Weekly Market Flash

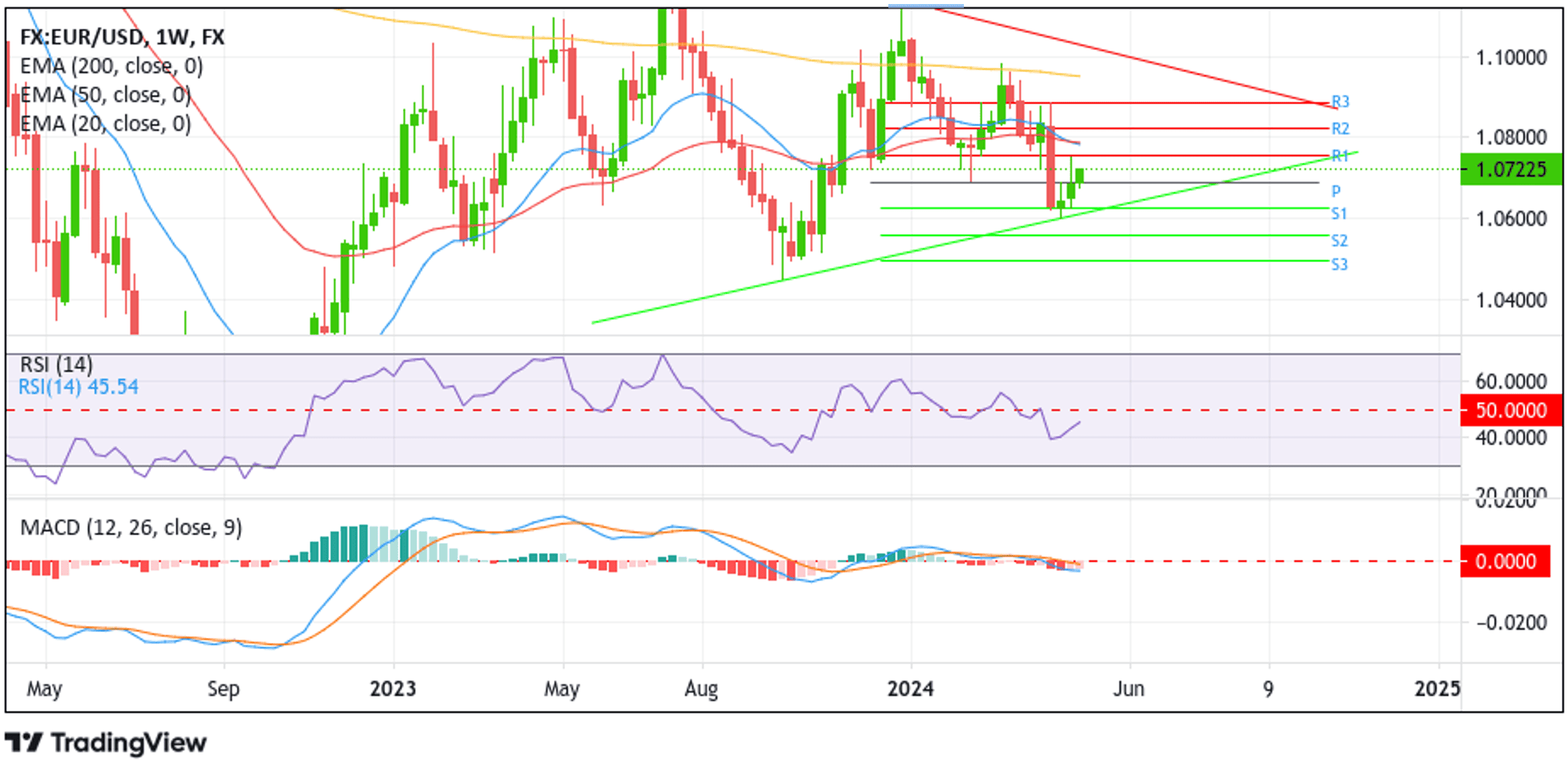

EUR/USD

EUR/USD cross last week started off the week on the back foot but managed to rise steadily throughout the week, supported by a weaker U.S. dollar, weighed by easing tension in the Middle East, and a combination of mixed U.S. macrodata to close the week with modest gains above the 1.06900 mark and register a second weekly gain. This week, the major currency pair has started the week on a high note compared to last week, trading firmly above the 1.07100 mark during the early Asian and seems poised for further gains in the coming sessions and days. However, further upticks now hing on incoming key euro and U.S. macrodata set for release this week. The first part of the week will be guided by euro area flash inflation data for April and Q1 GDP numbers. The second part of the week is what will mainly drive price action this week and will be guided by the Fed’s interest rate decision and U.S. nonfarm payroll numbers for April.

Based on EUR/USD’s weekly chart, here are the key levels to watch out for this week:

Resistance (R3): 1.0888 | Pivot Point (P.P.): 1.0690 | Support (S3): 1.0495 |

Resistance (R2): 1.0821 | Support (S2): 1.0559 | |

Resistance (R1): 1.0757 | Support (S1): 1.0626 |

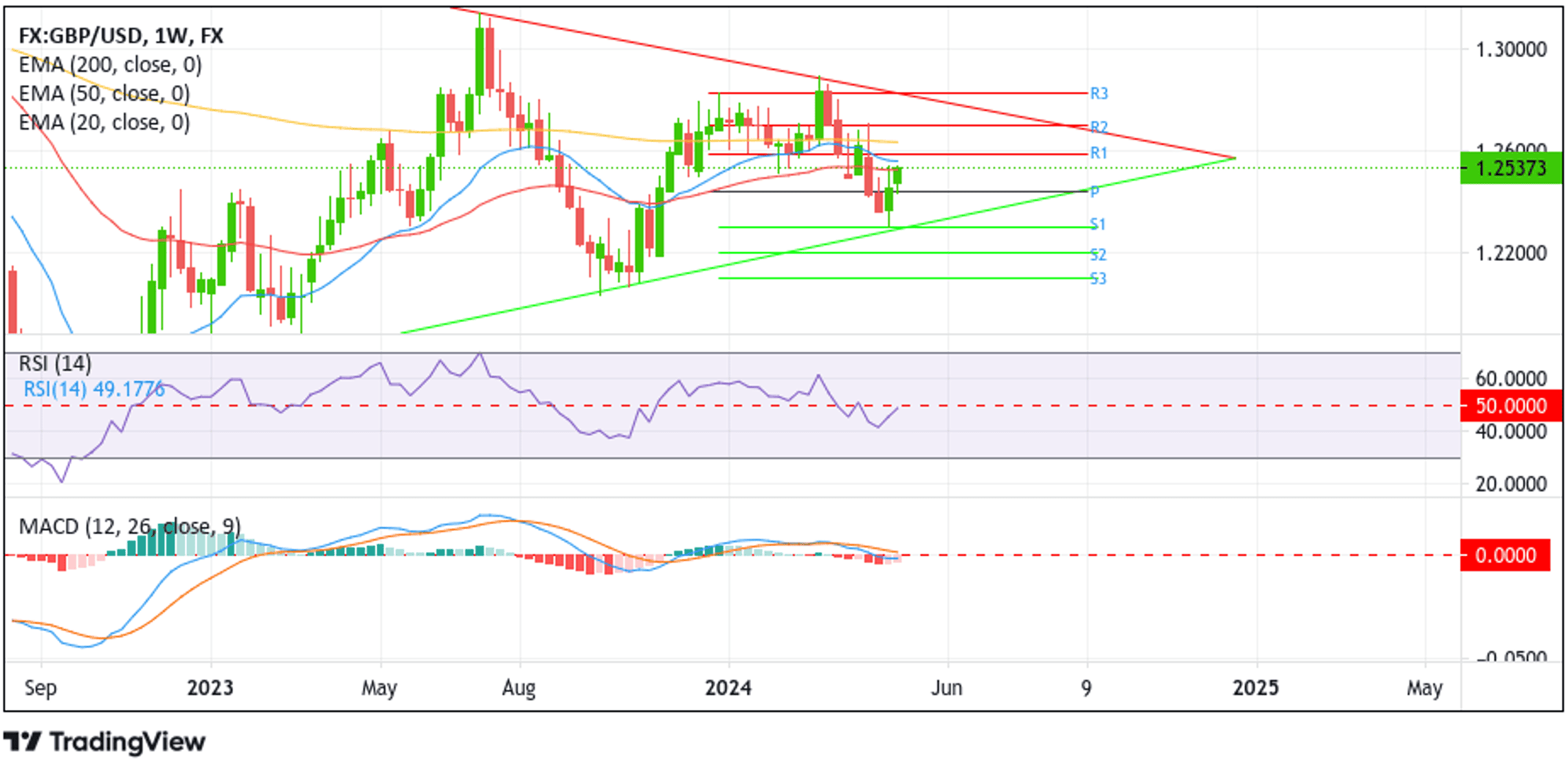

GBP/USD

GBP/USD cross last week managed to close with heavy gains just below the 1.25000 mark and post a 1.01% weekly gain after rebounding sharply from the vicinity of the 1.22994 early last week. The bullish momentum was supported by a weaker U.S. dollar, weighed by easing tension in the Middle East, and a combination of mixed U.S. macrodata. GBP/USD further builds on last week's sharp bounce on Monday and is placed firmly above the 1.25100 level during the early-Asian session after attracting some buying in the last hour or so, supported by the prevalent selling around the safe-haven buck. Looking ahead, major moves around the GBP/USD will be dictated by the upcoming UK Composite and Services PMI data releases. Additionally, the Fed’s Interest Rate Decision and U.S. Nonfarm Payrolls numbers for April set for release during the second half of the week will help provide directional impetus for the GBP/USD pair this week.

Based on GBP/USD’s weekly chart, here are the key levels to watch out for this week:

Resistance (R3): 1.28320 | Pivot Point (P.P.): 1.2443 | Support (S3): 1.21000 |

Resistance (R2): 1.26999 | Support (S2): 1.21990 | |

Resistance (R1): 1.25880 | Support (S1): 1.23052 |

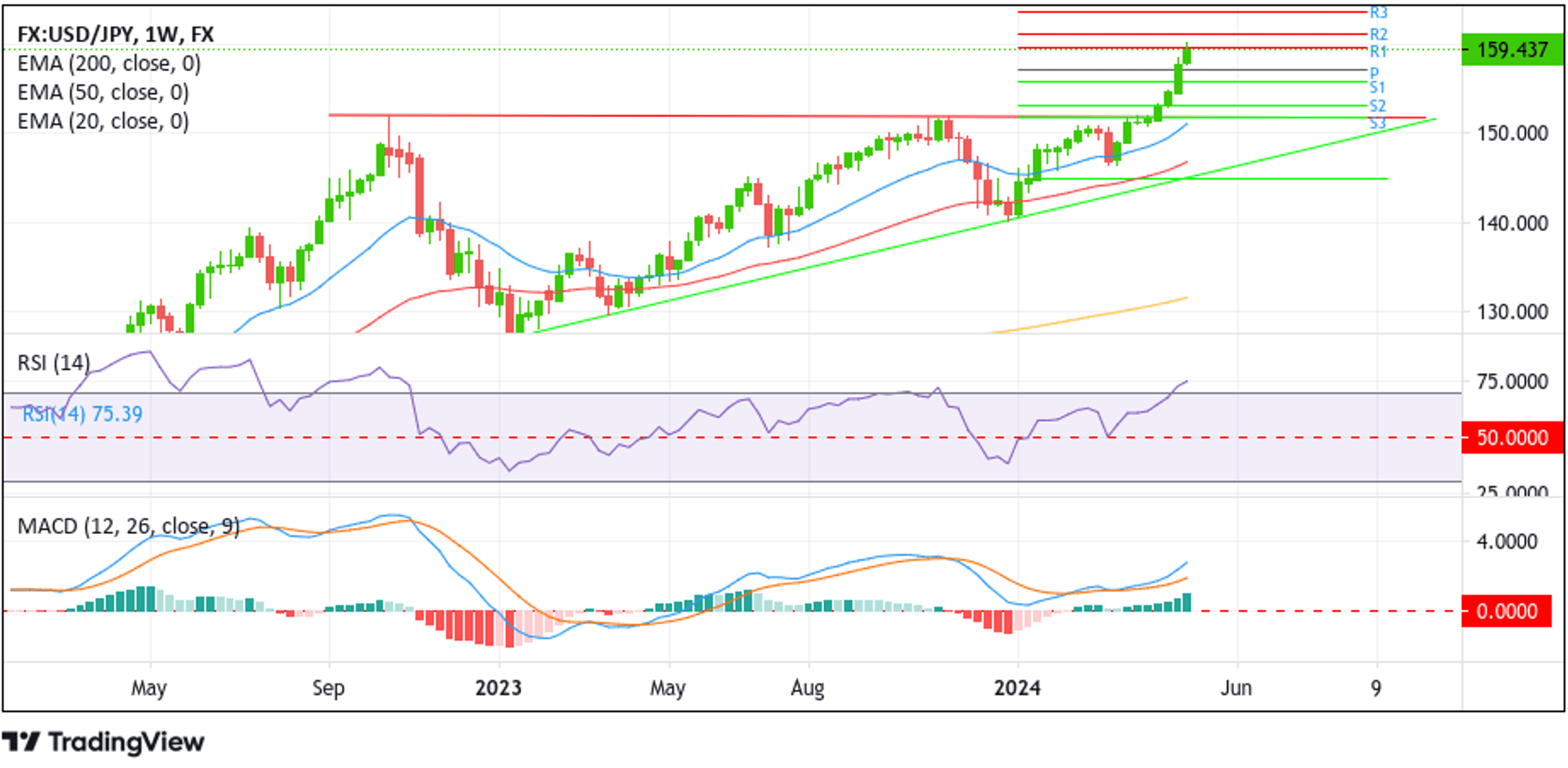

USD/JPY

The Japanese yen last week weakened by around 2.48% against the buck and hit a new record low of around $158.000’s following the Bank of Japan's interest rate decision announcement on Friday. Things seem to have taken a turn for the worst as the Yen hit another new record low against the greenback on Monday during the Asian session after it moved past the $160.000 psychological mark in a holiday truncated season as Japanese markets are closed today for the Showa Day holiday celebration. Going forward, the market focus this week remains on the release of the Fed’s interest rate decision and U.S. nonfarm payroll numbers for April. The two key releases would ignite market volatility and shape investor sentiment in the coming weeks, and furthermore impact the U.S. dollar's strength, which in turn would provide directional impetus for the major currency pair.

Based on USD/JPY’s weekly chart, here are the key levels to watch out for this week:

Resistance (R3): 163.680 | Pivot Point (P.P.): 157.08 | Support (S3): 151.840 |

Resistance (R2): 161.060 | Support (S2): 153.100 | |

Resistance (R1): 159.700 | Support (S1): 155.710 |

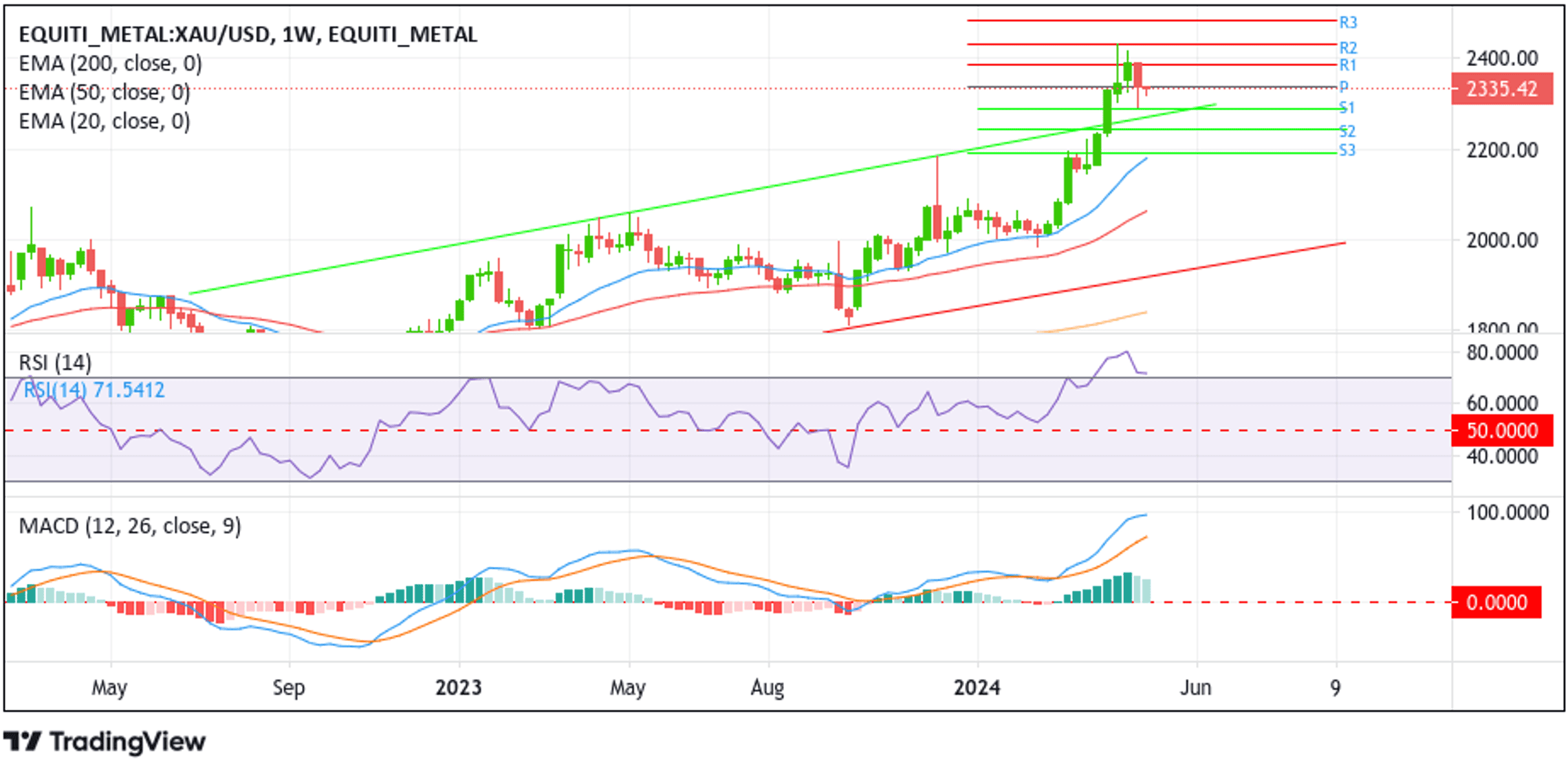

XAU/USD (Gold)

Gold (XAU/USD) price last week retreated further from its all-time high/$2431.31 an ounce and dropped to $2292.02 an ounce before paring losses and closed below $2340.00 levels. The precious yellow metal last week was pressured by firm, hawkish Fed expectations bolstered by robust U.S. data and hawkish Fed comments. In fact, markets now feel convinced that the Fed will delay cutting rates and prolong its hawkish stance through 2024, which remains supportive of rising U.S. Treasury bond yields and weighs heavily on the non-yielding bullion. Going forward, gold price action this week will be driven by two key U.S. macro releases set for release later this week. Fed’s interest rate decision will headline markets on Wednesday as the U.S. nonfarm payroll data report for April taking center stage on Friday.

Based on XAU/USD’s weekly chart, here are the key levels to watch out for this week:

Resistance (R3): 2484.49 | Pivot Point (P.P.): 2339.28 | Support (S3): 2192.52 |

Resistance (R2): 2430.67 | Support (S2): 2241.96 | |

Resistance (R1): 2387.16 | Support (S1): 2289.84 |

U.S Stock Futures

The Nasdaq Composite (US100) last week rallied around 4.2%, posting one of its best weekly performances in five months, while the S&P 500 jumped 2.7%, notching its best week since November and breaking a three-week negative streak as the Dow Jones Industrial Average capped a great week for U.S. equity investors with a 0.54 weekly gain. The rally behind U.S. equity markets is attributed to the weaker U.S. dollar, weighed by easing tension in the Middle East and a combination of mixed U.S. macrodata. Looking ahead, the Fed is set to release its latest interest rate announcement on Wednesday, and it is widely expected that the U.S. central bank will leave rates unchanged during the May meeting. On the economic data front, the U.S. Bureau of Labor Statistics is set to release April’s payroll figures, in which it is expected that the U.S. economy created 243K jobs in April compared to 303K jobs created in March. The earnings season also continues this week, with releases from major names including McDonald’s, Coca-Cola, Apple, and Amazon.

Looking to grow your wealth through social trading? Look no further than Pocket Trader! With Pocket Trader, you can connect with other traders, learn from experienced investors, and share your own insights with the community! Trade wiser now 🔥