2024 Investment Trend

Key Takeaways:

- According to analysts, 2024 is set to present a fresh wave of opportunities that will shape the investment landscape in the coming months

- As we approach a new year, it's the perfect time for traders to reflect on their strategies and further develop their skills

As we stand on the cusp of a new year, the ever-evolving landscape of global finance continues to beckon investors toward uncharted territories. The year 2023 has been a testament to markets' resilience, navigating through challenges, embracing technological advancements, and adapting to shifting geopolitical landscapes. As we usher in 2024, investors anticipate a fresh wave of opportunities and challenges shaping the investment landscape in the coming months. In this article, we will delve into investment trends and set our sights on 2024, using predictions as a key parameter to gauge the potential opportunities.

Prediction of Investment Trends

The investment landscape is a dynamic ecosystem influenced by many factors, including economic indicators, technological breakthroughs, regulatory changes, and societal shifts. Recognizing the importance of staying ahead of the curve, seasoned investors and financial enthusiasts alike are keenly attuned to emerging trends that promise to redefine traditional paradigms and unlock new avenues for economic growth. Without further ado, let's delve into some of the key investment trends expected to dominate 2024.

Is the U.S. economy heading toward a recession?

As the global economic landscape changes, there is a growing focus on discussions regarding the state of the U.S. economy in 2024 among economists, policymakers, and the general public. Concerns about a potential recession are prominent, and Chief Equity Strategist Jeffrey Buchbinder from LPL Financial suggests a high likelihood of the U.S. economy entering a recession next year. According to Buchbinder, if the Federal Reserve decides to reduce interest rates, it would indicate that a recession is imminent or already in progress. He explained, "The Fed will lower rates because it is concerned that monetary policy is too restrictive for a weakening economy."

Buchbinder emphasized that the central bank aims to achieve a soft landing. While its track record in accomplishing this goal has been inconsistent, it doesn't necessarily mean a severe economic downturn is inevitable. He further stated that if a recession were to occur in 2024, it would likely be mild, given the robust fundamentals of the U.S. economy and the absence of significant shocks or imbalances.

That said, as the possibility of a recession in 2024 looms, as an investor, protecting your investments requires a proactive approach and strategic decision-making. By diversifying your portfolio, focusing on quality and stability, staying informed, and considering alternative investments, you can fortify your financial position and potentially seize opportunities even during challenging economic times.

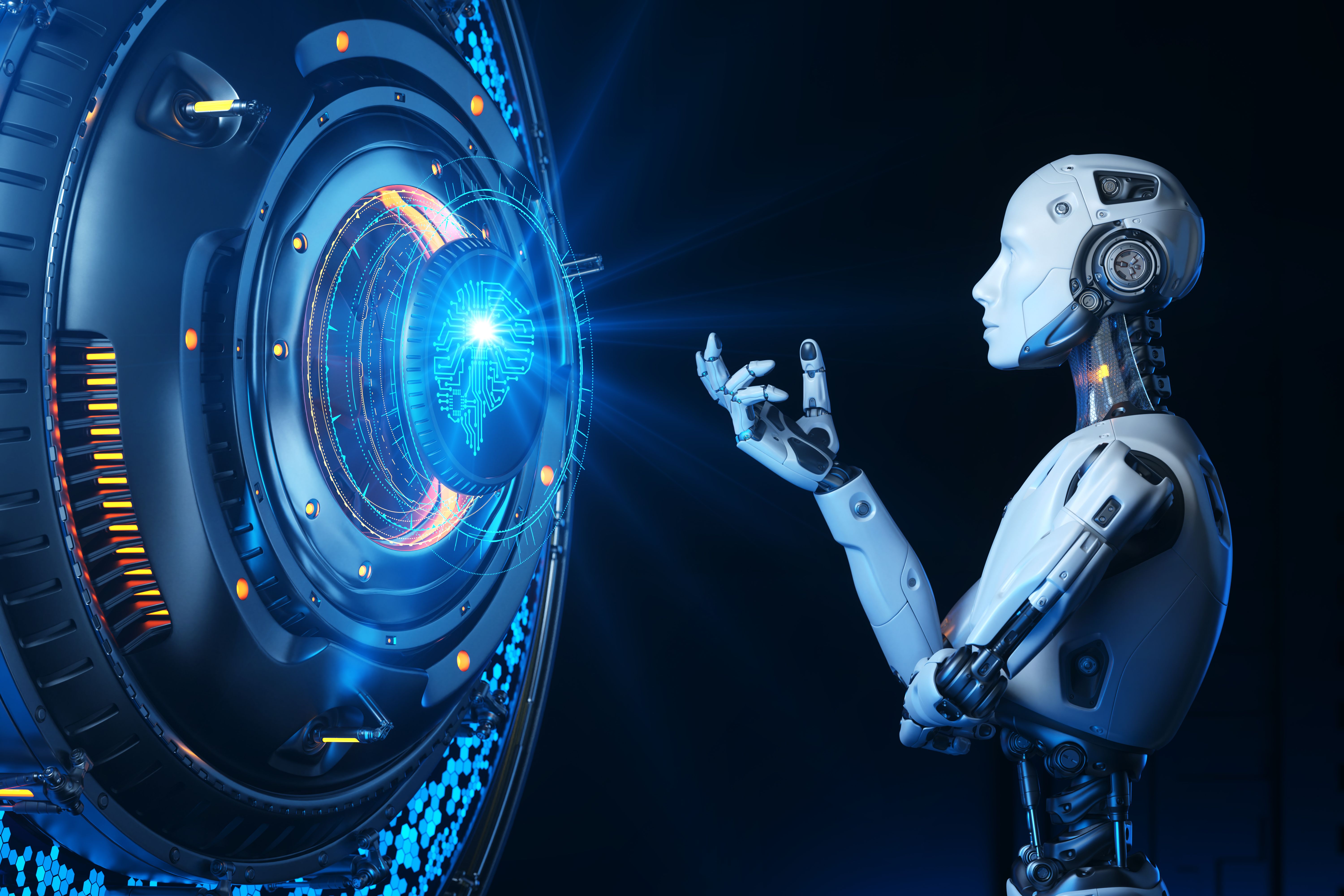

AI In Fintech

In the ever-evolving landscape of financial technology, it is evident that Artificial Intelligence (AI) will continue to weave its way into various aspects of the industry. As we look ahead to the year 2024, the influence of AI in fintech is expected to reach new heights, paving the way for revolutionary advancements and transforming how we interact with financial services. From personalized investment advice to robust fraud detection systems, AI is set to become an integral part of financial institutions, startups, and consumers alike. The potential of AI in fintech is limitless, empowering businesses to improve operational efficiency, enhance customer experiences, and drive unparalleled growth. As we embrace this remarkable trend, it becomes evident that AI will play a critical role in shaping the future of the fintech industry in 2024 and beyond.

Gold Prices to Hit Record Highs in 2024?

Gold has long been considered a safe-haven asset during economic turmoil, i.e., inflation, geopolitical tensions, and economic uncertainties, due to its history of retaining its value over time. 2023 saw an increased appetite for gold, which helped the precious yellow commodity price reach record highs supported by rising geopolitical risks, increased economic uncertainties, a softer U.S. dollar, and softened inflation.

According to research by ING, a Netherlands-based bank, gold is projected to rise higher and reach new ceilings in 2024. According to ING, with more data lately pointing to a cooling labor market and softened inflation pressures in many economies worldwide, central banks worldwide will be forced to start cutting rates next year, which would help gold prices go higher. Apart from this, a global recession in 2024 will impact the amount of easing the central banks will carry out. The more easing, the higher gold can go later next year and into 2025."

Moreover, central banks remain key participants in the gold market, expanding their reserves by around 800 tonnes during the initial three quarters of 2023. Apprehensions about geopolitical tensions and evolving approaches to currency reserves influence this remarkable growth. Prominent contributors to this upswing include China, Poland, Turkey, and India—the combination of central bank demand and ongoing investor interest positions gold for sustained robustness.

Apart from these, geopolitical uncertainties in 2024 would also help propel gold prices, making the precious yellow metal a good choice for investments in 2024.

Cryptocurrencies are firmly back

In November 2022, the collapse of FTX sent shockwaves throughout the crypto industry. The massive hack wiped out billions from investors' portfolios, leading to widespread panic and a sharp decline in market valuations. The incident highlighted the vulnerabilities inherent in centralized exchanges and underscored the urgent need for enhanced security measures to protect digital assets.

However, fast forward to 2023, the cryptocurrency market has demonstrated astonishing resilience, bouncing back more vital than ever. Bitcoin (BTC) and Ethereum (ETH) are leading the pack, two dominant players in the crypto market. Bitcoin, often considered the poster child of cryptocurrencies, has shown remarkable resilience this year, with its price rising over 167% since the start of the year to trade above the $44,000 mark as of press time. On the other hand, Ethereum has also put in a heavy shift this year, with the digital asset price currently posting a 92% gain since the start of the year to trade above the $2200.00 mark as of press time.

However, the success of these cryptocurrencies is not solely attributed to their prices but also the development of their governance and regulation frameworks. As the cryptocurrency market matures, regulators have recognized the need to establish guidelines to protect investors and prevent illicit activities. Striking a balance between fostering innovation and ensuring consumer safety remains a top priority for many nations, and more regulations can be expected in 2024. With improved governance and regulation, investors can now approach cryptocurrencies with renewed confidence, fueling their resurgence in popularity as an investment option.

As we advance, cryptocurrency assets are projected to rise further in 2024 amid cooling inflation and labor markets in most economies around the world; hence, a majority of central banks around the world are expected to cut rates as early as March 2024, which in turn would help push the cryptocurrency rally further.

Tips for 2024

Stay Invested

In the world of investing, predicting the future is no easy task, but according to Noah Damsky, principal at Marina Wealth Advisors in Los Angeles, next year could still deliver strong returns for stocks and bonds. This is why: Firstly, the global economy is expected to rebound with vigor after the disruptions caused by the COVID-19 pandemic. As businesses reopen and consumer confidence strengthens, corporate earnings are forecasted to surge, leading to increased stock valuations. Central banks worldwide have also implemented loose monetary policies, contributing to historically low interest rates. This environment makes stocks and bonds more attractive to investors seeking higher returns than what they can find in other investment options like fixed deposits or savings accounts. Moreover, technological advancements, such as artificial intelligence and automation, are projected to spur innovation and productivity, boosting overall economic growth and benefiting companies across various sectors. While risks and uncertainties always loom, it is essential to consider these factors as potential drivers of strong returns in the realm of stocks and bonds in 2024.

Discover Your Inner Trader

As we approach a new year, it's the perfect time for traders to reflect on their strategies and further develop their skills. The key to success in trading lies in market knowledge, self-awareness, and emotional intelligence - it's time to discover your inner trader. You can cultivate a more confident and disciplined approach to the markets by recognizing your strengths, weaknesses, and individual trading styles. Assess your risk tolerance, time commitment, and preferred trading instruments. Do you thrive in fast-paced environments, or are you more comfortable with long-term investments? Once you gain more clarity on your personal preferences and goals, you can fine-tune your strategies, capitalize on opportunities, and better navigate market uncertainties. So, as we head into 2024, embark on a journey of self-discovery and unlock your true potential as a trader.

Are you looking to start investing? You can Enjoy FREE USD 10,000 Virtual Funds for support by Signing Up on Pocket Trader. With Pocket Trader, You can invest in multiple markets, including forex and commodities, learn from experienced traders and share ideas with their social features to build wealth together.