Common Mistakes To Avoid In Forex Trading

Trading forex can be a rewarding and exciting challenge, but it can also be discouraging if you are not careful. Many people try their hand at trading the financial markets, but only a select few proceed to be successful. That is not to say that these select few never make trading mistakes; everybody does. These mistakes are part of a constant learning process whereby traders must habitually familiarise themselves by importantly understanding the logic behind them to avoid making the same mistakes again in the future.

That said, Whether you're a beginner trader or an experienced veteran, avoiding these common forex trading mistakes can help keep you on the right track to becoming a successful forex trader. In this article, we will look at eight common mistakes that traders make to ramp up returns but ultimately have the opposite effect. Once you know them, you can avoid making them using knowledge, discipline, and an alternative approach.

1. Lack of Education

One of the most common trading mistakes beginners is not educating themselves properly before getting started. Trading without knowledge of forex is a guaranteed way of setting yourself up for failure. Studying hard and educating yourself on your preferred market and how to trade is very important if you want to be a successful trader.

2. Trading without a strategy

Another of the most common trading mistakes is to start trading without first creating your trading strategy. Too many beginner traders are too eager to dive in and start trading without even having any trading strategy beforehand. This is a big mistake, and it's trading without a plan. Trading strategies have predefined guidelines and approaches to every trade. This prevents traders from making irrational decisions due to adverse movements. Devoting to a trading strategy is key to becoming a profitable trader because veering away may lead to traders plunging themselves into unchartered waters with regard to trading style. This eventually results in trading mistakes due to unfamiliarity. Trading strategies should be tested on a demo account. Once traders are comfortable and understand the strategy, they can proceed and trade on a live account. The best way to perfect your trading strategy is by joining a wider trading community on Pocket Trader. You will have the freedom to discuss trading ideas, validate your trading strategy, learn how to read between the candles to identify trading opportunities, and overall lift your trading game to master the markets.

3. Not Using Stop-Loss Orders

Placing a stop loss at the right price marks the difference between profitability, survival, and losing everything. The forex market becomes enormously volatile, especially after news releases, carving near-violent price swings with little or no warning. Add excessive leverage, and the new trader faces a potentially catastrophic loss in just a few minutes. Even walking downstairs to open the door for your friend can trigger career-ending losses, so it's vital to place a stop-loss after entering a new position.

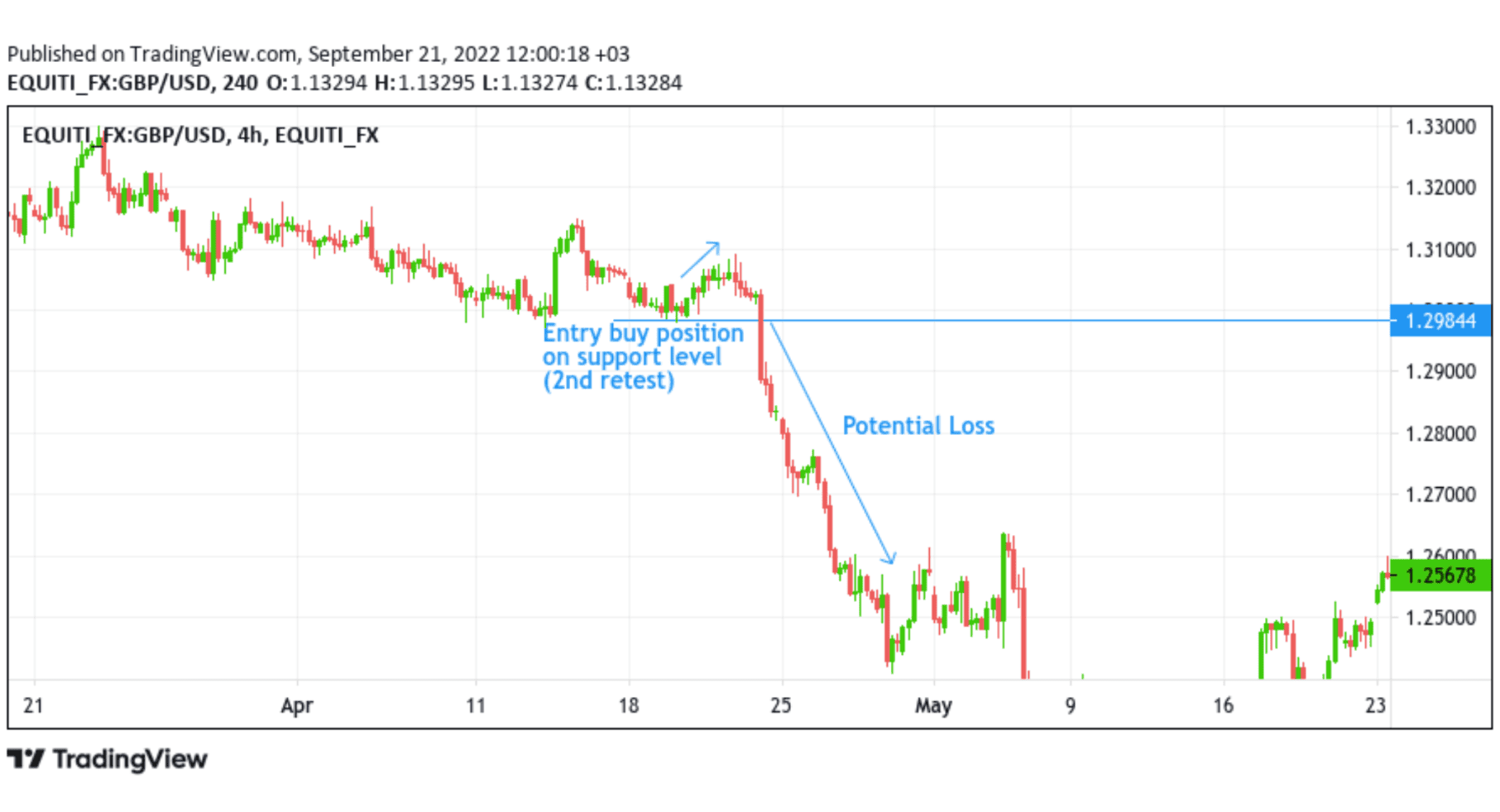

Potential loss as a result of not putting a stop-loss (GBP/USD 4hr)

With Pocket Trader, you are guaranteed not to lose your hard-earned money since there is an option of setting a stop-loss order or a trailing stop-loss when entering either a buy or sell trade.

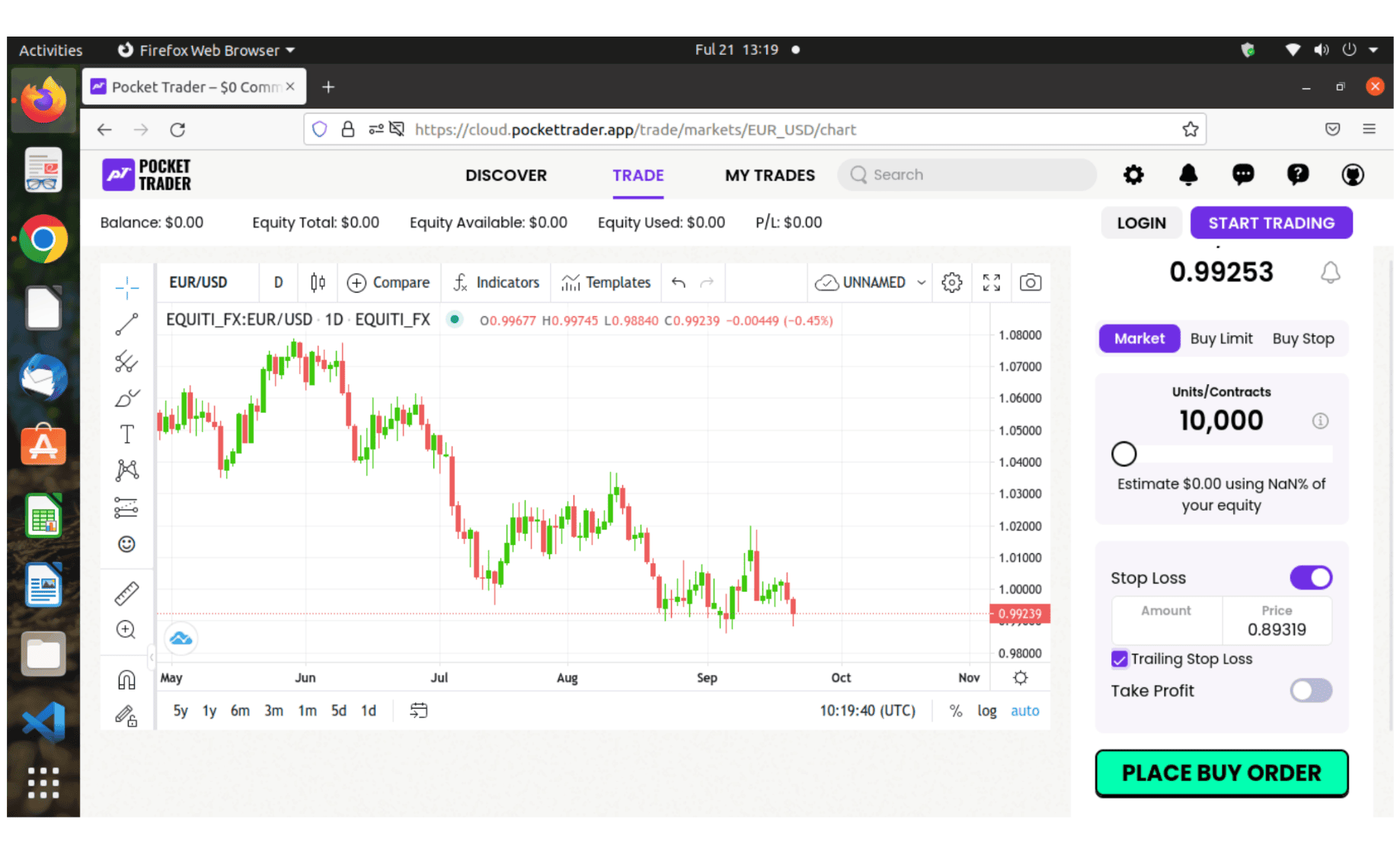

Setting up of stop-loss order on Pocket Trader

4. Not Researching the Market

Most forex traders fail to reach their potential because they start trading without investing in proper research to employ and execute a specific trading strategy. Studying the market the way it is will bring to light market trends, the timing of entry/exit points, and fundamental factors that will also influence the trade. The more time dedicated to the financial markets, the greater the understanding of the forex market. One of the best ways to carry out your market research and sharpen your forex trading skills is to stay updated on the current financial news and economic news releases that would cause high volatility in the market. To stay informed on the latest news around different markets while engaging with an active community of experienced traders that can help you refine trading ideas, all you have to do is visit the pocket traders news section.

5. Risking more than you can afford

The practice of taking on excessive risk does not equal excessive returns. Almost all traders who risk large amounts of capital on single trades will eventually lose it in the long run. A common rule is that a trader should risk (in terms of the difference between entry and stop price) no more than 1% of capital on any single trade. Professional traders will often risk far less than 1% of capital.

6. Trading Based on Emotions

Emotional trading often leads to irrational and unsuccessful trading. Traders frequently open additional positions after losing trades to compensate for the previous losses. These trades usually have no educational backing, technically or fundamentally, but rather are emotional-fueled trades. Trading plans are there to avoid this type of trading; therefore, the plan must be followed closely. There is a reason why many experienced traders describe trading as repetitive: they don't abandon their rules. They approach the market with an unemotional mechanical method, day after day. They treat winning and losing days the same while concentrating on their long-term goals

7. Cutting your losses early

The next on our list of common trading mistakes is a big one. It is responsible for a large amount of money lost by traders, particularly beginners, not knowing when to cut your losses when a particular trade moves against you. Once it becomes apparent that trade is moving against you, cut your losses early and exit the market before you lose even more. Don't ever become too attached to any single trade.

8. Over Confidence and Revenge Trading

These mistakes occur when traders let their emotions get the better. However, as these scenarios are so common, they deserve. After a few successful trades, it is easy and natural to fall into the trap of feeling overconfident in your ability. The elation you feel after winning trade can cloud your judgment and cause you to deviate from your trading strategy or re-enter the market without carrying out the proper analysis. Revenge trading, on the other hand, refers to the desire to get straight back into the market after a loss to recover your lost capital. Just as feeling overconfident after successful trades, revenge trading after unsuccessful ones can compromise your decision-making process and often lead to further losses.

Bottom Line

A solid foundation in trading forex is essential before undertaking any form of live trading. Taking the time to understand the do's and don'ts of forex trading will put you far ahead when trading in the financial markets. You should never forget that trading mistakes are a natural part of learning, and even the most successful traders worldwide still make mistakes from time to time. Therefore, don't be afraid of making mistakes or getting heartbroken when they occur. What's important is learning from your mistakes and taking steps to avoid repeating them in the future.