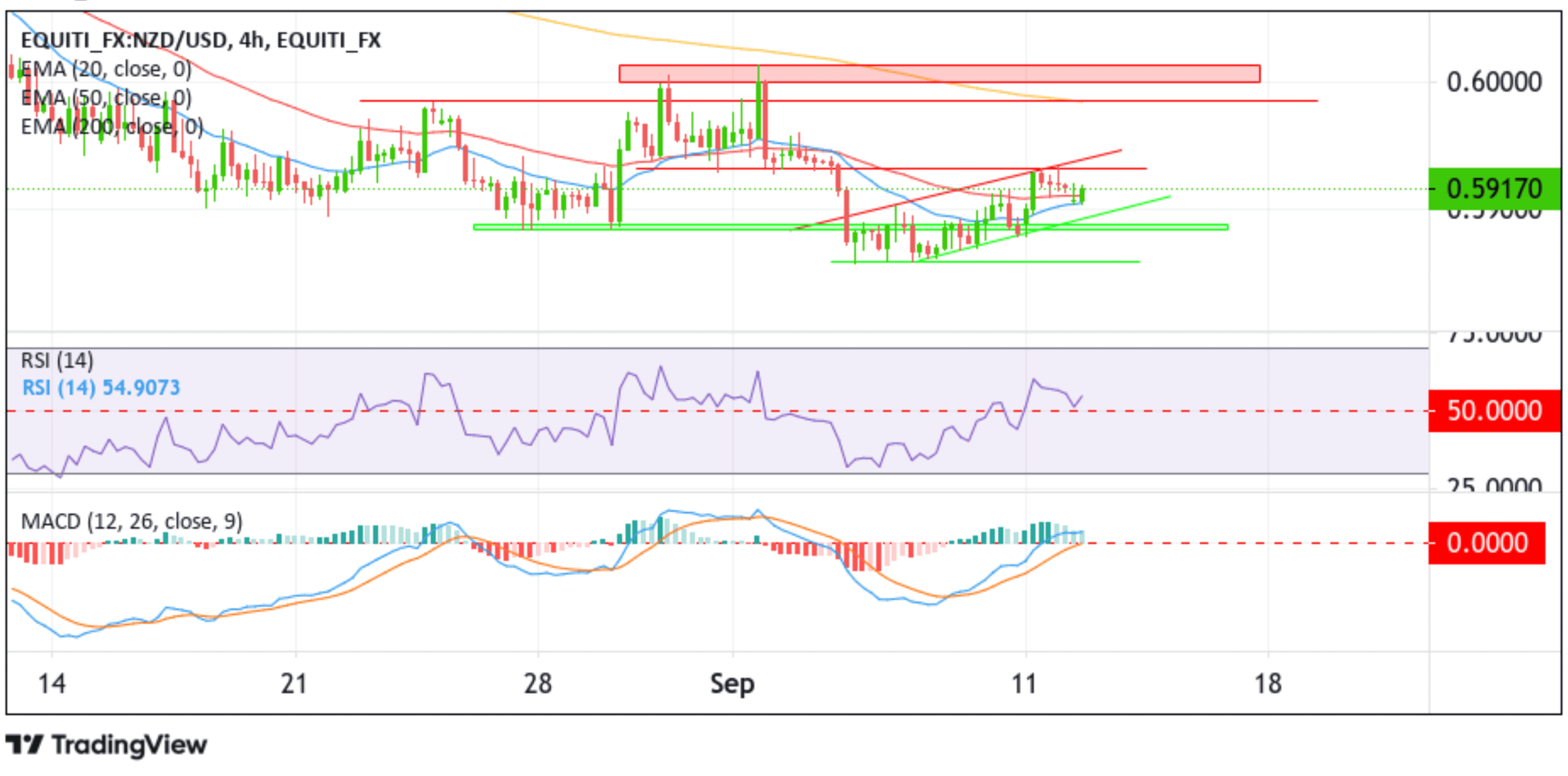

Technical Outlook: Four-Hour NZD/USD Price Chart

From a technical perspective, a further increase in buying pressure beyond the current price level would face initial resistance at the 0.59301 resistance level. If the price pierces this barrier, the NZD/USD price could appreciate further toward the upper limit of the ascending channel pattern. A subsequent break (bullish price breakout) above this resistance level would act as a fresh trigger for bullish traders to place new BUY trades, paving the way for a rally toward the 0.59843 key resistance level, which also coincides with the technically strong 200-day (yellow) Exponential Moving Average. A convincing move above this barricade would negate any near-term bearish outlook and prompt aggressive technical buying. The bullish uptick could be extended toward the 0.60139 - 0.60005 supply zone. Sustained strength above this barrier would reaffirm the bullish thesis and pave the way for further gains around the shared currency.

On the flip side, if bears overpower bulls, initial support appears at the lower limit of the descending channel pattern. A decisive break below this support level will pave the way for a drop toward the 0.58890 - 0.58845 demand zone. Sustained weakness below this zone would see the shared currency fall further toward the 0.58583 key support level. A decisive flip of this support level into a resistance level would cause the NZD/USD cross more vulnerable toward further southside moves.