To Rent vs To Buy?

Key Takeaways:

- The decision to rent or buy has long been a topic of debate in the real estate market as individuals and families embark on their journey into homeownership

- The dynamics of the decision to rent or buy have become increasingly complex in recent times due to the influence of global financial factors on the real estate market

- The decision to rent or buy ultimately depends on an individual's specific circumstances and goals, whether they are focused on the short-term or long-term

The decision to rent or buy has long been a topic of debate in the real estate market as individuals and families embark on their journey into homeownership. However, the dynamics of this decision have become increasingly complex in recent times due to the influence of global financial factors on the real estate market. With economic uncertainties, exchange rate fluctuations, and geopolitical events constantly shaping the global financial landscape, potential buyers and renters must understand how these parameters impact their choices. In this article, we delve into the intricacies of the rent or buy decision, providing insights into the global financial factors affecting the real estate market and guiding aspiring homeowners towards making informed choices that align with their financial goals and aspirations.

What factors should be considered?

When deciding to buy or rent a home, several crucial factors should be carefully considered. Some of these factors include:

- Financial Stability: Evaluate your current financial situation and consider factors such as stable income, savings, and credit score. It's essential to determine whether you can afford the down payment for buying a property or the monthly rental payments.

- Long-term Goals: Consider your plans. If you envision staying in one place for a long time, buying a property might be a better option as it provides stability and can be considered an investment. However, if you prioritize flexibility and want to avoid being tied down to a specific location, renting might be a more suitable choice.

- Maintenance Responsibilities: Purchasing a property means taking on the responsibility of maintenance, repairs, and associated costs. It would help if you were prepared to handle repairs and maintenance tasks or allocate a budget for hiring professionals. On the other hand, renting often transfers these responsibilities to the landlord.

- Real Estate Market: Research the real estate market in the area you are interested in. Are house prices appreciating? Is it a buyer's or a seller's market? Understanding the market trends can help you decide based on the potential return on investment and the overall stability of the property market.

- Fed Interest Rate: The Federal Reserve's decision to raise or lower interest rates can have a ripple effect on the mortgage rates offered by banks, ultimately influencing the affordability of buying a home. A higher interest rate increases the cost of borrowing, resulting in higher monthly mortgage payments, thereby making renting a more appealing option. Conversely, a lower interest rate can substantially decrease mortgage payments, making homeownership more financially viable. Therefore, potential buyers should closely monitor the fluctuations in federal interest rates and consider them as a critical element when weighing the decision of whether to buy or rent.

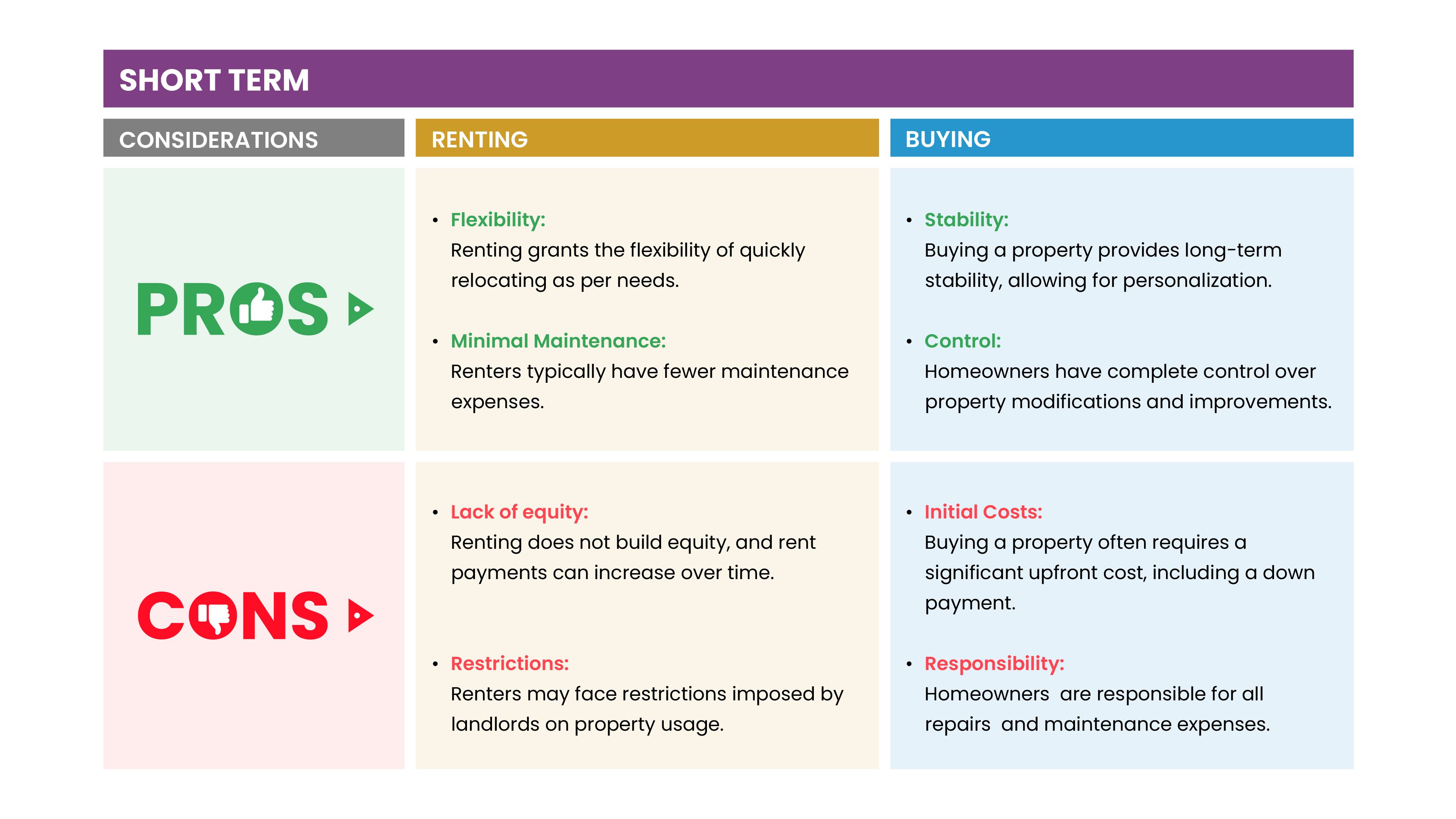

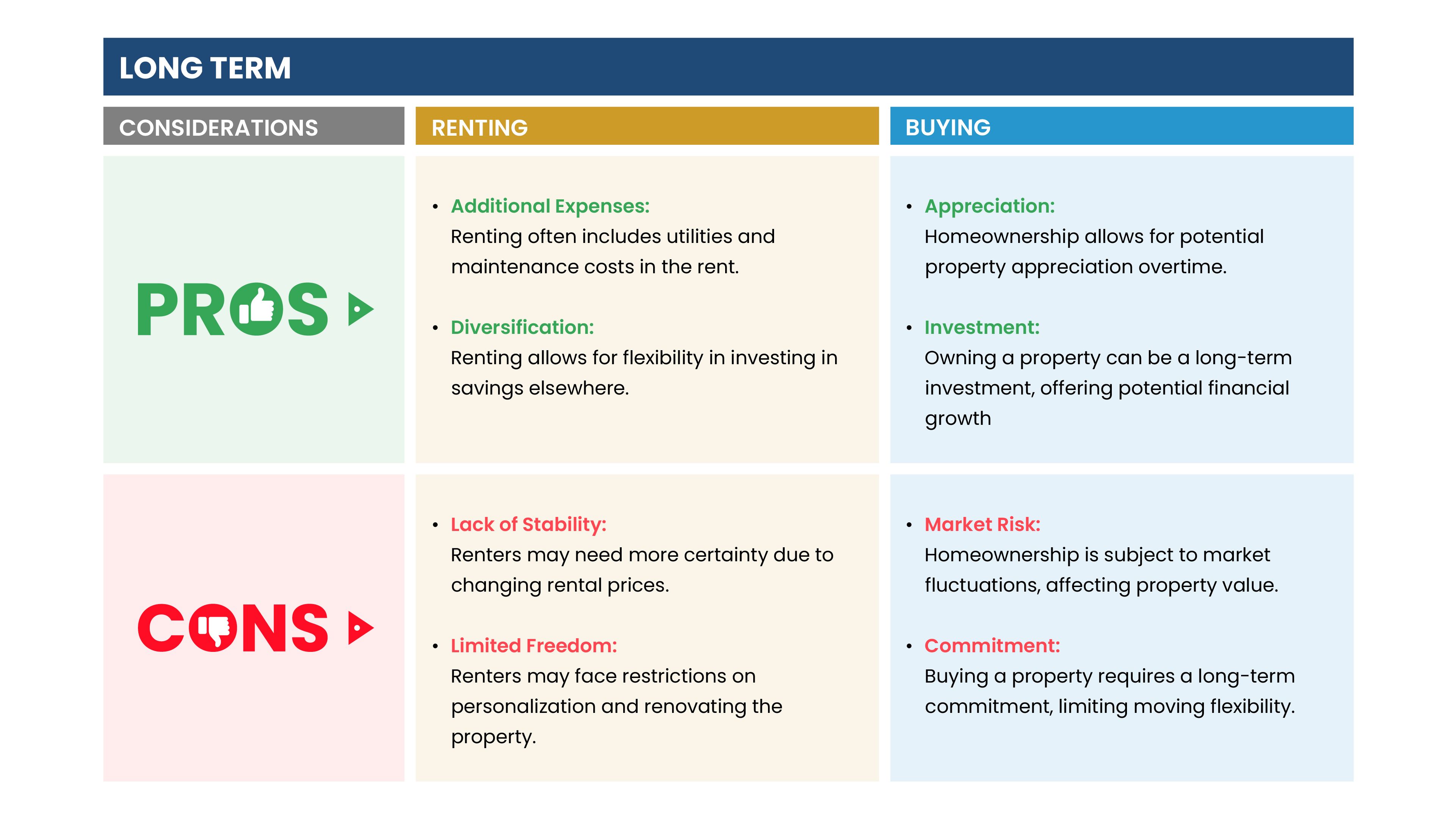

Renting VS Buying Comparison

When it comes to deciding whether to rent or buy a property, several factors need to be taken into consideration. The decision ultimately depends on an individual's specific circumstances and goals, whether focused on the short-term or long-term. To provide a clear comparison, let's explore the pros and cons of both options in a table format.

In conclusion, the debate between renting and buying a home is a complex decision that requires careful consideration of various factors. Renting provides flexibility and fewer financial responsibilities, making it a suitable choice for those who value mobility or have uncertain long-term plans. On the other hand, buying a property offers stability, potential appreciation, and the opportunity to build equity. Homeownership also provides the freedom to personalize and make renovations, allowing individuals to establish a sense of belonging truly. Ultimately, the decision between renting and buying should be based on individual circumstances, financial readiness, personal preferences, and long-term goals. It is crucial to weigh the pros and cons of each option to ensure a wise investment and a fulfilling living experience.

Are you looking to start trading in the Forex Market? You can Enjoy FREE USD 10,000 Virtual Funds for trading by Signing Up on Pocket Trader. With Pocket Trader, You can invest in multiple markets, including currencies, indices, and commodities, learn from experienced traders and share ideas with pocket trader's social features to build wealth together.