Currency Correlation in Forex Trading

There are many techniques that Forex traders can use to trade the market and improve their trading strategy. Because currencies are priced in pairs, no single pair trades completely independently of the others. This leads us to One of the most powerful yet often neglected techniques in forex trading: trading based on Forex correlation. This trading technique is important for traders who trade more than one currency pair or want to build a portfolio of trades. Forex correlation can significantly boost profitability and reduce market risk. While it can be useful for spotting opportunities, it can also increase your risk if you aren't careful. But by understanding how correlation works in forex trading, you can take a significant step towards lowering your overall risk and controlling your portfolio's exposure.

In this article, we'll cover everything you need to know about the correlation between Forex pairs, and we'll even explain the importance of Currency Pair correlation. Although Currency correlation may sound complicated and intimidating initially, it's easy to incorporate into your daily trading routine once you understand the concept properly.

What is Market Correlation

Market correlation measures how much assets move in line with each other. You can measure the correlation of specific markets, industries, or entire asset classes.

Correlation, in the financial world, is the statistical measure of the relationship between two securities. The correlation coefficient ranges between -1.0 and +1.0. A correlation of +1 implies that the two currency pairs will move in the same direction 100% of the time. A correlation of -1 implies the two currency pairs will move in the opposite direction 100% of the time. A zero correlation implies that the currency pairs' relationship is entirely random.

Types of Correlations

There are three types of correlation:

1. Positive Correlation In this case, if the price of one asset goes up, then the price of another asset also goes up

2. Negative Correlation In this case, if the price of one asset goes up, the price of another goes down.

3. No Correlation In this case, the two assets have no relationship and do not affect each other's movement.

Which Currency Pairs are Correlated?

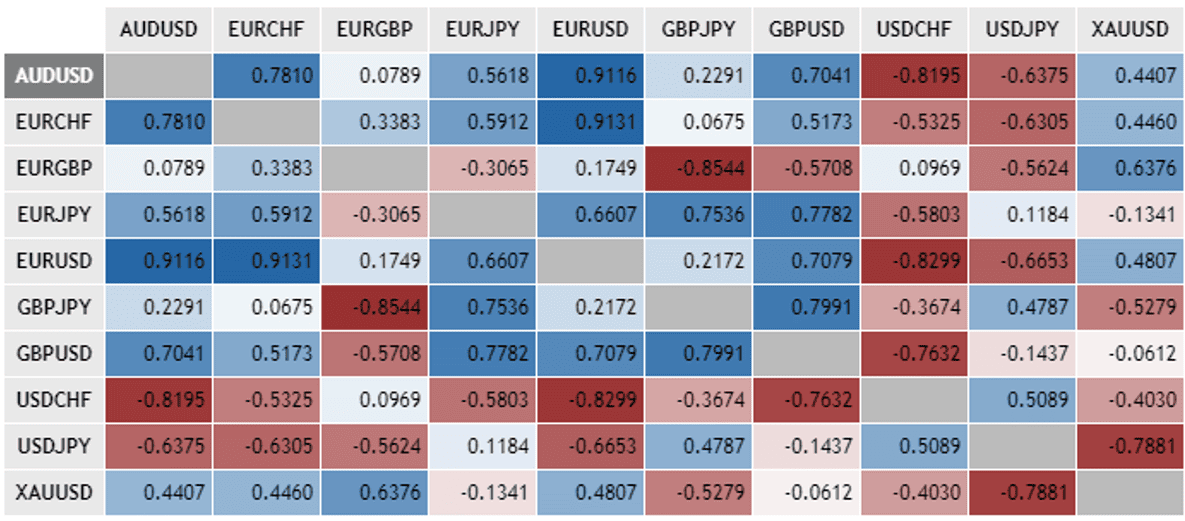

While the Forex correlation between currencies is vital to understand, Forex traders often use Forex correlation matrix tables to analyze the correlations between various currency pairs. Since currencies are always quoted in pairs, it makes perfect sense to follow the correlation coefficients among pairs to trade the market and take advantage of their correlation.

The most highly correlated currency pairs are usually those with close economic ties. For example, EUR/USD and GBP/USD are often positively correlated because of the close relationship between the euro and the British pound – including their geographic proximity and status as two of the world's most widely-held reserve currencies.

The table shows the correlation coefficients calculated from November 2012 to September 2018.

As you can see, pairs that include the same currency as the base or counter currency tend to have stronger correlations, which is no wonder, given that the same fundamentals impact those pairs. EUR/USD and EUR/CHF have a robust positive correlation of 0.91, while GBP/JPY and EUR/GBP exhibit a strong negative correlation of -0.85 (because the British pound is the base currency in one pair, and the counter currency in the second pair), making these pairs one of the best Forex correlation pairs. EUR/USD and AUD/USD also show a strong positive correlation of 0.91. It is worth noting correlation measures the interdependence between two variables, with the strength of the correlation expressed in the form of a correlation coefficient (-1 = variables move in opposite directions(negative correlation), +1 = variables move in the same direction(negative correlation), 0 = no significant relationship exists between the two variables(no correlation)).

Why are Correlations significant?

Currency correlations are essential; using them will make your trading more successful. Here is why below:

1. Eliminate Counterproductive Trading

Utilizing correlations can help you stay out of positions that cancel each other out. For instance, we know EUR/USD and USD/CHF have a negative correlation; opening a position long EUR/USD AND long USD/CHF is pointless and sometimes expensive. In addition to paying for the spread twice, any movement in the price would take one pair up and the other down.

2. Leverage Profits

Leverage profits….or losses! You have the opportunity to double up on positions to maximize profits. Again, let's take a look at the 1-week EUR/USD and GBP/USD relationship from the example in the previous lesson.

Opening a long position for each pair is like taking EUR/USD and doubling your position.

You'd be making use of leverage! Big profit if all goes right and Big losses if things go wrong!

3. Diversify Risk

Rather than trading a single currency pair all the time, you can spread your risk across two pairs that move the same way.

Pick pairs that have a strong to robust correlation (around 0.7). For example, EUR/USD and GBP/USD move together.

The imperfect correlation between these two currency pairs allows you to diversify, which helps reduce your risk. Let's say you're bullish on the USD.

Instead of opening two short positions of EUR/USD, you could short EUR/USD and short GBP/USD, which would shield you from some risk and diversify your overall position.

4. Hedge Risk

Although hedging can result in smaller profits, it can also help minimize losses.

Cac If you open a long EUR/USD position and it starts to go against you, open a small long position in a pair that moves opposite EUR/USD, such as USD/CHF, and major losses are averted!

Currency Correlation Trading Tips

❖ It is essential to know There are times when the regular correlation observed between markets can break down. A perfect example is a correlation between the US dollar and Gold. It has been established that during periods of economic downturn, investors and traders will seek a safer investment in Gold and sell the US dollar.

❖ When placing a trade, consider whether the markets are currently correlated, whether one market leads another, and whether the price is diverging. For example, if one market is making lower lows or higher highs and the other is ranging, it may be worth waiting for a period of sustained correlation.

❖ Traders will typically take positions on correlated pairs to diversify while maintaining the same overall direction – either up or down. This could be to protect themselves from the risk of a single pair moving against them, as they will still have the opportunity to profit from the other pair if that happens. It should be stated that perfectly correlated currency pairs are very rare, and there is always a degree of uncertainty when trading the financial markets.

❖ The value of some currencies is not only correlated to the value of other currencies but also the price of commodities. This is particularly true if a country is a net commodity exporter, such as crude oil or Gold. Typically, an increase in the price of a commodity will increase the value of the particular currency on the forex market. For instance (Crude oil and Canadian dollar) and (Australian dollar and Gold).

The Bottom Line

To be an effective trader and understand your exposure, it is essential to understand how different currency pairs move in relation to each other. Some currency pairs move in tandem, while others may be opposites. Learning about currency correlation helps traders manage their portfolios more appropriately. Regardless of your trading strategy and whether you are looking to diversify your positions or find alternate pairs to leverage your view, it is essential to keep in mind the correlation between various currency pairs and their shifting trends

Put your knowledge into practice-sign up for a demo account to validate your trading strategies in a risk-free environment.