Will Cryptocurrency Replace Fiat Currency

Cryptocurrency has been rising since the first digital asset was introduced in 2008. Its popularity has created ripples and waves across the financial markets to the extent that it has brought a debate on whether cryptocurrencies will ultimately replace fiat currencies in the future. But will this happen in the future? Well, this question has come across many people's minds at least once, and we would like to find out what is fueling this debate and learn about cryptocurrencies and their mature ecosystem.

With all the focus on digital assets, cryptocurrency, and the merging realities, many people have even come forward to predict the revolution of the whole financial system that we know can be possible before 2030. In 2018, futurist Thomas Frey stated that by 2030, roughly 25% of national currencies would be replaced by cryptocurrency. Frey believed that one day, cryptocurrency would replace fiat currency. Well, let's explore a bit more and learn how, if this was to happen in the future, how will it affect the economies in which it occurs.

First things first, let's, first of all, look in detail at Fiat Currency. Each jurisdiction worldwide has its own Fiat currency recognized as an official tender that the Central Bank backs. The supply of Fiat currency is primarily dictated by a country's monetary authority, which has the mandate to print and remove money from circulation. This is what keeps the value of a currency in check. Fiat currency represents government-issued notes and coins, and people commonly use it as a preferred medium of exchange of value. The different fiat currencies that exist include USD, Euro, Sterling Pound, Chinese Yuan, Swedish Franc, and Japanese Yen, to name a few.

What is Cryptocurrency

For new investors, cryptocurrency is a buzzword that turns ordinary folks into overnight millionaires. More often than not, it is alleged that these cryptos are acquired through scams.

Cryptocurrencies in their current form transcend borders and regulations, which have positive and negative effects. They are not controlled or influenced by central banks like Fiat currencies in developed and developing countries. Decentralization is the backbone behind cryptocurrencies, and it removes these tools as no central server or authority hosts these transactions. Instead, they are displayed so that anyone can see increasing transparency. However, the identities of the people making these transactions are hidden, showing only a public key.

But what is a cryptocurrency?

The whole idea of the cryptocurrency is based on a digital or virtual currency secured by cryptography, making it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology- a public time-stamped ledger in which all transactions on the virtual currency are verified by network nodes, which are essentially computers connected to the virtual currency network. Cryptocurrencies operate on different blockchains, which can be thought of as micro-economies. These tiny ecosystems run on blockchain networks powered by crypto tokens — they enable in-house operations and act as incentive tools for building a community around a particular project. You can think of them as the fiat money of the cryptocurrency world.

The most popular cryptocurrency is Bitcoin, founded in 2008 by an anonymous person who went by the pseudonym of Satoshi Nakamoto. The digital asset since 2011 has become the most widely utilized digital asset. The current Bitcoin market Capitalization stands at $407 Million against a global market capitalization of $1.023 Billion, accounting for almost 40% of the total cryptocurrencies in circulation. One significant fact that is known about bitcoin is that the maximum amount of bitcoins that can ever exist is 21,000,000 BTC because of the reward halving every four years. Reward halving happens roughly every four years when the number of bitcoins generated per one block halves every 210,000 blocks.

There are currently hundreds of alternative cryptocurrencies that try to capitalize on bitcoin's weaknesses and innovate by adding new functions. These include Ethereum, USD Tether, Ripple, and Dodge coin, with each having its operational network and market capitalization.

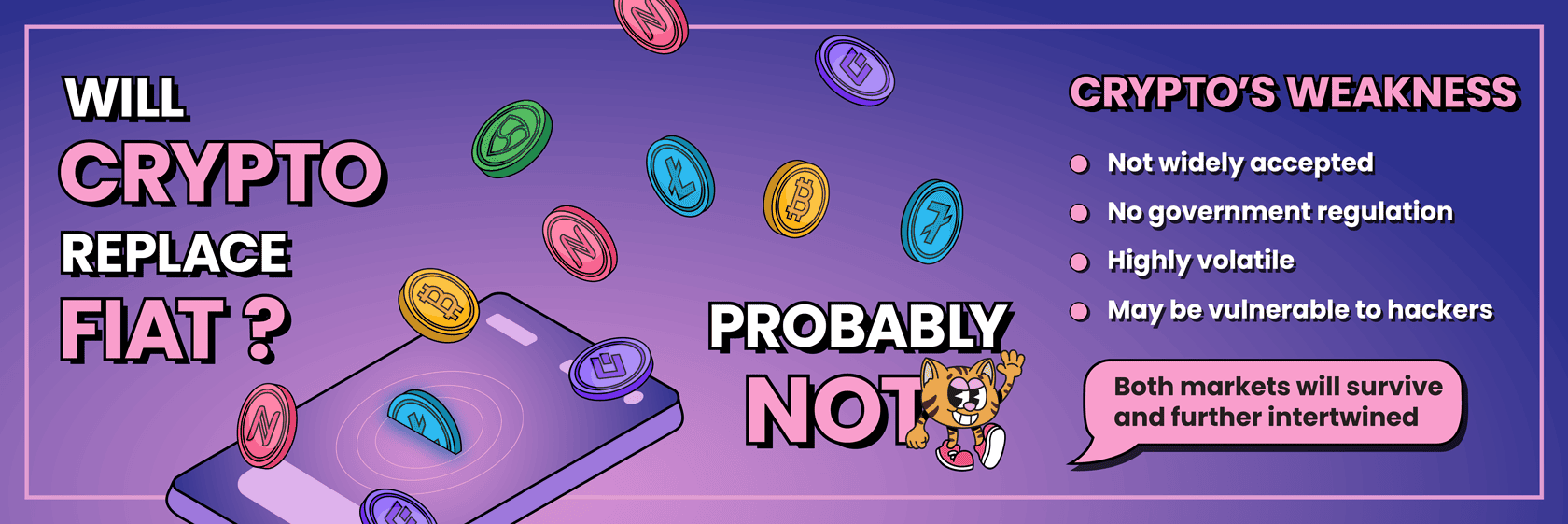

So what makes cryptocurrency unique from Fiat Currency, and what are its limitations?

First and foremost, Cryptocurrencies are decentralized in nature, meaning any central bank does not regulate them; hence monetary policy to control the digital assets would be ineffective. This implies control is back in the hands of ordinary people. At the same time, a decentralized system still fulfils many of the functions of the current banking system, including facilitating transactions, storing money, investing, and much more. In this way, cryptocurrency may be a path to financial equality.

Another feature is that cryptocurrency transactions are secure, which is an advantage over fiat currency. This makes it impossible to track down parties, and this can be a good thing as well as a bad thing. As long as you use a secure crypto wallet to store, send and receive crypto, it's almost impossible for someone to trace your transactions. Scammers and black market dealers use this to launder money from one crypto wallet to another, making it a perfect classical hallmark for scams. Moreover, Due to the decentralized nature, digital currencies are not backed by the central banks as they have no government approvals. Hence, customers have no legal protection in case someone gets scammed, making it riskier for someone who hasn't done meticulous research on how to invest in crypto assets.

Additionally, Cryptocurrencies don't require an intermediary to validate a transaction like a bank in the case of fiat currency. In cryptocurrency, each party is credited or debited correctly because blockchain technology and automated consensus mechanisms verify transactions and store the information in an unalterable way. This is usually very time-consuming and can take like 30mins for a transaction to reflect on someone's wallet. Therefore transaction speed is a challenge for most investors.

Last but not least, challenges of technical feasibility limit cryptocurrencies greatly. Running and sustaining the bitcoin network consumes a lot of electricity due to the extremely demanding cryptographic calculations that the miners have to compute on top of verifying transactions. This now will be a major hurdle if cryptocurrencies were to replace fiat currency, as not all countries in the world have sufficient electricity output to mine cryptocurrencies. This now leaves the door open for only countries with large electricity output to deal in mining cryptocurrencies.

Finally, Cryptocurrencies are more volatile than Fiat currencies, and this affects their stability. Their volatile nature is primarily driven by the speculative nature of the trade, where investors are focused on making money quickly, which often leads to panic selling or buying.

Despite the immense opportunities and efficiencies that cryptocurrencies and their impressive blockchain provide. Many countries are still apprehensive about cryptocurrencies replacing and taking over the fiat currencies in aspects of traditional coins and notes. This is because replacing fiat currency with cryptocurrency will mean countries will have to do away with their currency notes and coins and replace them with one of the existing cryptocurrencies.

In a world full of nations with different governments and ideologies, it will be almost impossible to bring them together on the same page to accept the use of the same cryptocurrency. Let's not forget that different countries worldwide have other political and economic systems, and introducing one digital asset to be used worldwide would harm a country's GDP, and a country's economy will be greatly impacted.

As we highlighted earlier on, cryptocurrencies still face many challenges for them to replace fiat currency in the future. Cryptocurrency is currently more like an investment opportunity rather than a legitimate currency. Cryptocurrency faces issues with stability, and the technology isn't quite there yet. Additionally, there are so many benefits enjoyed using a fiat currency that makes it is impossible to think of replacing it with cryptocurrencies even in the future.

So why still switch to cryptocurrencies in the future?