NZD/USD Rebounds From Five-Week Low As RBNZ Leaves Rates Unchanged Until 2025, FOMC Meeting Minutes Eyed

Key Takeaways:

- NZD/USD cross witnessed aggressive buying during the Asian session and rebounded sharply from a five-week low

- RBNZ announced today that it had left its OCR unchanged at 5.5% and hints that any rate reduction will happen during the first six months of 2025

- Retreating Treasury Bond yields weigh on the greenback and help limit further losses for the NZD/USD pair

- The market's focus shifts toward releasing the August FOMC Meeting minutes

NZD/USD pair attracted some dip-buying from the vicinity of the 0.59313 level/daily low during the mid-Asian session. They rebounded swiftly, moving above the 0.59600s amid fresh U.S. dollar supply. When speaking, the shared currency has fully recovered its earlier losses and looks set to keep its offered tone heading into the European session.

A combination of factors assisted the New Zealand Dollar (NZD) in rebinding sharply from a five-week low/0.59313 touched earlier on Wednesday and edging higher despite the immense bearish pressure witnessed over the last four weeks. Lifting the Kiwi on Wednesday was news that the Reserve Bank of New Zealand (RBNZ) had decided to keep the official cash rate (OCR) unchanged at 5.5% during its August meeting, extending the rate pause for the second month and matching market consensus. The board noted that monetary conditions restrict spending and reduce cost pressure after 525bps rate hikes since October 2021. However, inflation remains too high, and the OCR must stay at a restrictive level to bring inflation back to the target range of 1 to 3% annually by H2 of 2024.

The Reserve Bank of New Zealand (RBNZ) maintains its projection that the official cash rate (OCR) will reach its existing level of 5.5%, possibly with a slight chance of a further increase. However, the recent monetary policy review (MPR) released alongside the rate decision indicates that any rate reduction is anticipated in the first six months of 2025. Today's decision was widely expected as New Zealand's annual inflation has come off in recent months and is currently 6.0%, just below a three-decade high of 6.7%, with expectations it will return to the central bank's 1% to 3% target by the second half of 2024.

Further contributing to the sentiment around the NZD/USD pair is the fresh leg down in U.S. Treasury bond yields, which, along with a weaker risk tone, helped revive the U.S. dollar supply, which in turn is seen as another key factor that helped limit further losses for the AUD/USD cross. The generally positive tone around the equity markets further undermines the safe-haven greenback and exerts upward pressure on the AUD/USD pair.

Despite the combination of negative factors, the backdrop seems tilted in favor of the NZD/USD bears as the greenback continues to draw support from Speculation that the Federal Reserve (Fed) will lift its Fed Fund rates one last time before pivoting. The bets were raised after a U.S. Bureau of Labor Statistics (BLS) report released last Friday showed U.S. overall inflation rose more than expected in July, reversing a year-long cooling trend.

The hotter-than-expected PPI data came a day after another BLS report showed that consumer-level inflation rose slightly in July, supporting the case for a Fed pivot. However, the more robust PPI numbers, combined with July's jobs report released earlier this month and the U.S. GDP data, have to a greater extent, reversed hopes that the Federal Reserve may refrain from tightening monetary policy further this year.

Further supporting the greenback is the softer U.S. retail sales data, which showed retail sales in the U.S. were up 0.7% month-over-month in July of 2023, marking a fourth consecutive rise and beating market forecasts of a 0.4% increase. It follows an upwardly revised 0.3% gain in June and another sign consumer spending remains strong despite high prices and borrowing costs. To a greater extent, the better-than-expected U.S. retail sales data overshadowed a more substantial drop in relative business conditions in New York.

Additionally, weak macro data from China continues to point to the fact that the Post-Covid rebound has run out of steam, which in turn continues to weigh on the

Kiwi. Fresh macro data on Tuesday showed that Chinese retail sales, industrial production, and fixed asset investment all rose less than expected in July, while the urban unemployment rate ticked higher. That said, the combination of factors suggests the path of least resistance for the NZD/USD pair is to the upside and warrants caution

As we advance, investors might refrain from placing aggressive bullish bets ahead of the release of the August FOMC Meeting Minutes. Investors will look keenly into the minutes' report to get insights into FOMC's stance on monetary policy.

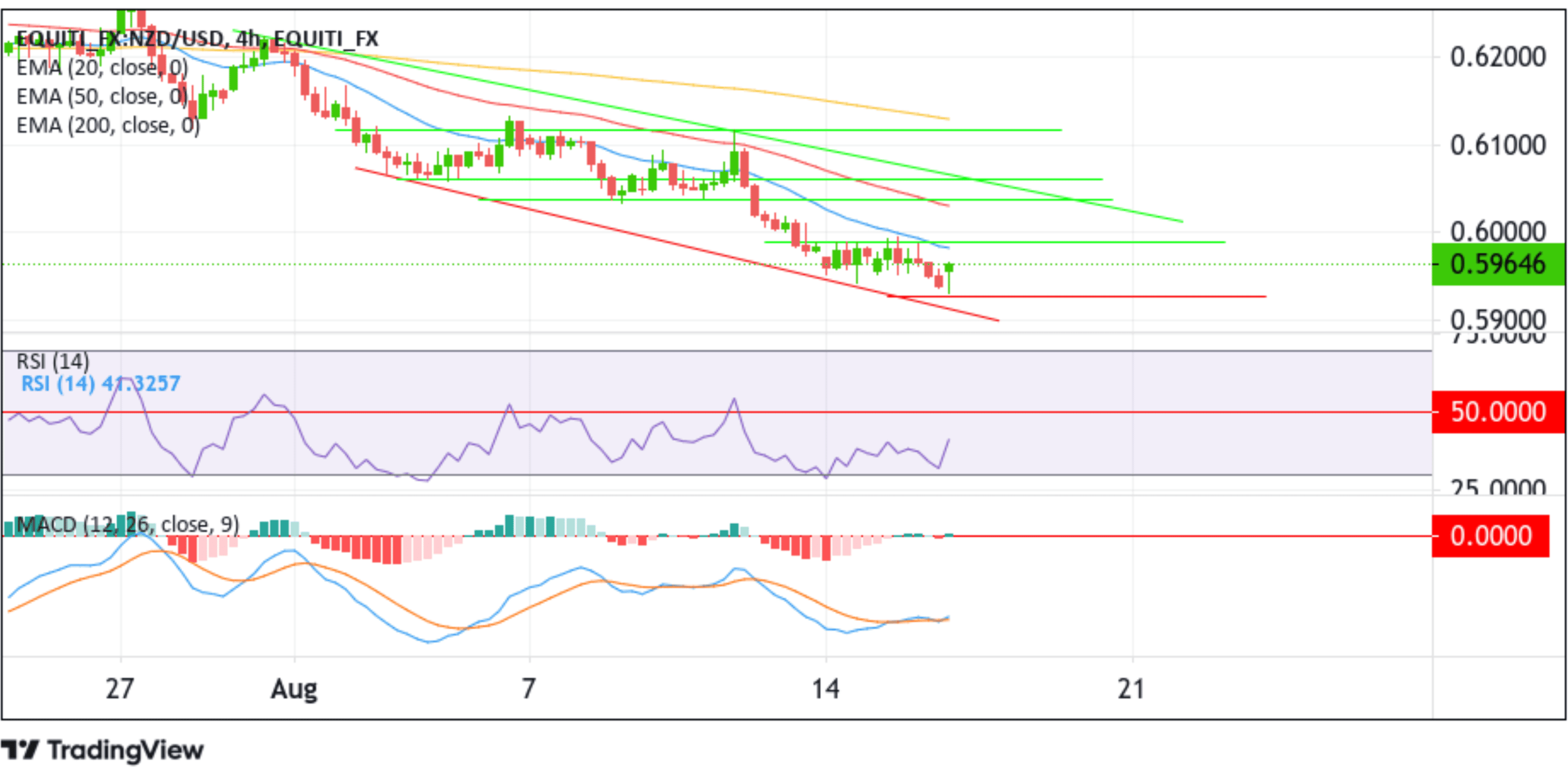

Technical Outlook: Four-Hours NZD/USD Price Chart

From a technical standpoint, the NZD/USD pair is trading in modest gains above the 0.59600s mark following a sharp rebound from the vicinity of the 0.59313 level. Subsequent follow-through buying would push spot prices toward tagging the 20-day (blue) EMA level at the 0.59807 level, which sits below the 0.59893 resistance level and the 0.60000 mark. A clear move above these levels will pave the way for an NZD/USD rally towards tagging the 50-day (red) EMA level at the 0.60283 level. Acceptance above this EMA level would pave the way for an ascent toward the 0.60381 horizontal level en route to the 0.60604 resistance level. A convincing move above these barriers would pave the way for an extension of the bullish uptick toward the upper limit of the descending channel pattern, about which, if the price decisively breaks (bullish price breakout) above this resistance level, it would reaffirm the bullish bias and pave the way for further gains around the NZD/USD cross.

From a technical standpoint, the NZD/USD pair is trading in modest gains above the 0.59600s mark following a sharp rebound from the vicinity of the 0.59313 level. Subsequent follow-through buying would push spot prices toward tagging the 20-day (blue) EMA level at the 0.59807 level, which sits below the 0.59893 resistance level and the 0.60000 mark. A clear move above these levels will pave the way for an NZD/USD rally towards tagging the 50-day (red) EMA level at the 0.60283 level. Acceptance above this EMA level would pave the way for an ascent toward the 0.60381 horizontal level en route to the 0.60604 resistance level. A convincing move above these barriers would pave the way for an extension of the bullish uptick toward the upper limit of the descending channel pattern, about which, if the price decisively breaks (bullish price breakout) above this resistance level, it would reaffirm the bullish bias and pave the way for further gains around the NZD/USD cross.

On the flip side, the 0.59313 level now acts as an immediate hurdle, below which a bout of short-covering can drag the pair back towards retesting the lower limit of the descending channel pattern. A subsequent break (bearish price breakout) below this support level would pave the way for further losses around the NZD/USD cross.