Trading Indicator Basic: Momentum Trading

Momentum trading is a strategy where investors buy assets with recent solid performance, expecting the trend to continue. The goal is to profit from short-term price movements rather than attempting to forecast future earnings or intrinsic value.

As the value of an asset increases, it tends to draw more interest from traders and investors, leading to a further rise in market price. This cycle persists until many sellers enter the market, for instance, due to an unexpected event causing them to reassess the asset's value. At this point, the momentum shifts, causing the asset's price to drop.

Momentum traders aim to ride the trend of rising or falling securities prices by buying high and selling higher or shorting low and covering at a lower price. Momentum trading can be applied to asset classes, including stocks, bonds, commodities, and currencies.

Types of Momentum Trading

There are three types of momentum trading:

Cross-sectional momentum

This is a trading strategy that involves buying currencies that have appreciated relative to other currencies over a certain period and selling currencies that have depreciated relative to other currencies over the same period. The basic idea is to identify the strongest and weakest currencies in a given basket and to go long or short accordingly.

Time-series momentum

This is a trading strategy that involves buying assets that have performed well in the recent past and selling assets that have performed poorly. In the context of forex trading, time-series momentum involves buying currencies that have appreciated in value over a certain period of time and selling currencies that have depreciated in value over the same period.

Relative strength momentum

This strategy is based on the idea that you can identify the relative strength of one currency against another by comparing their performance over a period of time. The basic idea is to identify two currencies and compare their performance over a certain period of time. You can then buy the currency that has performed better and sell the currency that has performed worse.

Ways to Use Momentum Trading

Traders can use momentum trading in two primary ways: Momentum Stocks and Trend Following.

Momentum Assets

Forex traders will focus on momentum financial assets since they tend to be extremely volatile. For example, here's a solid argument to be made that Nasdaq 100, US30 and S&P 500 have been a momentum financial asset for years since they always tend to move in wild swings or in a certain direction lets say uptrend after the opening of a the New York Stock exchange/ release of important economic news datas. Hence traders can take advantage of the price swings and enter trade in favour of the trend.

Trend Following

In this case, traders examine a stock or asset and quickly make a trade in its direction. If, for instance, the GBP/USD currency pair is increasing, the trader can profit from the price movement by purchasing the pair. On the other hand, if Microsoft’s stock price declines, the trader can bet against it by short selling, profiting as the price drops.

Three Common Momentum Indicators

Momentum Indicator

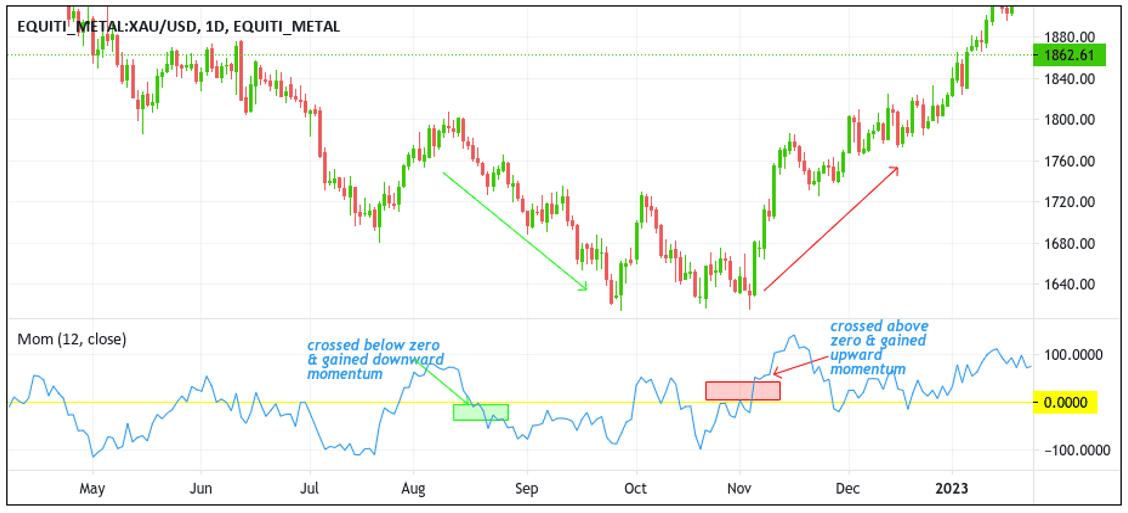

The momentum indicator is the most popular momentum indicator and it is represented as a line that moves above and below the chart and measures the rate of change or velocity of a financial asset. By examining this momentum, one can determine if the trend will persist or change abruptly. The indicator can also reveal divergences and confirmations.

As demonstrated in the Gold chart above, when the momentum is above zero, the price trend continues to increase. In contrast, when the momentum is below zero, the price trend continues to decrease a phenomenon referred to as the zero-line rule. In many instances, when the price falls below the zero line, it signals a sell signal.

The zero line is a crucial aspect of momentum trading, where it is believed that you should purchase when the momentum crosses above it and sell when it falls below it.

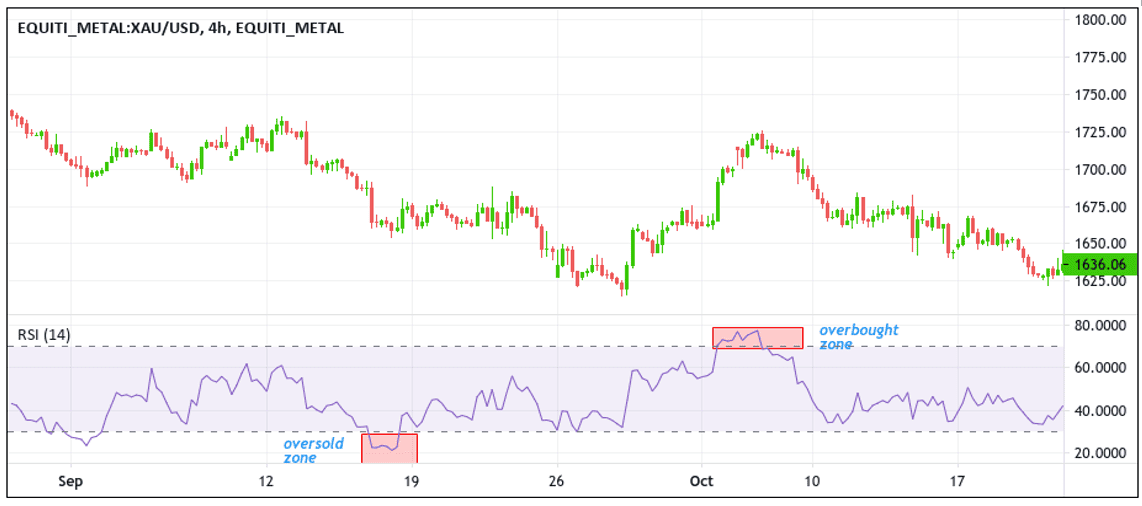

Relative Strength Indicator

The Relative Strength Index (RSI) is a type of momentum indicator that gives signals for buying and selling a financial asset. It is shown on a separate chart, similar to the momentum indicator, and ranges from 0 to 100. It is comparable to other indicators that are restricted to a certain range, as it gives signals for being overbought or oversold based on its readings. A value above 70 indicates overbought, while a value below 30 indicates oversold.

Moving Average Convergence Indicator(MACD)

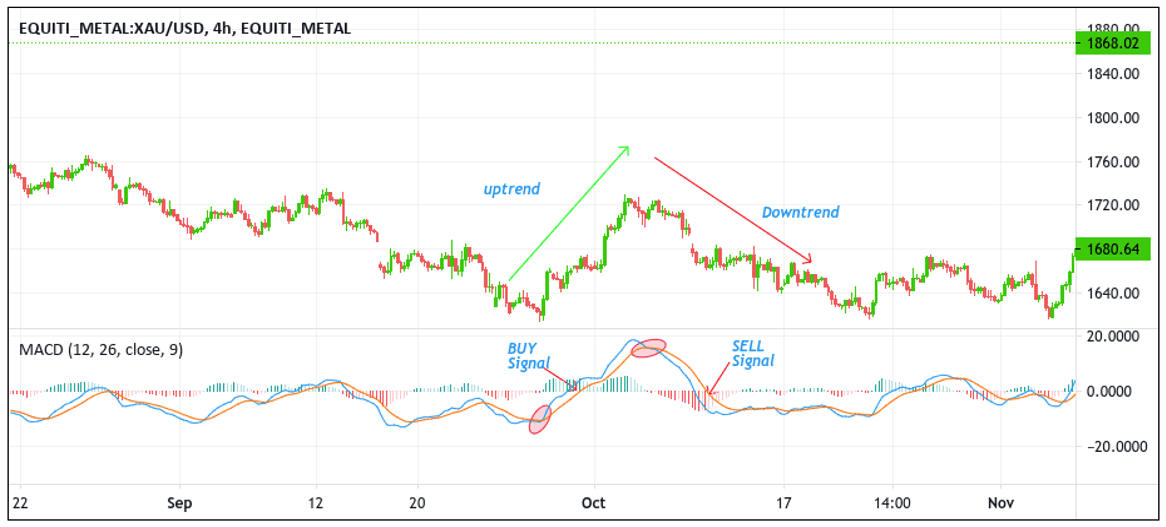

The Moving Average Convergence Divergence (MACD) is another popular indicator used in momentum trading. It is easy to understand and involves converting two moving averages into oscillators. The typical fast-moving average period is set at 12, the long-moving average is 26, and the smoothing average is 9.

In momentum trading, the MACD determines when there is a crossover between the two moving averages. For instance, when the price of an asset is in a bullish trend, and the moving averages cross over and move below the signal line, it often indicates that the momentum is fading and it's time to sell.

When the two lines cross over and move above the signal line in a bearish trend, it is an excellent time to buy. An example of this can be seen below in the Gold chart.

Principles to Consider for Momentum Trading

There are several principles to consider when trading with a momentum strategy:

💡 Trend Identification Trend identification: Identify the trend in the market by looking at price, volume, and other indicators. This can help you determine whether the market is in an uptrend, downtrend, or sideways trend.

💡 Entry Points Entry points: Look for entry points in the direction of the trend, as momentum traders typically buy rising securities and sell securities that are falling.

💡 Position Sizing Position sizing: Consider the size of your position relative to your total trading capital and the volatility of the security you are trading.

💡 Risk Management Risk management: Implement effective techniques to limit your downside potential, such as using stop-loss orders or setting a maximum acceptable loss.

Momentum trading may not be suitable for everyone; however, it can result in substantial gains if executed correctly. This strategy requires a high degree of discipline, as trades must be quickly terminated when signs of weakness appear. The capital should be promptly invested into another trade showing strength.

Are you looking to add the trade trending strategy as part of a range of forex trading strategies you can stick to? You can Enjoy FREE USD 10,000 Virtual Funds for trading by Signing Up on the Pocket Trader website. With Pocket Trader, You can invest in multiple markets, including forex, indices, and commodities, learn from experienced traders and share ideas through pocket-trader's social features to build wealth together.