AUD/USD Eyes To Find Acceptance Above Crucial Resistance Level As Markets Focus Shift Toward Key U.S. Inflation Data

Key Takeaways:

- The AUD rose to around 0.66180 per dollar on Tuesday during the Asian session, inching closer to a crucial resistance level/0.66275 level

- Mixed Aussie macro data released earlier today lends support to the antipodean and helps cap the downside for the AUD/USD pair

- A generally weaker U.S. dollar weighed by FED rate cut hopes acts as a tailwind for the AUD/USD cross

- Markets' focus shifts toward the release of key U.S. inflation data report for February

The Australian dollar rose to around 0.66180 per dollar on Tuesday during the Asian session, moving away from a one-week low of 0.65958 touched on Monday and inching closer to a crucial resistance level of 0.66275 as fresh mixed Australian data lent support to the Antipodean.

A National Australia Bank (NAB) survey report released earlier today revealed that business conditions were back above their long-run average, lifted by trading conditions and profitability in February. Notably, business conditions rose 3 points to +10 index points to be back marginally above the long-run average. Trading conditions and profitability both climbed 4 points.

The survey went on further to signal that the economy remained resilient in the new year; however, confidence and forward orders both eased to remain mired at low levels, and capacity utilization also eased. Business confidence fell 1 point to 0 index points, remaining below average. Forward orders fell 1 point to -3 index points, with retail remaining profoundly negative (-29 index points). Capex rose 4 points to +7 index points, while capacity utilization eased slightly to 83.4%.

Further lending support to the Antipodean were gains around gold, which currently sits almost at an all-time high, supported by rate cut hopes fuelled by the dovish Fed chair, Powell's remarks, and the mixed U.S. jobs data report released on Friday.

Moreover, the antipodean drew support from the hawkish comments of Reserve Bank of Australia (RBA), Assistant Governor (Economics) Sarah Hunter, who, while addressing a panel at the AFR Business Summit, said fourth-quarter GDP was in line with forecasts and that the recent inflation data was also consistent with forecasts but remained the biggest drag on household consumption.

That said, investors' decision to consolidate their positions before releasing the key U.S. inflation data report later today during the early North American session is another factor weighing the greenback and helping cap the downside for the AUD/USD pair. According to a consensus report, inflation is expected to have risen slightly in February to 0.4% from 0.3% in January. Excluding food and energy, inflation is expected to have dropped slightly in February to 0.3% from 0.4% in January.

This, combined with the generally positive tone around the U.S. equity markets, further weighs on the buck and helps exert upward pressure on the AUD/USD cross.

Investors look forward to the U.S. docket, which will feature the key U.S. inflation data reports as we advance. Any surprises would cause volatility in the AUD/USD cross.

Sarah Hunter, Assistant Governor (Economics) at the Reserve Bank of Australia (RBA), addressed a panel at the AFR Business Summit on Tuesday, discussing fourth-quarter GDP in line with forecasts. Hunter mentioned that recent inflation data also matched expectations, with inflation remaining the primary hindrance to household consumption.

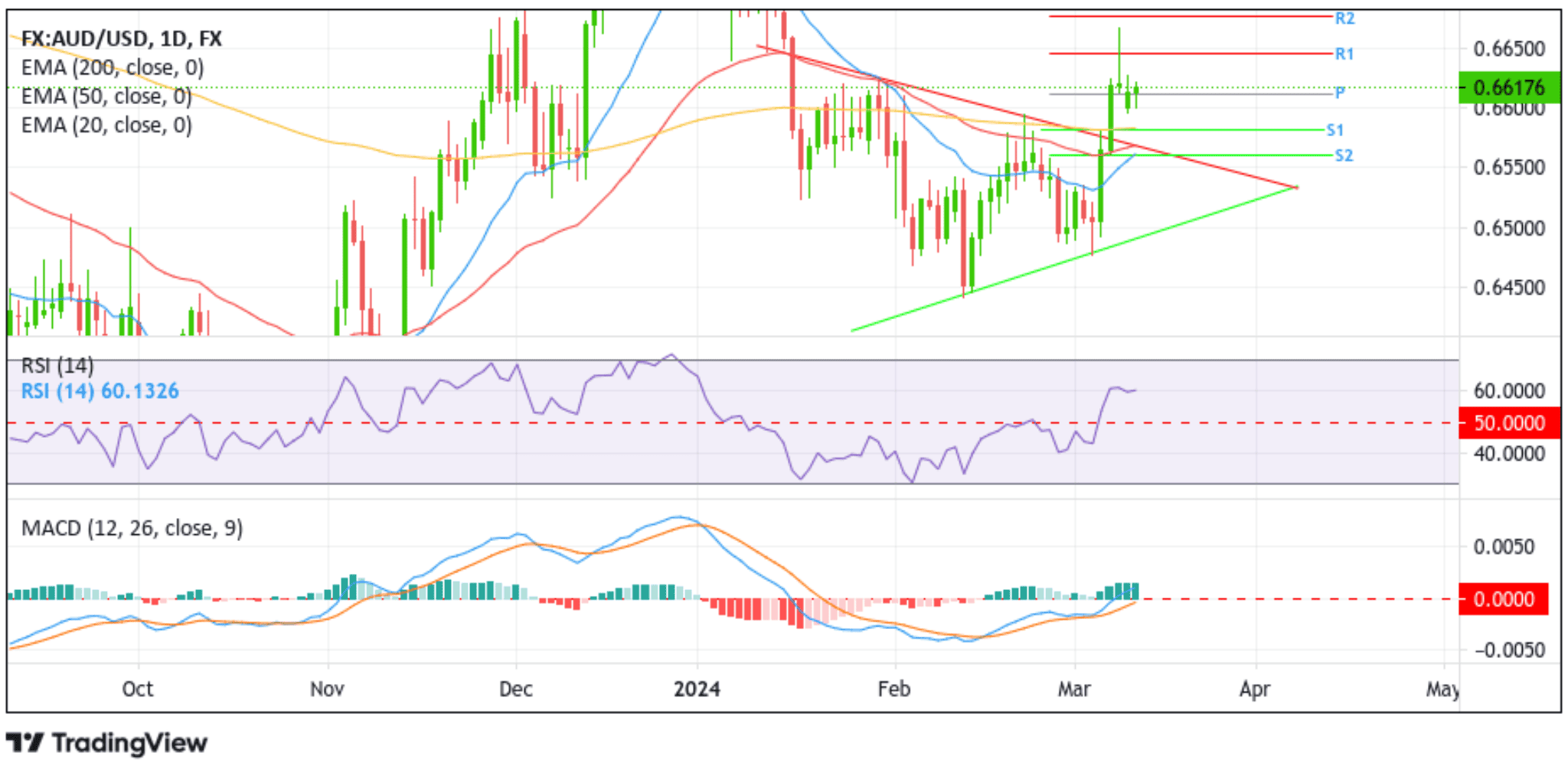

Technical Outlook: One-Day AUD/USD Price Chart

Looking at AUD/USD's one-day price chart, AUD/USD is bullish, with bulls looking to force a further reversal toward 0.66200 levels. The bullish outlook is supported by the price's ability to break above the upper limit of the Bearish Pennant Chart Pattern extending from the late-January 2024 swing lower low and the subsequent acceptance above the technically strong 200-day (yellow) EMA level at 0.65820, followed by the move above the neckline of the inverted head and shoulder at the 0.65943 level of the shared currency's highest swing since February 22nd.

Furthermore, the bullish bias is supported by the 20-day (blue) and 50-day (red) EMA, which all point upwards. The technical oscillators on the chart are all in positive territory, suggesting the continuation of the bullish price action this week.

That said, above the current price lies a crucial resistance level (0.66251), which the price needs to pierce if the bullish trajectory is to be extended further upwards. Sustained strength above this level will pave the way for an ascent toward the 0.66762 (R2), which, if cleared decisively, will pave the way for a rise toward the 0.67000 round mark.

On the flip side, the 0.65943 level now protects the downside for the AUD/USD pair. A one-day candlestick close below this level could see the shared currency drop to tag the important 200-day (yellow) EMA level at 0.65820. A convincing move below this level will negate the bullish outlook and pave the way for aggressive technical selling around the shared currency. AUSD/USD could then accelerate the drop toward the key resistance level, which has now turned to the support level (upper limit of the Bearish Pennant Chart Pattern extending from the late-January 2024 swing lower low). A clean break below this level would affirm the bearish bias and pave the way for new sellers to jump in, paving the way for further losses around the shared currency.