Indices is now on Pocket Trader!

A stock market index is created to closely track the performance of any particular market aspect, whether it's the 500 largest U.S. companies or the rate of inflation. They are tools that economists, investors, and others can use to monitor market performance differently.

What is an Index

An index is an indicator or measure of something. Indexes typically measure the price performance of a basket of securities using a standardized metric and methodology intended to replicate a specific market area. In finance, it typically refers to a statistical measure of change in securities markets. In the case of financial markets, stocks and bond market indexes consist of a hypothetical portfolio of securities representing a particular market or a segment of it. These could be constructed as a broad-based index that captures the entire market or as more specialized such as indexes that track a particular industry or segment.

Examples of Indexes

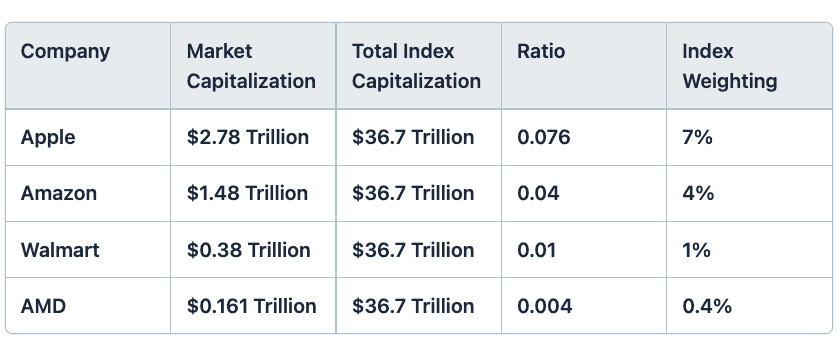

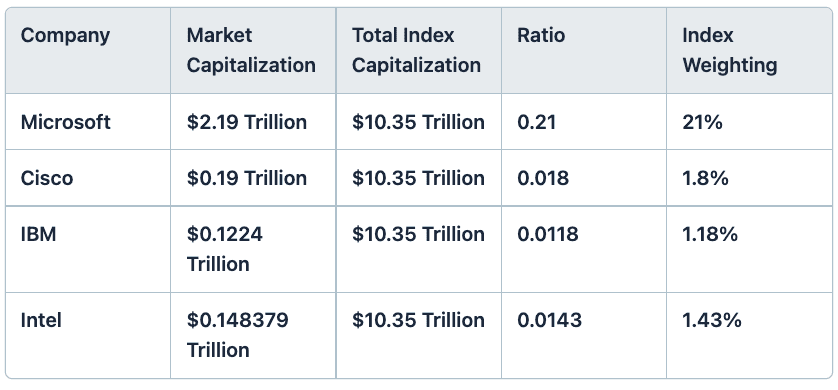

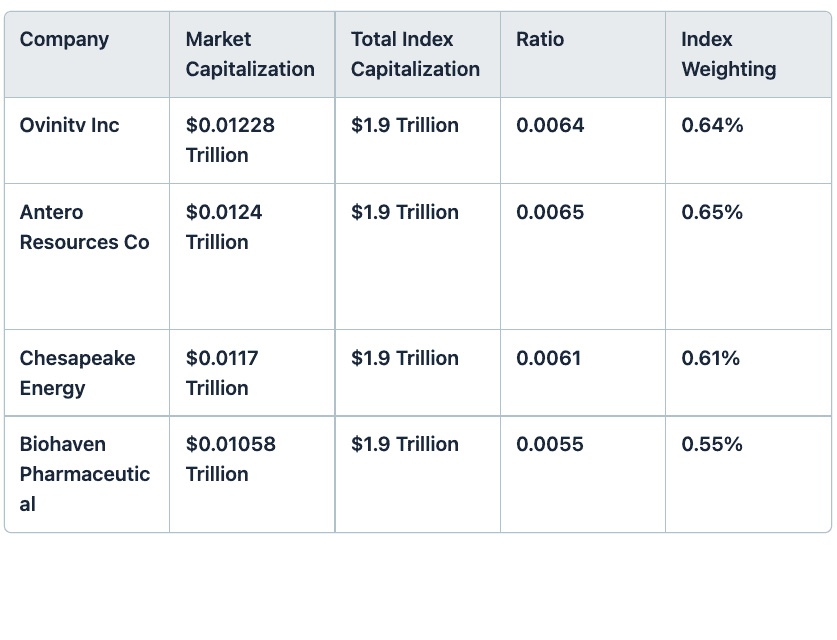

Indexes can be classified as broad-based indexes(S&P 500 and US30) and those that only track a particular industry or segment (Russell 2000). Below we will look at the different examples of Indexes and the respective companies in each Index, categorized according to their Market capitalization, Total index capitalization, ratio, and Index weighting.

1. S&P 500 Index

The Standard and Poor's 500 Index, also known as S&P 500 index, is one of the world's best-known indexes and one of the most commonly used benchmarks for the stock market. It is regarded as one of the best gauges of prominent American equities performance and, by extension, that of the stock market overall. It features 500 leading U.S publicly traded companies, with a primary emphasis on market capitalization.

2. Dow Jones Industrial Average(DJIA) Index

The DJIA is the second-oldest U.S. market index; the first was the Dow Jones Transportation Average (DJTA). The DJIA was designed to serve as a proxy for the health of the broader U.S. economy. The Dow Jones Industrial Average (DJIA), also known as the Dow 30/US30, is a stock market index that tracks 30 large, publicly-owned blue-chip companies trading on the New York Stock Exchange (NYSE) Nasdaq. The media use the Index as a barometer of the broader stock market and the economy as a whole.

3. Russell 2000 Index

The Russell 2000 Index is a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. London's FTSE Russell Group manages the Russell 2000. It is widely regarded as a forerunner of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Index is frequently used as a benchmark for measuring the performance of small-cap mutual funds.

How does a company get added to the Index?

When considering the eligibility of a new addition, the committee assesses the company's merit using eight primary criteria: market capitalization, liquidity, domicile, public float, Global Industry Classification Standard and representation of the industries in the economy of the United States, financial viability, length of time publicly traded, and stock exchange. Ultimately If the company fulfils all the requirements needed after being assessed by the committee, it will be added to the Index chosen.

What is Index investing?

Index investing(Indexing) is a passive investment technique that attempts to generate returns similar to a broad market index. Investors use this buy-and-hold strategy to replicate the performance of a specific index —generally an equity or fixed-income Index — by purchasing the Index's component securities or investing in an index mutual fund or exchange-traded fund (ETF) that itself closely tracks the underlying Index. For instance, many mutual funds compare their returns to the return in the S&P 500 Index to give investors a sense of how much more or less the managers are earning on their money than they would make in an index fund.

Advantages of Index Investing

There are several advantages of Index investing. For one, empirical research finds that Index investing tends to outperform active management over a long time. Taking a hands-off investment approach eliminates many biases and uncertainties that arise in a stock-picking strategy. Additionally, Indexing offers greater diversification and lower expenses and fees than actively managed strategies.

How to invest in a small amount

Since an index is a hypothetical basket of stocks, it cannot be invested directly. But, thousands of investment products track indexes available through product providers and fund issuers, including mutual funds, ETFs, and derivatives. So the only way if someone wants to invest in an index with a small amount and in an inexpensive way is to gain exposure through discount brokers. Starting with a small amount, look for a brokerage firm offering low-fee trading options. If you don't have an account, look for one that meets your investment criteria. Once your account is set up, you can begin investing in your funds. But keep in mind that some brokerage firms may impose minimum investment requirements.

The Bottom Line

Investing in indexes is a great way to diversify your portfolio. Whether you choose an ETF or a mutual fund depends on how much you can afford and your future goals. Regardless of which option you choose (or if you choose both), you will likely see consistent returns. Make sure you have the proper brokerage account for your needs so you'll save on fees and commissions.

Click Here: https://bit.ly/3zYnqN8

Are you looking to start investing in indexes? The pocket trader allows you to trade in different indices, including US500, UK100, US30, HK50, NIKKEI225, and much more, with as little as $10 with absolutely zero commission. You can Enjoy FREE USD 10,000 Virtual Funds for investing by Signing Up on Pocket Trader. With Pocket Trader, You can make investments in multiple markets, including forex and commodities, learn from experienced traders and share ideas with their social features to build wealth together.