US30 Retreats From YTD Highs Amid Hawkish FED Remarks

US30 trimmed part of its earlier gains on Friday despite Stocks jumping a second day on Thursday as investors cheered another better-than-expected inflation report. The Dow Jones Industrial Average(US30) rose 214 points or 0.6% after the release of the latest inflation data, which showed that the headline US PPI unexpectedly fell in July amid a drop in the cost of energy products and that underlying producer inflation appears to be on a downward trend. The latest PPI data showed the U.S. July PPI inflation fell - by 0.5% MOM against a dow jones expectation of 0.2% and against the previous print of 1.0% In June. The U.S. Core PPI inflation data rose 0.2% MOM against a Dow Jones expectation of 0.4% and the last print of 0.4%. The PPI reading excluding food and energy rose less than expected.

The latest inflation data followed Wednesday's CPI inflation data report, which showed that the headline US CPI remained flat in July against Dow Jones expectations for a modest 8.7% rise on an annual basis and 0.2% monthly. Even with the lower-than-expected numbers, inflation pressures remained strong.

Following the better-than-expected inflation data reports, which showed that inflation might have cooled in the U.S., investors have slashed bets on the possibility that the Fed will raise interest rates by 75 basis points for a third consecutive time when it meets in September.

The U.S. Dollar index (DXY), which measures the value of the U.S. dollar relative to a basket of global currencies, extended its losses against other major currencies on Thursday, a day after a report showed U.S. inflation was not as hot as anticipated in July, prompting traders to dial back expectations for aggressive rate hikes by the Federal Reserve going forward. That said, Short-term Treasury yields were lower on Thursday, and the yield curve steepened as market participants digested another economic report that showed a slowdown in inflation. The three-month yield fell nearly five basis points to 2.551%. The 2-year Treasury yield was up one basis point lower at 3.225%, following a dramatic move in the previous session.

At the time of speaking, The dollar has clawed back some of its losses after Fed officials attempted to temper expectations of significantly looser policy, with Neel Kashkari telling a conference on Wednesday that the central bank was "far, far away from declaring victory" on inflation and needs to raise the policy rate much higher than its current 2.25%-2.50% range. Kashkari's remarks were backed by Chicago Fed President Charles Evans, who said inflation is still "unacceptably" high, and the Fed will likely need to lift its policy rate to 3.25% - 3.50% this year and to 3.75% - 4.00% by the end of next year. The FED official's remarks were seen as a hawkish stance by investors on their monetary stance against fighting the surging inflation in the U.S.

As we advance, in the absence of any major market-moving economic news data, the bond yields and the broader market risk sentiment would influence the USD price dynamics and offer some trading opportunities around the indices.

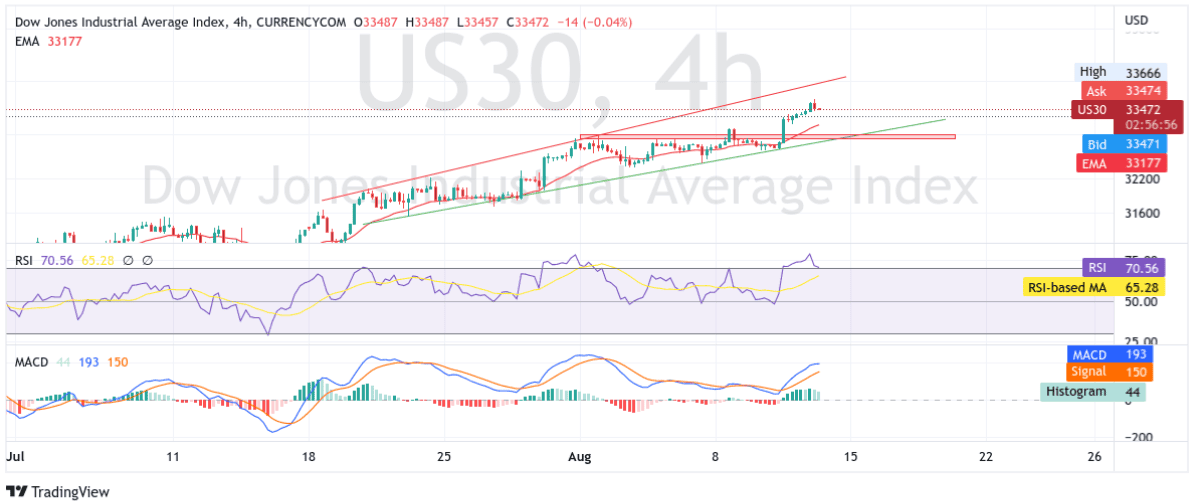

Technical Outlook: Four-Hour Price Chart

From a technical perspective, using a four-hour price chart, the price has rebounded modestly from the vicinity of the 33665 level after attracting fresh selling on Friday. Some follow-through selling would push the asset towards testing the key demand zone turned support level ranging from 32907 - 33009 levels and coincides with the lower horizontal trendline of the falling wedge pattern formation plotted as from 21st July. That said, if broken decisively, the aforementioned zone would be seen as a fresh trigger for bears to continue pushing down the price and pave the way for additional losses.

The RSI(14) level at 70.56 level is flashing oversold condition. The Moving average convergence divergence(MACD) crossover will add to the bearish sentiment later today.

On the flipside, a pullback toward testing the upper horizontal trendline of the falling wedge pattern formation turned vital resistance level followed by a convincing break above the aforementioned zone would negate any near-term bearish bias and pave the way for technical buying.