U.S. 30 Index Retreats From YTD Low Amid Minor USD Weakness, Eyes Now On NFP Report

- US 30 Index rebounds from the 29855.83 level after sensing Minor US Dollar weakness further uptick seems elusive

- Prospects of further monetary policy tightening by the FED continue to underpin the greenback

- A host of hawkish top FED Officials' comments also support the greenback

- The U.S. Department of Labor is set to announce the Non-Farm Payrolls report today

Dow Jones's average industrial (US.30) index rebounded on Friday from the 29855.83 level/previous day's Low after sensing minor U.S. Dollar weakness ahead of the very important September Jobs Report. As such, futures tied to the Dow Jones industrial average were up by 64 points or 0.21% as of 05:05 UTC +3. The supporting U.S. 30 Index uptick could be attributed to the fresh leg down in the U.S. government bond yields, dragging lower the U.S. Dollar index. As of press time, The U.S. dollar index, which measures the greenback against a basket of six currencies, was down 0.13%/ 147 points with rumours that the FED will resort to a moderate stance of monetary policy tightening at subsequent meetings. Further limiting the U.S. Dollar was the disappointing ISM Manufacturing PMI data on Monday which showed manufacturing activities in the U.S. had Slowed down in august.

That said, a better-than-expected job reading today, or rather its falls per the market expectation, would uplift the U.S. Dollar. In fact, in the headline Non-farm payrolls(sep) market analysts expect the U.S. economy to have created about 250,000 jobs last month, but well below the 315,000 seen in August, with average hourly earnings forecast remaining steady at about 0.3% and the unemployment rate at 3.8%. In the manufacturing sector as well as in the private sector, indicators should similarly demonstrate positive dynamics. That being said, expectations are high for a solid labor report today in the U.S., especially after the Department of Labor report released yesterday showed that the number of people filing for unemployment insurance last month had decreased by 219,000 people against a market expectation of 203,000 people and well above the 190,000 increase of people who had filed for unemployment insurance in august. That said, a strong U.S. dollar today following a strong jobs market or upside surprise signals that the Fed may need a tougher stance to slow the economy and tame surging prices. In turn, we would ultimately see the U.S. 30 index declining.

The Prospects for a more aggressive policy tightening by the FED and the risk of further escalation in the Russia-Ukraine conflict have fueled recession fears. Continue to support the greenback. Money markets are now pricing an almost 86% chance of a fourth straight 75 basis-point rate hike when policymakers meet on Nov. 1-2. Additionally, a top Federal Reserve official on Thursday warned that the U.S. central bank isn't close to ending its cycle of interest rate hikes yet. Atlanta Fed President Raphael Bostic said that the U.S. policy tightening cycle is "still in its early days" and warned explicitly against betting on an early 'pivot'. Despite "glimmers of hope" in recent data, Bostic said, "the overarching message I'm drawing...is that we are still decidedly in the inflationary woods, not out of them,". Bostic hasn't been the only Fed official to push back against speculation on a pivot, with San Francisco's Mary Daly making similar comments on two occasions this week alone, despite a big drop in job vacancies that pointed to some cooling off in a red-hot labor market.

Additionally, Chicago Fed President Charles Evans said the fed "has further to go," forecasting interest rates to rise to a range of 4.5% to 4.75%, flagging ongoing growth in the shelter and car prices as key drivers of core inflation. Other fed members, including Minneapolis Fed president Neel Kashkari, were in favor of further tightening, saying the central bank was "quite a ways away" from pausing rate hikes. Following the Top FED official's comments, the US30 Index Futures tied to the Dow Jones Industrial Average reacted negatively and shed 12 points, or 0.04%, while S&P 500 futures dipped 0.15%. Futures tied to the Nasdaq 100 slipped 0.29%.

Going forward, despite all the Major averages closing lower during regular trading on Thursday, they are on pace to cap their best week since June 24 and finish about 4% higher.

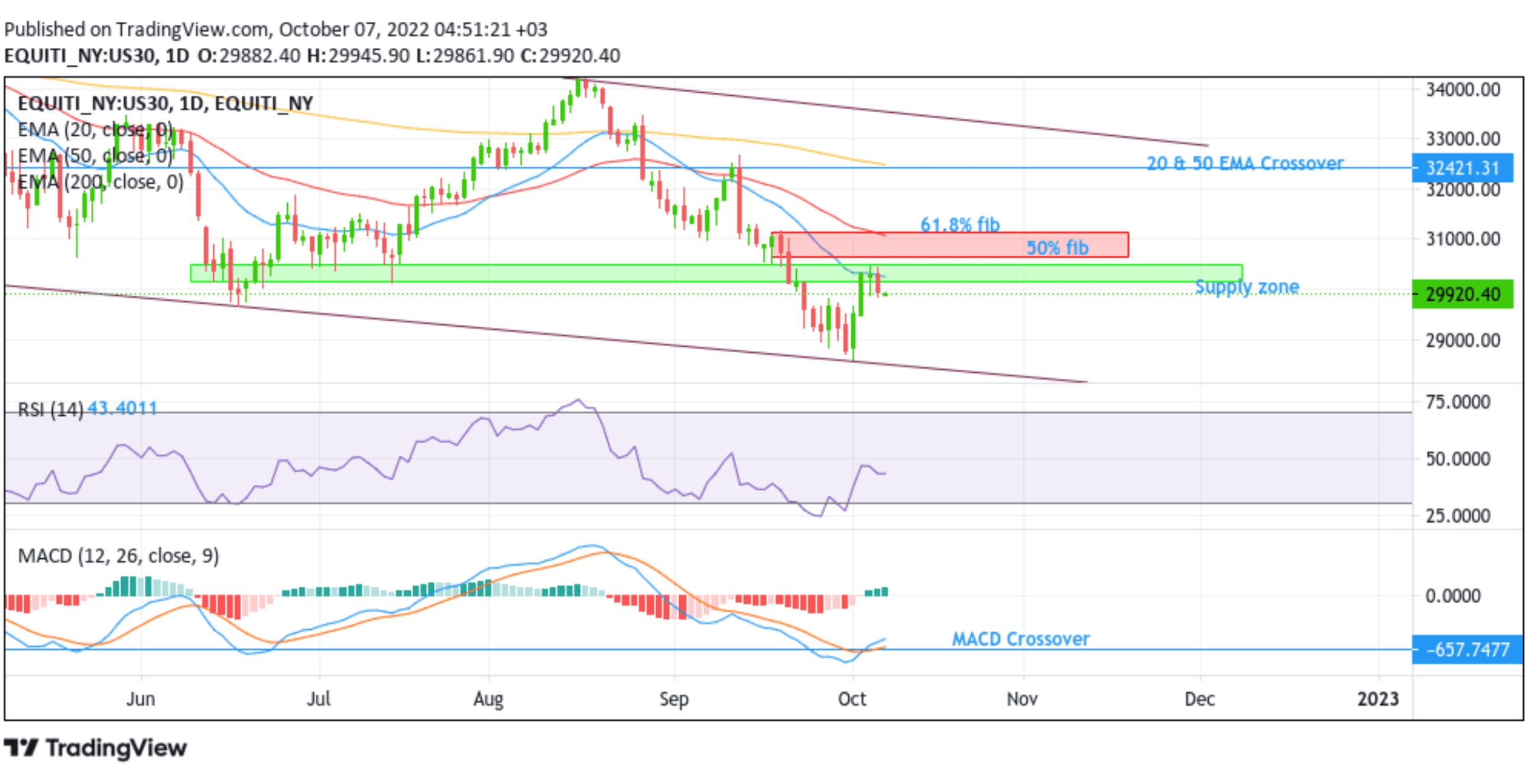

Technical Outlook: One-Day US30 Index Price Chart

From a technical standstill using a one-day price chart, the price looks to extend the modest rebound from the lower trendline of the descending channel pattern plotted as from the June 2022 swing low. However, the price made a minor correction after failing to break above the ceiling (key supply zone), ranging from 30148.76- 30502.50 levels. That said, the aforementioned zone would act as a barricade for the pair against any further uptick. However, a convincing break would pave the way for additional gains. The uptick, however, will face immediate resistance at the 50% and 61.78% Fibonacci retracements levels at 30643.51 - 31133.09 levels, respectively. Sustained strength above the Fib levels would negate any near-term bearish outlook and pave the way for aggressive technical buying.

The Technical indicators, despite recovering, are still holding out in the bearish territory, with the RSI(14) level at 43.4011 below the neutral level. At the same time, the MACD Crossover at 657.74 portrays a bullish filter but is still deep in the bearish territory.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial resistance appears at 29691.82 support level. Selling interest could gain momentum if the price pierces this floor, creating conditions for a drop toward the lower trendline of the descending channel pattern. Sustained weakness below this support level would expose the index to additional losses.