NZD/USD Drops To A Fresh Weekly Low As RBNZ Holds Rate Steady For A Third Consecutive Time

Key Takeaways:

- The NZD/USD dropped to a fresh weekly low, weighed down by a combination of factors

- Elevated U.S. yields, supported by hawkish Fed expectations, underpin the greenback and help limit any meaningful NZD/USD uptick

- RBNZ's decision to hold rate rates steady for the third consecutive time undermines the Kiwi

- A slew of key U.S. macro data is set to be released today that will provide directional impetus to the NZD/USD pair

The NZD/USD cross attracted fresh selling on Wednesday during the mid-Asian session and dropped to a fresh weekly low/0.58710 level to trade just a few pips above the nine-month low/0.58591 level touched early last month. The NZD/USD pair has managed to reverse most of its earlier gains and looks set to maintain its bid tone heading into the European session. The NZD/USD cross-sharp rebound earlier on Wednesday could be attributed to the latest decision by the Reserve Bank of New Zealand (RBNZ). Earlier today, the Reserve Bank of New Zealand announced it had held its official cash rate (OCR) at 5.5% during its October meeting, extending the rate pause for the third straight meeting and matching market consensus.

The accompanying Monetary Policy Statement showed that the Central Bank board continued to judge that monetary conditions were restricting spending and reducing cost pressure following a 525bps rate hike in October 2021. Simultaneously, the central bank viewed that inflation remained too high, and the OCR needs to stay at a restrictive level for longer to return inflation to a goal range of 1 to 3% annually by H2 of 2024.

Wednesday's decision was widely expected after the annual inflation rate in New Zealand slowed to 6% in the second quarter of 2023, the lowest since the fourth quarter of 2021 and compared to 6.7% in the previous period. The consumer price index rose 1.1% in the second quarter every quarter, slowing from a 1.2% gain in the preceding quarter.

It was worth noting that the RBNZ's interest rate decision comes a day after the Reserve Bank of Australia announced it had kept its cash rate unchanged at 4.1% during the first meeting under new Governor Michele Bullock, extending the rate pause for the fourth straight month. Tuesday's move was in line with market estimates, with the board again saying inflation had passed its peak, but it was still too high and will stay so for some time.

That said, further contributing to the sentiment surrounding the NZD/USD cross is the ongoing rise in U.S. Treasury bond yields, bolstered by hawkish Fed expectations, which remain supportive of the greenback and help cap the upside for the NZD/USD cross. The odds for further monetary policy tightening by the Fed were cemented after Federal Reserve Bank of Cleveland President Loretta Mester, during a Q&A session before the 50 Club of Cleveland Monthly Meeting, said that higher rates are needed to ensure the disinflation process continues.

Mester comments come on the heels of another FOMC Member, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, who said on Tuesday that a soft landing for the U.S. economy is more likely than not but still pegged the probability at about 60% that the Fed "potentially" raises rates one more quarter of a percentage point and then holds borrowing costs steady "long enough to bring inflation back to target in a reasonable period of time."

Additionally, the greenback continues to be underpinned by the better-than-expected U.S. JOLTS Job Openings data report, which showed the number of job openings rose by 690,000 from the previous month to 9.61 million in August 2023, well above the market consensus of 8.8 million and indicating a robust labor market despite the Fed's unprecedented monetary policy tightening measures, a U.S. Bureau of Labor Statistics report showed on Tuesday.

The Upbeat Jobs report comes on the heels of another better-than-expected U.S. macro data released early this week, which showed the U.S. ISM Manufacturing PMI rose to 49 in September 2023 from 47.6 in the previous month, well above market expectations of 47.8 to reflect the slowest contraction in the U.S. manufacturing sector in ten months.

These, combined with the generally weaker tone around the U.S. equity markets, should limit any meaningful uptick for the NZD/USD cross and suggest the path of least resistance is to the upside.

As we advance, investors look forward to the U.S. docket featuring the release of the ADP Nonfarm Employment Change (Sep), Services PMI (Sep), and the ISM Non-Manufacturing PMI (Sep) data report. Traders will further look for cues from FOMC member Michelle Bowman's speech during the mid-North-American session.

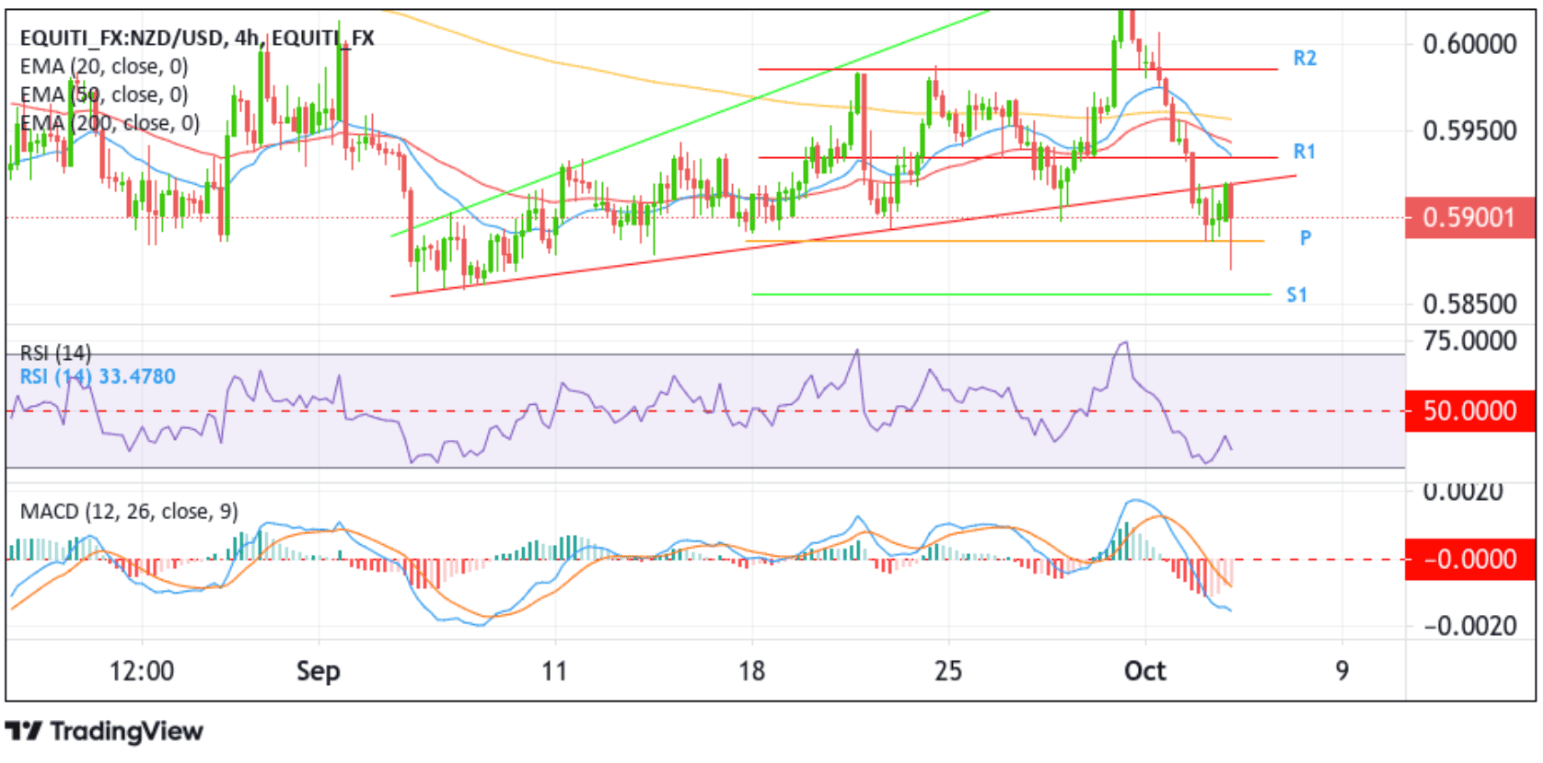

Technical Outlook: Four-Hour NZD/USD Price Chart

From a technical standpoint, Tuesday's bearish price breakout below the key support level plotted by an ascending trendline extending from the early-September 2023 swing low supported the case for further downside moves. However, the price found some support at the 0.58869 level (pivotal point-P) and retraced, moving back above the 0.59200 mark. However, some strong selling during the mid-Asian session today saw the shared currency weaken and drop to a fresh weekly low/0.58710 level before paring losses and moving back above the 0.59000 mark. Some strong follow-through selling beyond the current price level would drag spot prices toward the immediate support level at 0.58869. Failure to defend the aforementioned support level would make the NZD/USD pair vulnerable to extending the downward trajectory toward the 0.58553 support level (S1). A clean break below this support level would pave the way for more profound losses around the NZD/USD cross.

On the flip side, any meaningful pullback finds immediate resistance at the key support level plotted by an ascending trendline. A subsequent break (bullish price breakout) above this resistance level would see the NZD/USD cross aim for the 0.59345 resistance level (R1), which also coincides with the 20-day (blue) EMA level. A decisive flip of this resistance level into a support level will pave the way for a move toward the seller congestion zone due to the 50 (red) and 200 (yellow)-days Exponential Moving Average (EMA) at 0.59417 and 0.59570 levels, respectively. Suppose side-lined buyers join in from this zone. In that case, it will rejuvenate the bullish momentum, provoking an extended rally toward the 0.59859 level (R2) followed by the 0.60486 level (R3), and in extreme bullish cases, the shared currency could extend a leg up toward the key resistance level plotted by an ascending trendline extending from the early-September 2023 swing high.